NEWS

Japan: CPI base revision will not alter the inflation trend, BoJ’s 2% target remains intact

05 August 2015, 04:42

Japan's CPI calculation will be revised next year due to a periodical

rebasing which is conducted every five years. In the next revision, we may see

increased weighting and upward pressure on prices in areas such as electricity

costs (especially after the 2011 earthquake disaster) and home renovation costs

(imputed rent). Among these items, the discussion on imputed rent costs are

especially under focused, as the BoJ has also been focusing on this point.

Revision to the calculation of imputed rent could push up CPI as much as 0.2pp,

according to the BoJ's study.

In addition, there are discussions regarding the possibility for changing the BoJ's inflation target from "CPI" to "CPI excluding fresh food and energy". In the BoJ's July Monthly economic report, a chart of "CPI less fresh food and energy" was introduced for the first time. This index indicates stronger inflation than other indices, due to the effect of declining oil prices. As the BoJ's price stability target is a "flexible inflation targeting", the BoJ will continue to look at various economic and monetary conditions.

The 2015 base revision probably will not have much of an effect on the CPI trend and the BoJ's commitment to achieve the 2% price stability target remains intact. This target was determined in a joint statement by the government as well as the BoJ. PM Abe's LDP had committed in the manifesto during the election campaign to a 2% inflation target and this won the confidence of voters. Therefore, it will not be altered in any of the BoJ policy meetings.

In addition, there are discussions regarding the possibility for changing the BoJ's inflation target from "CPI" to "CPI excluding fresh food and energy". In the BoJ's July Monthly economic report, a chart of "CPI less fresh food and energy" was introduced for the first time. This index indicates stronger inflation than other indices, due to the effect of declining oil prices. As the BoJ's price stability target is a "flexible inflation targeting", the BoJ will continue to look at various economic and monetary conditions.

The 2015 base revision probably will not have much of an effect on the CPI trend and the BoJ's commitment to achieve the 2% price stability target remains intact. This target was determined in a joint statement by the government as well as the BoJ. PM Abe's LDP had committed in the manifesto during the election campaign to a 2% inflation target and this won the confidence of voters. Therefore, it will not be altered in any of the BoJ policy meetings.

