NEWS

05 August 2015, 13:55

GREEK PRIME MINISTER TSIPRAS SAYS TAX BURDEN MUST BE EQUALLY DISTRIBUTED

Pound rises vs dollar despite negative U.K. data; BOE policy meeting on tap

5 August 2015, 13:52

On Wednesday the pound was higher against the dollar despite data indicating

that growth in the U.K. service sector slowed more than expected last month,

signaling that the economic recovery may be losing momentum.

GBP/USD was last higher 0.16% at 1.5589.

The Markit U.K. services purchasing managers' index fell to 57.4 in July from 58.5 in June, below expectations for a reading of 58.0.

Hiring in the sector declined to its slowest pace since March 2014, the report said.

Markit commented that, taken together with surveys of the manufacturing and construction sector earlier this week, the reading points to economic growth of 0.6% in the third quarter - down slightly from 0.7% in the three months to June.

The British currency was supported before the Bank of England's announcement of its latest interest rate decision on Thursday. The bank is also expected to release the minutes of its monetary policy meeting and give their latest quarterly forecasts for economic growth and inflation.

The pound was also higher against the euro with EUR/GBP last trading at 0.6964.

Data on Wednesday showed earlier that private sector growth in the eurozone eased in July, as the euro area composite index fell to 53.9 from June’s four year high of 54.2.

Another report showed that retail sales in the region fell by a larger than forecast 0.6% in June.

Separate data showed that euro zone service sector activity rose unexpectedly in the last quarter, industry data showed on Wednesday. Markit said in a report that Euro Zone Services PMI rose to 54.0, from 53.8 in the preceding quarter. Analysts had expected Euro Zone Services PMI to remain unchanged at 53.8 in the last quarter.

GBP/USD was last higher 0.16% at 1.5589.

The Markit U.K. services purchasing managers' index fell to 57.4 in July from 58.5 in June, below expectations for a reading of 58.0.

Hiring in the sector declined to its slowest pace since March 2014, the report said.

Markit commented that, taken together with surveys of the manufacturing and construction sector earlier this week, the reading points to economic growth of 0.6% in the third quarter - down slightly from 0.7% in the three months to June.

The British currency was supported before the Bank of England's announcement of its latest interest rate decision on Thursday. The bank is also expected to release the minutes of its monetary policy meeting and give their latest quarterly forecasts for economic growth and inflation.

The pound was also higher against the euro with EUR/GBP last trading at 0.6964.

Data on Wednesday showed earlier that private sector growth in the eurozone eased in July, as the euro area composite index fell to 53.9 from June’s four year high of 54.2.

Another report showed that retail sales in the region fell by a larger than forecast 0.6% in June.

Separate data showed that euro zone service sector activity rose unexpectedly in the last quarter, industry data showed on Wednesday. Markit said in a report that Euro Zone Services PMI rose to 54.0, from 53.8 in the preceding quarter. Analysts had expected Euro Zone Services PMI to remain unchanged at 53.8 in the last quarter.

05 August 2015, 13:52

GREEK PRIME MINISTER TSIPRAS SAYS DESPITE DIFFICULTIES HOPES DEAL WILL END

UNCERTAINTY ON FUTURE OF GREECE, OF EUROZONE

05 August 2015, 13:50

RUSSIAN DEPUTY AGRICULTURE MINISTER SAYS WANTS TO CHANGE MECHANISM FOR

CALCULATING WHEAT EXPORT TARIFF - INTERFAX

05 August 2015, 13:49

INDONESIA FINANCE MINISTER SAYS SEES 5-5.2 PCT GDP GROWTH IN FULL YEAR 2015

All not dire in China

05 August 2015, 13:33

While bad news are reeling around Chinese economy and its market, all is not

truly at world's end.

Chinese manufacturing as measured by PMI while slumped to lowest in almost 2 years, services sector PMI has hit highest level in almost a year.

Caixin/Markit services PMI moved to 53.8 in July from 51.8 in June. This move points to not only some underlying momentum in Chinese domestic market, but a change in China's changing economic structure.

Growth in the services sector are not only provides relief at a time when manufacturing has taken a nose dive but also points to that China is slowly shifting its economy from a manufacturing and export oriented one to domestic consumer driven.

However China's benchmark stock index, Shanghai composite failed to gain over the improvement and closed at 3694, down -1.65%.

Chinese manufacturing as measured by PMI while slumped to lowest in almost 2 years, services sector PMI has hit highest level in almost a year.

Caixin/Markit services PMI moved to 53.8 in July from 51.8 in June. This move points to not only some underlying momentum in Chinese domestic market, but a change in China's changing economic structure.

- China's services sector grew in July at its fastest pace, indicating strong demand in domestic market. This is the biggest since August last year, when the index rose by 4.1 points.