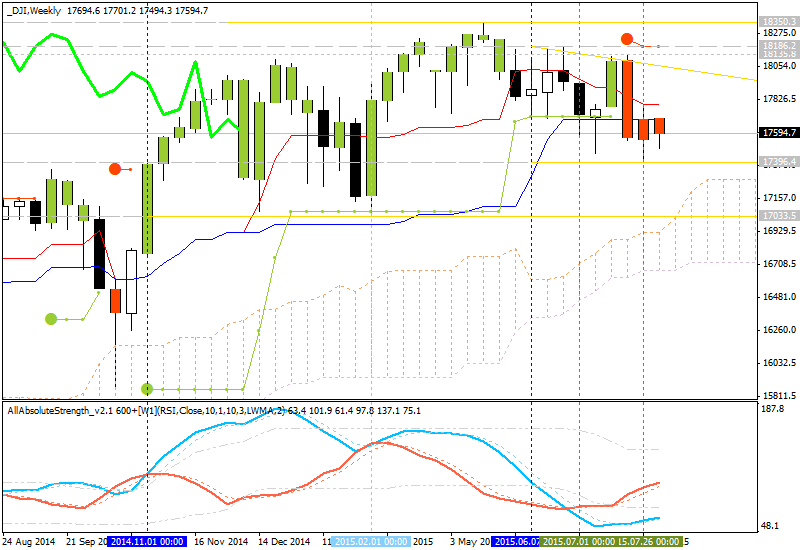

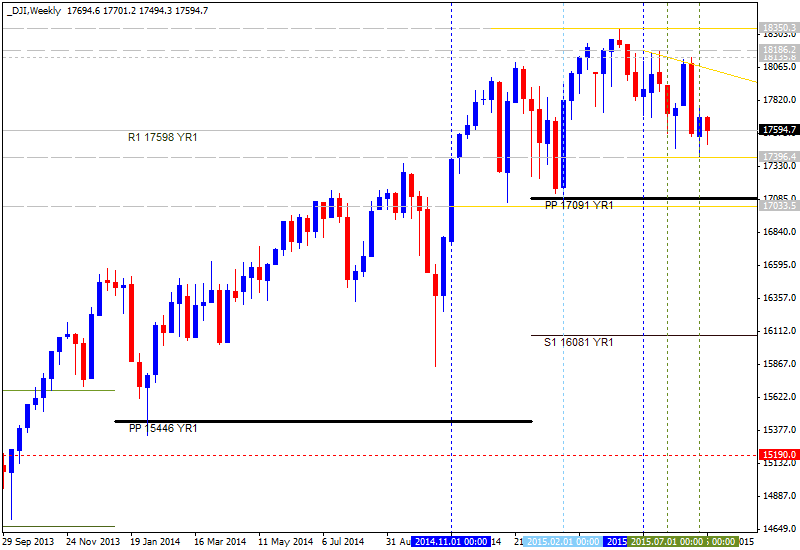

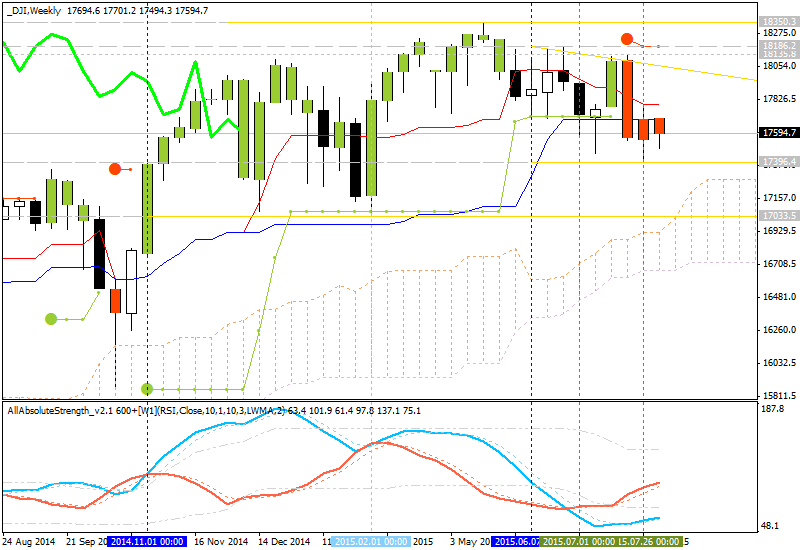

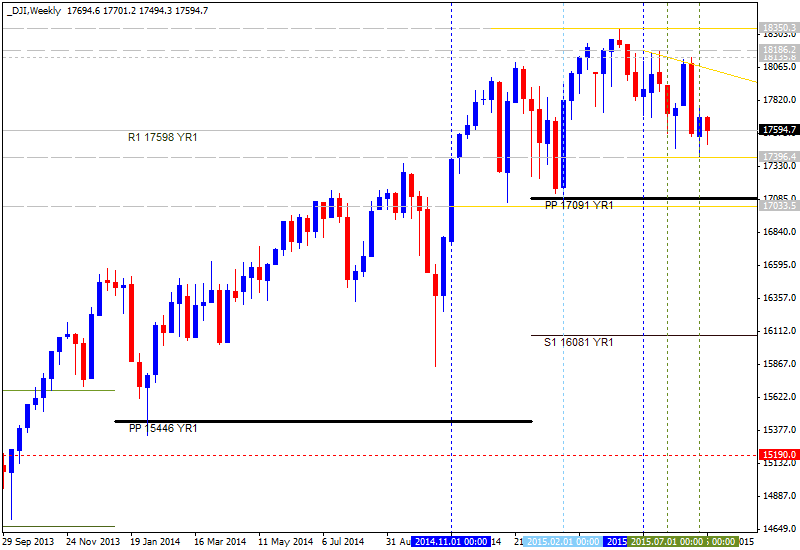

Quick Technical Overview - Dow Jones Industrial Average: levels and ideas

5 August 2015, 04:11

Weekly price is on bullish market condition for ranging between 17396.4

support level and 18350.3 resistance level:

If W1 price will break 17396.4 support level so the secondary

correction will be started.

If W1 price will break 17396.4 support level so the secondary

correction will be started.

If W1 price will break 17033.5 support level so we may see the reversal of the price movement from the primary bullish to the primary bearish market condition.

If W1 price will break 18350.3 resistance level on close W1 bar so the bullish trend will be continuing.

If not so the price will be ranging between the levels.

Trend:

W1 - ranging bullish

- Chinkou Span line is indicating the ranging condition.

- The nearest resistance levels are 18186.2 and 18350.3.

- The nearest support levels are 17396.4 and 17033.05.

- Absolute Strength indicator is estimating the secondary ranging within the primary bullish.

- Pivot Points (yearly PP on weekly chart): the price is ranging between yearly Central Pivot at 17091 and R1 Pivot at 18841.

| Instrument | S1 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|

| DJI | 16081 | 17091 | 18841 |

If W1 price will break 17033.5 support level so we may see the reversal of the price movement from the primary bullish to the primary bearish market condition.

If W1 price will break 18350.3 resistance level on close W1 bar so the bullish trend will be continuing.

If not so the price will be ranging between the levels.

Trend:

W1 - ranging bullish

Dutch home sales and prices continue to rise

05 August 2015, 03:58

Since June 2013 the number of sales of existing homes has been growing fast

and steadily, with only one big interruption in the first quarter. As a result,

house prices have also been growing in the past year and a half, albeit at a

slower pace than sales. Just like in 2012, the recent peak and drop in sales

around the turn of the year resulted from changing tax regulations and credit

standards. Stricter rules pushed buyers to buy their homes before the rules were

being implemented.

The second quarter rebound in home sales now has confirmed the underlying trend of growth in housing market activity. Figures from the Dutch Association of Real Estate Brokers (NVM) on pending home sales point to further growth in the third quarter.

"We expect home sales to grow further in the remainder of this year and to stabilise in 2016. House price growth is expected to accelerate somewhat next year, but will remain modest compared to the decade before the crisis erupted," notes Rabobank.

The second quarter rebound in home sales now has confirmed the underlying trend of growth in housing market activity. Figures from the Dutch Association of Real Estate Brokers (NVM) on pending home sales point to further growth in the third quarter.

"We expect home sales to grow further in the remainder of this year and to stabilise in 2016. House price growth is expected to accelerate somewhat next year, but will remain modest compared to the decade before the crisis erupted," notes Rabobank.

Dutch GDP growth held back by lower gas production

05 August 2015, 03:53

Dutch GDP growth in the second quarter of 2015 seems to have been very

negatively impacted by lower gas extraction. The government decision in February

to reduce the maximum allowed gas production from the Groningen field in the

first half of the year to 16.5 billion cubic meters -as well as uncertainty

about the total limit that the government would set for 2015- has resulted in a

rather drastic fall in extraction in the second quarter, which will most likely

lead to lower Q2 GDP growth than the current forecast. But this quarterly drop

is expected to be a one-off effect.

"Looking at the total impact of the reduction in the production from the Groningen gas field, we have already taken the 0.5%-pt impact that this should have on growth into account in our GDP forecast for 2015 as a whole. So while Q2 is set to disappoint, the underlying economic trend remains on track," notes Rabobank.

Although Dutch producers' opinion about their production in the next three months took a small hit in July as a result of the Greek crisis, producers' confidence in both the Netherlands and abroad is still at levels that coincide with further growth of production and exports.

"Looking at the total impact of the reduction in the production from the Groningen gas field, we have already taken the 0.5%-pt impact that this should have on growth into account in our GDP forecast for 2015 as a whole. So while Q2 is set to disappoint, the underlying economic trend remains on track," notes Rabobank.

Although Dutch producers' opinion about their production in the next three months took a small hit in July as a result of the Greek crisis, producers' confidence in both the Netherlands and abroad is still at levels that coincide with further growth of production and exports.

UK public finances are improving

05 August 2015, 03:16

UK public finances are improving with government borrowing in the first three

months of the current fiscal year (April-June) declining by nearly 20% compared

to the same period last year. What's more, the June deficit was the smallest in

seven years for that period, mainly due to increased tax revenues from personal

incomes and corporate profits. As a result, Chancellor Osborne now aims to bring

down the budget deficit in the current fiscal year to GBP 69.5bn (3.7% of GDP),

a reduction compared to the previous target of GBP 75.3bn (4% of GDP) set in

March.

In early July, the Conservative government presented a new 2015 budget which included a softening of fiscal tightening compared to the budget outlined before the elections. For example, the GBP 12bn cut from the welfare budget will now be carried out over four years instead of just two. As a result, the target date by when the government plans to reach a budget surplus is set back by a year to 2019/2020. Going forward, austerity measures will be softened and so the negative impact on economic growth will be less than previously expected.

In early July, the Conservative government presented a new 2015 budget which included a softening of fiscal tightening compared to the budget outlined before the elections. For example, the GBP 12bn cut from the welfare budget will now be carried out over four years instead of just two. As a result, the target date by when the government plans to reach a budget surplus is set back by a year to 2019/2020. Going forward, austerity measures will be softened and so the negative impact on economic growth will be less than previously expected.

UK economic growth back on track

05 August 2015, 02:52

According to the preliminary estimate, UK economic growth picked up to 0.7%

q-o-q in the second quarter of 2015, after a slowdown to 0.4% in the first

quarter of 2015. However, the recovery seems unbalanced. The services sector,

which accounts for more than three quarters of economic output, rose by 0.7% in

the quarter, and therefore was the main driver of growth. In contrast,

agriculture shrank by -0.7% q-o-q and construction remained flat. And although

industrial output increased by 1%, this was mainly driven by an increase in oil

output. Manufacturing output, a sub category of industry, fell by 0.3% q-o-q, as

British factories struggled due to the strong pound - which weighs on

exports.

"We expect the pound to remain strong and thus that a slower export performance could continue to put a drag on manufacturing output and economic growth," says Rabobank.

The latter is in line with data from the CBI Industrial Trends Survey, in which manufacturing orders dropped to a two-year low in July. On the bright side, households' real spending power is improving due to strong nominal wage growth and low inflation.

"We expect the pound to remain strong and thus that a slower export performance could continue to put a drag on manufacturing output and economic growth," says Rabobank.

The latter is in line with data from the CBI Industrial Trends Survey, in which manufacturing orders dropped to a two-year low in July. On the bright side, households' real spending power is improving due to strong nominal wage growth and low inflation.

BoJ Monetary Policy: Impact on yen rates

05 August 2015, 02:23

The BoJ is expected to maintain the current QQE at its Monetary Policy

Meeting on 6-7 August. While the focus shifts back to supply-demand in the JGB

market, the BoJ may keep an eye on how the overseas environment, China's unclear

economic outlook, the decline in oil prices, and the Greek situation, will

affect Japan's economy and prices for some time in the future. Since the BoJ is

likely to continue the current monetary policy, rates are still expected to

basically follow a downward trend; however, a sharp rise in volatility is of

increasing concern JGB yields are declining, but could be back to unstable

territory depending on overseas markets.

According to JSDA's trading activity by investors for June, trust banks were net purchasers of super-long-term bonds again, and the amount of ¥338.2bn marked a big increase from May. Trust banks turned to net selling in September 2014 to conform to changes in the GPIF portfolio. The recent switch from selling back to purchasing suggests JGB selling by the GPIF is dying down. Also, net purchasing of coupon-bearing JGBs by foreign investors recovered to ¥412.3bn in June, from ¥76.2bn in May. City banks were net purchasers of only ¥36.9bn of coupon-bearing JGBs in June, but it was their largest net purchase in the year since June 2014.

Furthermore, the banks were conspicuously large purchasers of super-long-term JGBs, extending their average maturities. We cannot find aggressive JGB buyers except the BoJ, but sellers seem to be fading at the same time. The BoJ's expansion of QQE in October 2014 means it will need more sellers of JGBs than there were last year, and if no new sellers show up there is a risk of the BoJ being unable to buy JGBs according to plan.

On the other hand, although more than eight months have passed since the expansion of QQE, JGB yields are almost same levels as at the time (there were swings and roundabouts). If the nominal yields do not decline from here on, the BoJ may need to review the effect of the expansion of QQE. The BoJ will likely be forced into a more cautious monetary policy if prices do not rise in accordance with its outlook.

At this stage, it will probably stick with its current QE formula, but if it does opt for additional easing, given it will be difficult for it to significantly increase the quantity of its JGB purchases and that any further declines in already low JGB yields would likely have limited impact, rather than pursue greater quantity the BoJ is more likely to strengthen qualitatively, such as by lengthening the maturities of the JGBs it purchases, increasing its ETF purchases, and buying new types of financial assets.

According to JSDA's trading activity by investors for June, trust banks were net purchasers of super-long-term bonds again, and the amount of ¥338.2bn marked a big increase from May. Trust banks turned to net selling in September 2014 to conform to changes in the GPIF portfolio. The recent switch from selling back to purchasing suggests JGB selling by the GPIF is dying down. Also, net purchasing of coupon-bearing JGBs by foreign investors recovered to ¥412.3bn in June, from ¥76.2bn in May. City banks were net purchasers of only ¥36.9bn of coupon-bearing JGBs in June, but it was their largest net purchase in the year since June 2014.

Furthermore, the banks were conspicuously large purchasers of super-long-term JGBs, extending their average maturities. We cannot find aggressive JGB buyers except the BoJ, but sellers seem to be fading at the same time. The BoJ's expansion of QQE in October 2014 means it will need more sellers of JGBs than there were last year, and if no new sellers show up there is a risk of the BoJ being unable to buy JGBs according to plan.