- New orders rose at solid pace and services firms gained new customers.

- Services sector continue to provide employment to the economy.

Growth in the services sector are not only provides relief at a time when manufacturing has taken a nose dive but also points to that China is slowly shifting its economy from a manufacturing and export oriented one to domestic consumer driven.

However China's benchmark stock index, Shanghai composite failed to gain over the improvement and closed at 3694, down -1.65%.

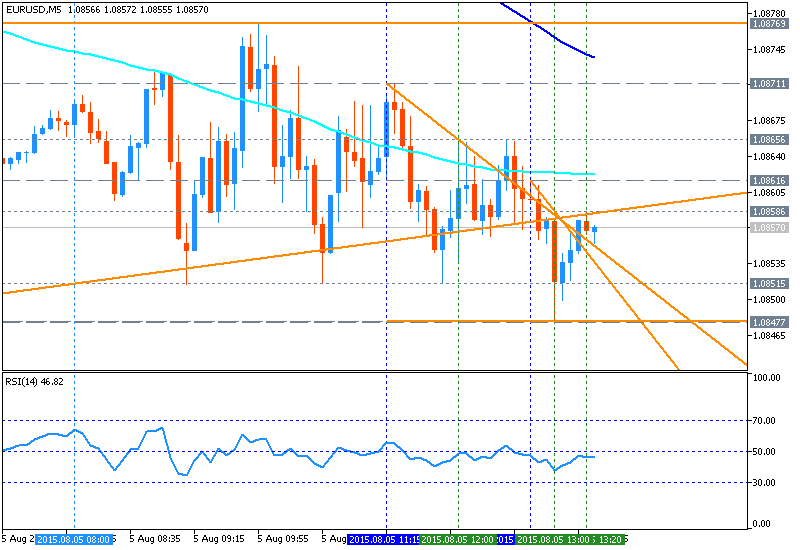

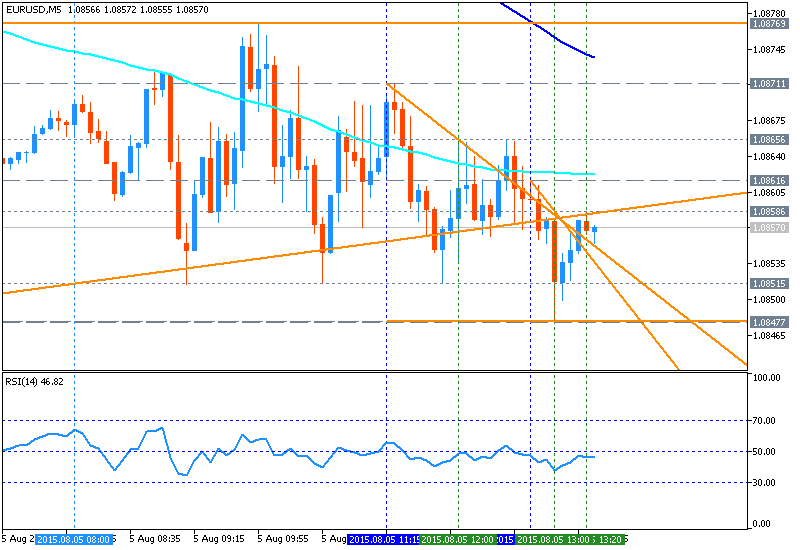

EUR/USD Intra-Day Technical Analysis - symmetric triangle pattern to be broken for direction

5 August 2015, 13:27

M5 price is located below SMA with period 200 (200-SMA) for the

primary bearish market condition. SMA with the period 100 (100-SMA) is located

near and above the price, and if the price will break 100-SMA from below to

above so we may see the ranging market condition within the primary bearish. The

price is breaking symmetric triangle pattern for direction ranging between the

following levels:

TREND : waiting for direction

- 1.0876 resistance located above 200-SMA on the bullish area of the chart, and

- 1.0847 support levels located on bearish area out of ranging zone.

- if price will break 1.0876 resistance level so we may see the reversal of the price to the bullish trend to be started on this timeframe.

- if price will break 1.0847 support so the bearish trend will be continuing to be out of ranging situation.

- if not so the price will be ranging within the levels.

| Resistance | Support |

|---|---|

| 1.0876 | 1.0847 |

| N/A | N/A |

- Recommendation to go short: watch the price to break 1.0847 support level for possible sell trade

- Recommendation to go long: watch the price to break 1.0876 resistance level for possible sell trade

- Trading Summary: ranging

TREND : waiting for direction

Euro area July Final PMIs slightly down on lower services confidence

05 August 2015, 13:19

Euro area final composite PMIs in July were slightly increased from the flash

estimates by 0.2 points to 53.9, edging down from June's four-year peak (-0.3

point). The upward revision of PMI was equally driven by the services and

manufacturing sectors.