On the other hand, although more than eight months have passed since the expansion of QQE, JGB yields are almost same levels as at the time (there were swings and roundabouts). If the nominal yields do not decline from here on, the BoJ may need to review the effect of the expansion of QQE. The BoJ will likely be forced into a more cautious monetary policy if prices do not rise in accordance with its outlook.

At this stage, it will probably stick with its current QE formula, but if it does opt for additional easing, given it will be difficult for it to significantly increase the quantity of its JGB purchases and that any further declines in already low JGB yields would likely have limited impact, rather than pursue greater quantity the BoJ is more likely to strengthen qualitatively, such as by lengthening the maturities of the JGBs it purchases, increasing its ETF purchases, and buying new types of financial assets.

UK July construction PMI slowdown in early 2015

05 August 2015, 01:22

It is a relatively quiet day for data with the July construction PMI the only

release of note in the UK. While this rose sharply in June, it is still below

its level in Q1 and even further below the average for 2014. This relatively

poor performance is also reflected in the official construction data, which

shows that construction output has so far made no contribution to GDP growth in

2015.

The weakening of the PMI series in the first half of the year reflects a slowdown in both housing and commercial activity. Last month's rebound was led by the commercial sector but recent signs of life in the housing market, with transactions rising, point to a likely rise in construction in that sector.

The weakening of the PMI series in the first half of the year reflects a slowdown in both housing and commercial activity. Last month's rebound was led by the commercial sector but recent signs of life in the housing market, with transactions rising, point to a likely rise in construction in that sector.

Global Markets: Simmering risks

05 August 2015, 01:06

US data painted a mixed picture for Fed interpretations. The ISM fell from

53.5 to 52.7, which disappointed estimates and is seen as further evidence that

the strong dollar is having a detrimental impact on industry. However, the core

PCE price index remained steady at 1.3% y/y despite the disinflationary force.

With the Fed having lowered the bar for the lift-off by way of less optimistic

growth and inflation forecasts, a rate hike is still on the cards this year. The

market is still discounting a greater than 50% probability of an increase by the

end of the year, but is less convinced about a September hike.

The deputy governor of the BoJ dismissed the risk posed by a Fed rate hike. Yet the weakness in EM currencies and in equity markets suggest otherwise. There may be brewing concern over the impact of higher US rates on growth at a time when earnings momentum is slowing sharply. The VIX is low but seems to be turning a corner and the EMBI spread has increased.

The oil price again made headlines yesterday as the weak PMI data from China permeated markets, fuelling the deflationary fears of a lack of demand. Brent crude fell below US$50/bbl, the first time since January, and opens the day at US$49.68/bbl. This is proving to be a welcome offset to weaker EM exchange rates, particularly for oil importers such as South Africa.

In China the weakness in the economy is being acknowledged - the Commerce Ministry reportedly alluded to continued low import growth. Yet policymakers are still trying to stem market forces - according to media reports, short selling on the equities bourse was restricted yesterday.

Restrictions were not going to help the Greek equity market. It reopened yesterday after being closed for five weeks, with stocks plummeting by 23% before rebounding by 8% - on a net basis the market was down by 16% by the close of trade. MSCI has indicated that it will monitor restrictions on trade and may need to reclassify the Greece index. Negotiations are ongoing and Greek officials have indicated that they would be in a position to submit detailed pension reforms by October. The next payment to creditors is due on 20 August. The renewed concerns over the sustainability of sovereign debt has prompted S&P to revise the outlook on the European Union's debt from stable to negative, with the rating currently at AA+.

Puerto Rico's Public Finance Corporation defaulted on a debt repayment, which came as no surprise. The US territory is trying to restructure its US$72bn worth of debt. To put this into perspective: Puerto Rico's debt per capita is around US$20,500 versus South Africa's US$2,500.

Australia kept its policy rate unchanged at 2.0% this morning, in line with expectations. This gave modest support to the Australian dollar but the big picture of falling commodity prices is evident in the unit losing 21% against the US dollar over the past year.

The deputy governor of the BoJ dismissed the risk posed by a Fed rate hike. Yet the weakness in EM currencies and in equity markets suggest otherwise. There may be brewing concern over the impact of higher US rates on growth at a time when earnings momentum is slowing sharply. The VIX is low but seems to be turning a corner and the EMBI spread has increased.

The oil price again made headlines yesterday as the weak PMI data from China permeated markets, fuelling the deflationary fears of a lack of demand. Brent crude fell below US$50/bbl, the first time since January, and opens the day at US$49.68/bbl. This is proving to be a welcome offset to weaker EM exchange rates, particularly for oil importers such as South Africa.

In China the weakness in the economy is being acknowledged - the Commerce Ministry reportedly alluded to continued low import growth. Yet policymakers are still trying to stem market forces - according to media reports, short selling on the equities bourse was restricted yesterday.

Restrictions were not going to help the Greek equity market. It reopened yesterday after being closed for five weeks, with stocks plummeting by 23% before rebounding by 8% - on a net basis the market was down by 16% by the close of trade. MSCI has indicated that it will monitor restrictions on trade and may need to reclassify the Greece index. Negotiations are ongoing and Greek officials have indicated that they would be in a position to submit detailed pension reforms by October. The next payment to creditors is due on 20 August. The renewed concerns over the sustainability of sovereign debt has prompted S&P to revise the outlook on the European Union's debt from stable to negative, with the rating currently at AA+.

Puerto Rico's Public Finance Corporation defaulted on a debt repayment, which came as no surprise. The US territory is trying to restructure its US$72bn worth of debt. To put this into perspective: Puerto Rico's debt per capita is around US$20,500 versus South Africa's US$2,500.

Australia kept its policy rate unchanged at 2.0% this morning, in line with expectations. This gave modest support to the Australian dollar but the big picture of falling commodity prices is evident in the unit losing 21% against the US dollar over the past year.

US auto sales soar in July

05 August 2015, 00:46

US auto sales soared to 17.5 million units on a seasonally-adjusted

annualised basis in July, marking the third consecutive month of sales above the

17 million unit mark. Of the top 8 selling brands, seven recorded gains in the

5-8% y/y range, with Nissan, Hyundai and Kia leading the way. Toyota lagged

behind with an increase of only 1% y/y. Helped by lower gasoline prices, light

trucks continued to be the key drivers of overall sales, up 13% y/y in July,

while passenger car sales were down 1.8% y/y.

American consumers were car shopping in full force in July, as rising employment, low interest rates and longer loan terms have made vehicles more affordable. These conditions are likely to remain in place going forward. Even with the Federal Reserve expected to begin a rate-hiking cycle in September, the process of normalizing rates will be slow and gradual, with borrowing costs remaining low for quite some time still. July's auto numbers set the stage for another solid performance in the third quarter, giving spending on durables a boost. Overall, auto sales for the year as a whole are on track for the highest sales pace in 10 years.

American consumers were car shopping in full force in July, as rising employment, low interest rates and longer loan terms have made vehicles more affordable. These conditions are likely to remain in place going forward. Even with the Federal Reserve expected to begin a rate-hiking cycle in September, the process of normalizing rates will be slow and gradual, with borrowing costs remaining low for quite some time still. July's auto numbers set the stage for another solid performance in the third quarter, giving spending on durables a boost. Overall, auto sales for the year as a whole are on track for the highest sales pace in 10 years.

Fed's Lockhart signals September rate Liftoff

05 August 2015, 00:25

When Lockhart comes out and says September could be an appropriate time to

lift rates - markets pay attention. He is a voter on the central/dovish side of

the Fed spectrum and he was pretty explicit in his comments: "I think there is a

high bar right now to not acting". He notes that the addition of the word "some"

(in the phrase "some further improvement" in the labour market) was "a qualifier

that conveys to the public that we're getting closer"..."I don't think it would

be a big policy error to wait somewhat longer... I'm not one to quibble over one

meeting or so. But I do think we are close. The economy is in a state of

readiness for beginning normalization".

The reaction in FX markets pushed USD higher. EUR/USD tumbled 80pts to sub 1.09 (low 1.0883, spot 1.0890/95), USD/JPY popped up to 124.40 (spot 124.30). USD/CAD traded through 1.32 (high 1.3203, spot 1.3180).

"Our house view looks for the first hike in September though attention will quickly shift to the pace of tightening once the Fed gets going. Right now the market is priced for a slow pace of tightening (Dec 16 Fed fund fut at 1.04%) - our rates strategists see upside risks," notes RBC Capital Markets.

The reaction in FX markets pushed USD higher. EUR/USD tumbled 80pts to sub 1.09 (low 1.0883, spot 1.0890/95), USD/JPY popped up to 124.40 (spot 124.30). USD/CAD traded through 1.32 (high 1.3203, spot 1.3180).

"Our house view looks for the first hike in September though attention will quickly shift to the pace of tightening once the Fed gets going. Right now the market is priced for a slow pace of tightening (Dec 16 Fed fund fut at 1.04%) - our rates strategists see upside risks," notes RBC Capital Markets.

Americas Roundup: US Dollar rises on Atlanta Fed chief's rate hike view-August 5th, 2015

05 August 2015, 00:21

Market Roundup

EUR/USD is supported around 1.0815 levels and currently trading at 1.0892 levels. It has made session high at 1.0981 and lows at 1.0890 levels. The euro was trading slightly in bullish trend during early hours of New York session on Tuesday. The pair was unmoved and was trading flat after the release of US factory orders, which came in line with expectation. In the late hours in the New York session, dollar climbed to session highs against the euro, after the Wall Street Journal published online an interview with Atlanta Federal Reserve President Dennis Lockhart who said, the Fed is close to being ready to hike rates. The pair started to fall from, 1.0962 to hit session lows at 1.0885, in the late New York session. Meanwhile, earlier in the day, both Greece and its lenders said on Tuesday they were optimistic they could broker a deal within days on a multi-billion euro bailout, striking a surprisingly upbeat tone on a process previously fraught with bitterness. To the upside, immediate resistance can be seen at 1.0915. To the downside, major support level is located at 1.0870 levels.

GBP/USD is supported around 1.5545 levels and currently trading at 1.5585 levels. It has made session high at 1.5626 and low at 1.5560 levels. The dollar rose sharply against the sterling after Federal Reserve Bank of Atlanta President Dennis Lockhart, a member of the Fed's policy setting committee who typically votes with the core, told the Wall Street Journal it would take a sharp turn for the worst in economic data to change his view in support of a rate hike after the mid-September meeting. The cable fell from 1.5663 to hit session lows at 1.5552. Earlier in European session, Construction PMI data was released, which printed worse than expected figures at 57.1 against the forecast of 58.4. Growth in Britain's construction industry slowed unexpectedly in July, hurt by a loss of momentum in house building and civil engineering, according to a survey published on Tuesday that highlighted the economy's reliance on its services sector. To the upside, immediate resistance can be seen at 1.5630. To the downside, major support level is located at 1.5460 levels.

USD/JPY is supported around 123.90 levels and currently trading at 124.31 levels. It has made session high at 124.39 and low at 123.92 levels. The dollar rose against Japanese yen on Tuesday, in the late hours in US session, as a top U.S. Federal Reserve official voiced support for an interest rate increase in September despite a batch of disappointing data on wages and manufacturing activity. A record small rise in second-quarter U.S. wages posted on Friday and a surprise fall in a private measure of domestic manufacturing activity on Monday had raised doubts about a possible Fed interest rate hike in September. The greenback rose 0.3 percent on the day to 124.33 Japanese yen. To the upside, immediate resistance can be seen at 124.40. To the downside, major support level is located at 123.70 levels.