In July, lower services confidence led to a modest decline in composite PMIs, while manufacturing confidence held firm.

According to Barclays's estimation, "Overall PMI at the start of Q3 suggests that the growth momentum will be maintained, with our Q3 PMI-based GDP indicator standing at + 0.4% q/q- a similar rate than our Q2 forecast (preliminary GDP data to be released on August 14) and only slightly below the 0.5% q/q Q3 GDP projection. The impact of the Greek crisis seems to have been muted until now, with the manufacturing sector showing resiliency despite the decline in Greek confidence."

In July, lower services confidence led to a modest decline in composite PMIs, while manufacturing confidence held firm.

According to Barclays's estimation, "Overall PMI at the start of Q3 suggests that the growth momentum will be maintained, with our Q3 PMI-based GDP indicator standing at + 0.4% q/q- a similar rate than our Q2 forecast (preliminary GDP data to be released on August 14) and only slightly below the 0.5% q/q Q3 GDP projection. The impact of the Greek crisis seems to have been muted until now, with the manufacturing sector showing resiliency despite the decline in Greek confidence."

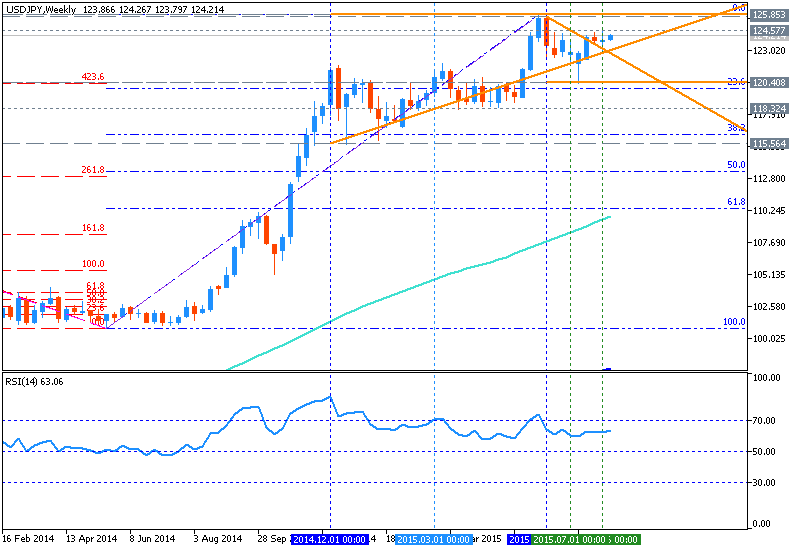

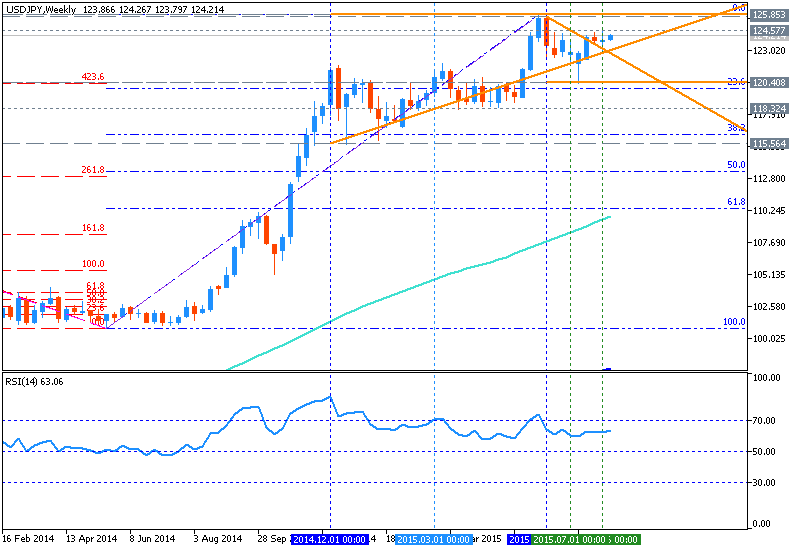

USDJPY Weekly Outlook - symmetric triangle pattern to be broken for breakout

5 August 2015, 13:11

W1 price is located above 200 period SMA (200-SMA) and 100 period SMA

(100-SMA) with the primary bullish for secondary ranging between Fibo resistance

level at 125.85 and 23.6% Fibo support level at 119.93:

If the price will break 23.6% Fibo support level at 119.93 so we may

see the secondary correction within the primary bullish.

If the price will break 23.6% Fibo support level at 119.93 so we may

see the secondary correction within the primary bullish.

If the price will break Fibo resistance level at 125.85 from below to above so the primary bullish market condition will be continuing.

If not so the price will be ranging between between the levels.

Trend:

W1 - ranging bullish

- symmetric triangle pattern was broken by the price from below to above for the bullish trend to be continuing;

- "USD/JPY continues to consolidate below the 124.70 78.6% retracement of the June/July range";

- “A daily close above 124.70 is needed to re-instill upside mometum into the exchange rate”;

- “A close back below 123.00 would turn us negative again USD/JPY”;

- RSI indicator is estimating the uptrend to be continuing.

If the price will break Fibo resistance level at 125.85 from below to above so the primary bullish market condition will be continuing.

If not so the price will be ranging between between the levels.

Trend:

W1 - ranging bullish

GBP/AUD takes support around 2.1000, jump till 2.130 is possible

05 August 2015, 13:10

Harmonic pattern - Bullish BAT pattern

Potential Reversal Zone (PRZ) - 2.1000

Potential Reversal Zone (PRZ) - 2.1000

- Any break below 2.100 would confirm trend reversal and a decline till 2.0880

is possible .

- On the higher side minor resistance is around 2.115 and any indicative break

above would extend gains till 2.1230/2.1300 in short term.

- Bullish invalidation only below 2.1000.

Comparative analysis indicates crude and loonie still moving in indirect proportionate swings

05 August 2015, 12:51

Ever since January 2014 the crude prices have been in negative correlation

with USD/CAD, The above chart evidences the same every bit of movements in both

prices. The significance of crude for the Canadian dollar is not mere the value

of its single largest exporting capacity but it is an extra common substitute in

the present situation for the general Canadian economy that had become highly

leveraged to oil prices. Like U.S, home equity loans that bolstered consumption,

investment and asset prices.

It has been almost more than a year that the crude oil front month light sweet crude and Canadian dollar have been diverging in the opposite direction. However, the capital inflows and outflows of Canada swamp the oil exporting valuations which are also offset by the fact that provinces in the east import oil.

In 2014, Canada exported almost close to $105 bln of energy goods and imported about $46 bln of energy goods. Let's not forget that Canada is an important exception to the US ban on oil exports. In fact, the conventional model has been for the eastern regions to import more expensive Brent, while a few western provinces export cheaper oil to the US.

It has been almost more than a year that the crude oil front month light sweet crude and Canadian dollar have been diverging in the opposite direction. However, the capital inflows and outflows of Canada swamp the oil exporting valuations which are also offset by the fact that provinces in the east import oil.

In 2014, Canada exported almost close to $105 bln of energy goods and imported about $46 bln of energy goods. Let's not forget that Canada is an important exception to the US ban on oil exports. In fact, the conventional model has been for the eastern regions to import more expensive Brent, while a few western provinces export cheaper oil to the US.

FxWirePro: EUR/GBP’s slumps likely to continue; major downtrend still remains intact

05 August 2015, 12:47

Technical Glimpse and Trade

Tips:

EOD technical charts have shown down-streak has now continued back again that had taken a brief pause while a slight recovery took place on last Friday's bounces from 0.7005 to 0.7096 levels. Intraday sentiments are bearish bias and leading indicators fortify these downswings with downward convergence. Things seem like taking track back onto its usual business on euro side, the euro continue to freezing its long lasting loses against sterling and held sturdy in early Asian trades today.

The convergence on RSI is seen on daily charts as it is trending near 40.4243 levels with a supportive signal from stochastic curve as %D line crossover near the same levels which can neither be considered as oversold nor overbought zone. These signals can be attributed as positive movers for those who expect price slumps; however closing figures should be crucial for long-term decision making.

On a swing trading perspective, it is smart to sell on rallies, we advocate buying binary delta puts for targets of 20-25 pips. Intraday charts sell signal caused by sharp bearish candles with long real body and RSI curve is also moving in convergence with dipping prices.

EOD technical charts have shown down-streak has now continued back again that had taken a brief pause while a slight recovery took place on last Friday's bounces from 0.7005 to 0.7096 levels. Intraday sentiments are bearish bias and leading indicators fortify these downswings with downward convergence. Things seem like taking track back onto its usual business on euro side, the euro continue to freezing its long lasting loses against sterling and held sturdy in early Asian trades today.

The convergence on RSI is seen on daily charts as it is trending near 40.4243 levels with a supportive signal from stochastic curve as %D line crossover near the same levels which can neither be considered as oversold nor overbought zone. These signals can be attributed as positive movers for those who expect price slumps; however closing figures should be crucial for long-term decision making.

On a swing trading perspective, it is smart to sell on rallies, we advocate buying binary delta puts for targets of 20-25 pips. Intraday charts sell signal caused by sharp bearish candles with long real body and RSI curve is also moving in convergence with dipping prices.