USD/CAD is supported around 1.3100 levels and currently trading at 1.3161 levels. It has made session high at 1.3173 and low at 1.3112 levels. The Canadian dollar slipped against US dollar on Tuesday after the Wall Street Journal reported that Atlanta Federal Reserve president Dennis Lockhart would likely support a rate hike in September. Canadian dollar hit weakest close against the U.S. dollar in over a decade helped by a steadying decline in the price of oil, a major Canadian export. Meanwhile Business conditions in the Canadian manufacturing sector continued to improve for the second month in a row in July, but at a slower pace than June, with an increase in export sales supporting the recovery. The RBC Canadian Manufacturing Purchasing Managers' index (PMI), a measure of manufacturing business conditions released on Tuesday, slid to 50.8 last month from June's six-month high of 51.3. To the upside, immediate resistance can be seen at 1.3200. To the downside, major support level is located at 1.3105 levels.

Equities Recap

European stocks closed lower on Tuesday, as investors kept their focus on the newly reopened Athens stock exchange. UK's benchmark FTSE 100 slipped 0.1 percent at close, the pan-European FTSEurofirst 300 closed, down by 0.2 percent, Germany's Dax closed up by 0.2 percent, France's CAC closed down at 0.2 percent, Italy's FTSE MIB closed down by 1 percent. Meanwhile, Spain's IBEX 35 was down by 1.6 percent at close.

US stocks ended lower at close on Tuesday, as further decline was reported by corporate earnings and improving oil prices. Dow Jones closed down by 0.27 percent, S&P 500 closed down by 0.22 percent, Nasdaq closed down by 0.19 percent.

Treasuries Recap

U.S. Treasuries prices fell on Tuesday after comments from a top Federal Reserve official revived expectations that the central bank would hike interest rates in September, while profit-taking ahead of a key U.S. jobs report also weighed on prices.

Benchmark 10-year Treasury notes were last down 17/32 in price to yield 2.21 percent, from a yield of 2.15 percent late Monday. U.S. 30-year bonds were last down 22/32 in price to yield 2.90 percent, from a yield of 2.86 percent late Monday.

Three-year notes were last down 7/32 to yield 1.06 percent, from a yield of 0.97 percent late Monday.

Commodities Recap

Global crude prices advanced from multi-month lows on Tuesday, helped by a stock market rally in No. 2 oil consumer China, but abundant supply and a weak demand outlook make crude's rebound unlikely to hold, traders and analysts said.

Brent, the world benchmark for oil, and U.S. crude settled up for the first time in four sessions and after Monday's 5 percent rout triggered by weak factory activity in China.

At the close, Brent was up 47 cents, or 1 percent, at $49.99 a barrel. It hit a six-month low on Monday, coming within cents of its 2015 bottom of $49.19.

U.S. crude settled up 57 cents, or 1.3 percent, at $45.74. It plumbed a four-month bottom of $45.17 the previous session, about $3 from the year low.

Gold retreated from intraday highs on Tuesday as the dollar moved higher and a voting member of the U.S. Federal Reserve said he is ready to support an interest rate increase in September.

Spot gold was up 0.2 percent at $1,087.61 an ounce at 3:10 p.m. EDT (1910 GMT), not far above the $1,077 it hit on July 24, the lowest since February 2010.

U.S. gold futures for December delivery settled up 0.1 percent at $1,090.70 an ounce.

- Fed's Lockhart Fed is close to being ready to raise rates, Sept could be appropriate time to hike.

- Lockhart says economy would have to suffer significant deterioration for him not to support hike in Sept.

- Japan PM adviser Honda sees no need for BOJ easing to meet inflation target, looks toward tapering.

- Fonterra Dairy prices fall, volumes increase at auction.

- Greece says no significant problems in privatization talks.

- Greek stocks close down 1.2 percent, banks shed near 30 percent.

- US Factory Ex-Transport MM Jun 0.5%, -0.1%-previous.

- US Factory Orders MM Jun 1.8%, f/c 1.8%, -1.1%-previous.

- US Nondef Cap Ex-Air R MM Jun 0.7%, 0.9%-previous

- 22:45 New Zealand HLFS Unemployment Rate* Q2 f/c 5.9%, 5.80%-previous

- 22:45 New Zealand HLFS Job Growth QQ* Q2 f/c 0.5%, 0.70%-previous

- 22:45 New Zealand HLFS Participation Rate* Q2 f/c 69.6%, 69.60%-previous

- 22:45 New Zealand Labour Cost Index - QQ* Q2 f/c 0.5%, 0.30%-previous

- 22:45 New Zealand Labour Cost Index - YY* Q2 f/c 1.8%, 1.80%-previous

- 23:30 Australia AIG Services Index Jul 51.2-previous

- 01:45 China Caixin Services PMI Jul 51.8-previous

- No Significant Events

EUR/USD is supported around 1.0815 levels and currently trading at 1.0892 levels. It has made session high at 1.0981 and lows at 1.0890 levels. The euro was trading slightly in bullish trend during early hours of New York session on Tuesday. The pair was unmoved and was trading flat after the release of US factory orders, which came in line with expectation. In the late hours in the New York session, dollar climbed to session highs against the euro, after the Wall Street Journal published online an interview with Atlanta Federal Reserve President Dennis Lockhart who said, the Fed is close to being ready to hike rates. The pair started to fall from, 1.0962 to hit session lows at 1.0885, in the late New York session. Meanwhile, earlier in the day, both Greece and its lenders said on Tuesday they were optimistic they could broker a deal within days on a multi-billion euro bailout, striking a surprisingly upbeat tone on a process previously fraught with bitterness. To the upside, immediate resistance can be seen at 1.0915. To the downside, major support level is located at 1.0870 levels.

GBP/USD is supported around 1.5545 levels and currently trading at 1.5585 levels. It has made session high at 1.5626 and low at 1.5560 levels. The dollar rose sharply against the sterling after Federal Reserve Bank of Atlanta President Dennis Lockhart, a member of the Fed's policy setting committee who typically votes with the core, told the Wall Street Journal it would take a sharp turn for the worst in economic data to change his view in support of a rate hike after the mid-September meeting. The cable fell from 1.5663 to hit session lows at 1.5552. Earlier in European session, Construction PMI data was released, which printed worse than expected figures at 57.1 against the forecast of 58.4. Growth in Britain's construction industry slowed unexpectedly in July, hurt by a loss of momentum in house building and civil engineering, according to a survey published on Tuesday that highlighted the economy's reliance on its services sector. To the upside, immediate resistance can be seen at 1.5630. To the downside, major support level is located at 1.5460 levels.

USD/JPY is supported around 123.90 levels and currently trading at 124.31 levels. It has made session high at 124.39 and low at 123.92 levels. The dollar rose against Japanese yen on Tuesday, in the late hours in US session, as a top U.S. Federal Reserve official voiced support for an interest rate increase in September despite a batch of disappointing data on wages and manufacturing activity. A record small rise in second-quarter U.S. wages posted on Friday and a surprise fall in a private measure of domestic manufacturing activity on Monday had raised doubts about a possible Fed interest rate hike in September. The greenback rose 0.3 percent on the day to 124.33 Japanese yen. To the upside, immediate resistance can be seen at 124.40. To the downside, major support level is located at 123.70 levels.

USD/CAD is supported around 1.3100 levels and currently trading at 1.3161 levels. It has made session high at 1.3173 and low at 1.3112 levels. The Canadian dollar slipped against US dollar on Tuesday after the Wall Street Journal reported that Atlanta Federal Reserve president Dennis Lockhart would likely support a rate hike in September. Canadian dollar hit weakest close against the U.S. dollar in over a decade helped by a steadying decline in the price of oil, a major Canadian export. Meanwhile Business conditions in the Canadian manufacturing sector continued to improve for the second month in a row in July, but at a slower pace than June, with an increase in export sales supporting the recovery. The RBC Canadian Manufacturing Purchasing Managers' index (PMI), a measure of manufacturing business conditions released on Tuesday, slid to 50.8 last month from June's six-month high of 51.3. To the upside, immediate resistance can be seen at 1.3200. To the downside, major support level is located at 1.3105 levels.

Equities Recap

European stocks closed lower on Tuesday, as investors kept their focus on the newly reopened Athens stock exchange. UK's benchmark FTSE 100 slipped 0.1 percent at close, the pan-European FTSEurofirst 300 closed, down by 0.2 percent, Germany's Dax closed up by 0.2 percent, France's CAC closed down at 0.2 percent, Italy's FTSE MIB closed down by 1 percent. Meanwhile, Spain's IBEX 35 was down by 1.6 percent at close.

US stocks ended lower at close on Tuesday, as further decline was reported by corporate earnings and improving oil prices. Dow Jones closed down by 0.27 percent, S&P 500 closed down by 0.22 percent, Nasdaq closed down by 0.19 percent.

Treasuries Recap

U.S. Treasuries prices fell on Tuesday after comments from a top Federal Reserve official revived expectations that the central bank would hike interest rates in September, while profit-taking ahead of a key U.S. jobs report also weighed on prices.

Benchmark 10-year Treasury notes were last down 17/32 in price to yield 2.21 percent, from a yield of 2.15 percent late Monday. U.S. 30-year bonds were last down 22/32 in price to yield 2.90 percent, from a yield of 2.86 percent late Monday.

Three-year notes were last down 7/32 to yield 1.06 percent, from a yield of 0.97 percent late Monday.

Commodities Recap

Global crude prices advanced from multi-month lows on Tuesday, helped by a stock market rally in No. 2 oil consumer China, but abundant supply and a weak demand outlook make crude's rebound unlikely to hold, traders and analysts said.

Brent, the world benchmark for oil, and U.S. crude settled up for the first time in four sessions and after Monday's 5 percent rout triggered by weak factory activity in China.

At the close, Brent was up 47 cents, or 1 percent, at $49.99 a barrel. It hit a six-month low on Monday, coming within cents of its 2015 bottom of $49.19.

U.S. crude settled up 57 cents, or 1.3 percent, at $45.74. It plumbed a four-month bottom of $45.17 the previous session, about $3 from the year low.

Gold retreated from intraday highs on Tuesday as the dollar moved higher and a voting member of the U.S. Federal Reserve said he is ready to support an interest rate increase in September.

Spot gold was up 0.2 percent at $1,087.61 an ounce at 3:10 p.m. EDT (1910 GMT), not far above the $1,077 it hit on July 24, the lowest since February 2010.

U.S. gold futures for December delivery settled up 0.1 percent at $1,090.70 an ounce.

Canada's RBC manufacturing PMI slipped on last month

05 August 2015, 00:14

Canada's RBC manufacturing PMI slipped on last month (50.8, prior 51.3) - the

first moderation in five months. It was weighed down by weakening in output and

employment though new orders were steady. Regionally, it continues to be the

case that weakening conditions in Alberta and BC are almost fully offsetting

improving conditions elsewhere in the country.

Trade data are released tonight. The nominal trade balance is expected to increase to a deficit of - CAD2.6bn in June from a near record -CAD3.3bn in May. A similar-sized improvement in the real trade balance would still result in net trade subtracting more than 1.0pp from Q2 GDP as a whole. As usual, however, prior-month revisions to the trade data will bear watching and can meaningfully affect the net trade contribution to growth.

Trade data are released tonight. The nominal trade balance is expected to increase to a deficit of - CAD2.6bn in June from a near record -CAD3.3bn in May. A similar-sized improvement in the real trade balance would still result in net trade subtracting more than 1.0pp from Q2 GDP as a whole. As usual, however, prior-month revisions to the trade data will bear watching and can meaningfully affect the net trade contribution to growth.

FxWirePro partners with SYSTRA to launch Algorithm Building Engine FXTraBox

05 August 2015, 00:12

SYSTRA Inc., a fintech firm that is making algorithmic trading accessible to

anyone, today launched its flagship product, FXTraBox, a powerful

algorithm building tool that enables traders to build and deploy complex

automated trading strategies without writing a single line of code.

Offered on a monthly subscription basis, FXTraBox delivers comprehensive modular, DIY, low-cost algorithm building and management features. Initially, FXTraBox will support OTC Forex trading and back testing via Metatrader4. In the near future, FXTraBox will add options, equities, futures and fixed income trading, along with live trading connections to large FX brokers and FX platforms.

SYSTRA Inc., bootstrapped, has spent the past 3 years developing FXTraBox, to deliver an intuitive design, easy-to-use interface, but user-friendly functionality that is uncommon with traditional financial software products.

"We are putting powerful institutional tools into the retail traders' hands with the launch of FXTraBox," said Andrew Bark, SYSTRA CEO. "Algorithmic trading has long been available only to institutional traders that have the resources for software engineers to build and execute on every trading strategy. We created FXTraBox to provide an intuitive, modular design that will provide anyone access to a web-based platform for building, simulating and executing algorithmic trading strategies. Most algorithm building platforms in the market has been very limited in its capacity to actualize complex trading strategies. We have built FXTraBox incrementally based on hundreds of actual traders' feedbacks from the beginning, rather than purporting to specify the platform before development even starts."

Today, algorithmic or algo trading, which are sets of trading instructions that can be installed on a platform and are able to open and close positions without human input, represents 75 percent of the equity volume in the United States. Just as options trading evolved into the retail market a decade ago, algo trading is gaining popularity because it enables traders to test and analyze investment strategies more effectively than the human brain and removes emotion from trading decisions. However, the high cost of employing specialized financial software developers limits this trading practice to large institutions.

SYSTRA's patented builder eliminates the need to interface with software engineers. Instead, users have the ability to simply set key conditions, actions, indicators, and relationships. FXTraBox currently offers over 1,300 technical indicators and will soon add fundamental newsfeed, which can be set to an interval of anywhere from one minute to one day. SYSTRA's cloud-based platform can be accessed from anywhere and does not require downloading or specialized software.

With FXTraBox, users have the option to back-test then trade using their strategies through their brokers via MetaTrader4, world's most popular FX trading platform.

Offered on a monthly subscription basis, FXTraBox delivers comprehensive modular, DIY, low-cost algorithm building and management features. Initially, FXTraBox will support OTC Forex trading and back testing via Metatrader4. In the near future, FXTraBox will add options, equities, futures and fixed income trading, along with live trading connections to large FX brokers and FX platforms.

SYSTRA Inc., bootstrapped, has spent the past 3 years developing FXTraBox, to deliver an intuitive design, easy-to-use interface, but user-friendly functionality that is uncommon with traditional financial software products.

"We are putting powerful institutional tools into the retail traders' hands with the launch of FXTraBox," said Andrew Bark, SYSTRA CEO. "Algorithmic trading has long been available only to institutional traders that have the resources for software engineers to build and execute on every trading strategy. We created FXTraBox to provide an intuitive, modular design that will provide anyone access to a web-based platform for building, simulating and executing algorithmic trading strategies. Most algorithm building platforms in the market has been very limited in its capacity to actualize complex trading strategies. We have built FXTraBox incrementally based on hundreds of actual traders' feedbacks from the beginning, rather than purporting to specify the platform before development even starts."

Today, algorithmic or algo trading, which are sets of trading instructions that can be installed on a platform and are able to open and close positions without human input, represents 75 percent of the equity volume in the United States. Just as options trading evolved into the retail market a decade ago, algo trading is gaining popularity because it enables traders to test and analyze investment strategies more effectively than the human brain and removes emotion from trading decisions. However, the high cost of employing specialized financial software developers limits this trading practice to large institutions.

SYSTRA's patented builder eliminates the need to interface with software engineers. Instead, users have the ability to simply set key conditions, actions, indicators, and relationships. FXTraBox currently offers over 1,300 technical indicators and will soon add fundamental newsfeed, which can be set to an interval of anywhere from one minute to one day. SYSTRA's cloud-based platform can be accessed from anywhere and does not require downloading or specialized software.

With FXTraBox, users have the option to back-test then trade using their strategies through their brokers via MetaTrader4, world's most popular FX trading platform.

Canadian and US vehicle sales strong in July

04 August 2015, 23:52

Canada's record-breaking pace continued last month, with purchases advancing

0.4% above a year earlier and setting a new record for the month of July.

Purchases climbed to an annualized 1.92 million units last month, up from an

average of 1.84 million during the first half of 2015. Light trucks led the way,

buoyed by broad-based gains, especially year-over-year increases of more than

20% for both Jeep and Asian brands.

US vehicle sales were stronger than expected last month, climbing to an annualized 17.5 million units. This represents the third consecutive month that volumes have exceeded an annualized 17 million units and is the best performance since early 2000, prior to the collapse of the global tech bubble. Gains are being driven by a strengthening economy, including the lowest unemployment rate in more than seven years and solid replacement demand. According to IHS Automotive, the average age of the U.S. vehicle fleet increased to a record 11.5 years in early 2015, and will continue to edge higher, as there are more than 40 million vehicles on U.S. roads between the age of 11 and 14 years.

Crossover utility vehicles continue to drive gains, with volumes surging 17% above a year earlier, and more than offsetting weaker car sales. In particular, small CUVs were exceptionally strong, with volumes soaring 65% above a year earlier and garnering a record 5% of the U.S. market last month, up from only 3% a year ago.

US vehicle sales were stronger than expected last month, climbing to an annualized 17.5 million units. This represents the third consecutive month that volumes have exceeded an annualized 17 million units and is the best performance since early 2000, prior to the collapse of the global tech bubble. Gains are being driven by a strengthening economy, including the lowest unemployment rate in more than seven years and solid replacement demand. According to IHS Automotive, the average age of the U.S. vehicle fleet increased to a record 11.5 years in early 2015, and will continue to edge higher, as there are more than 40 million vehicles on U.S. roads between the age of 11 and 14 years.

Crossover utility vehicles continue to drive gains, with volumes surging 17% above a year earlier, and more than offsetting weaker car sales. In particular, small CUVs were exceptionally strong, with volumes soaring 65% above a year earlier and garnering a record 5% of the U.S. market last month, up from only 3% a year ago.