NEWS

Indonesia faces strict monetary and fiscal policy constraints

06 August 2015, 00:46

Indonesia faces strict monetary and fiscal policy constraints, despite the

urgent need to arrest slowing growth and market pessimism. Bank Indonesia is

unable to loosen its tight monetary policy stance, given high headline inflation

of over 7%, well above its inflation target range of 3-5%. Core inflation has

been creeping higher as well. Concerns about a persistent (albeit narrowing)

current account deficit (forecast at 2.5% of GDP in 2015) and weak currency

(having depreciated 7.6% year-to-date) are also tying the central bank's hands.

BI has turned to the relaxation of macro-prudential measures in a bid to boost

growth. These moves will help, but the impact may be limited.

The government's fiscal flexibility is also limited, given weak tax revenue collection on a slowing economy and a constitutional fiscal deficit limit imposed at 3% of GDP (and public debt ceiling at 60% of GDP). As of the first five months of 2015, tax collection totaled Rp435.3tn ($33bn), only 29% of the full year target, and roughly 1.6% lower than the same period last year. Revenue is falling short because of slower GDP growth, falling commodity prices, and lower oil lifting. Fuel subsidies may also be quietly returning, with the last price adjustment on 28th March.

"We estimate the market price of RON88 gasoline to be about Rp7,900/liter currently, about 6.9% higher than the current fixed price of Rp7,400," notes BofA Merrill Lynch.

The government's fiscal flexibility is also limited, given weak tax revenue collection on a slowing economy and a constitutional fiscal deficit limit imposed at 3% of GDP (and public debt ceiling at 60% of GDP). As of the first five months of 2015, tax collection totaled Rp435.3tn ($33bn), only 29% of the full year target, and roughly 1.6% lower than the same period last year. Revenue is falling short because of slower GDP growth, falling commodity prices, and lower oil lifting. Fuel subsidies may also be quietly returning, with the last price adjustment on 28th March.

"We estimate the market price of RON88 gasoline to be about Rp7,900/liter currently, about 6.9% higher than the current fixed price of Rp7,400," notes BofA Merrill Lynch.

INR: lending rate cuts key to cyclical recovery

06 August 2015, 00:36

India's June quarter GDP growth on 31 August is expected to remain weak at

6.8% yoy, down from 7.5% in the March quarter, as high real rates continue to

delay recovery. However, March quarter growth was largely on account of bunching

up of taxes at the end of the financial year that saw 18.9% growth in net taxes.

The gross value added, i.e., GVA = GDP - net taxes, which is the true measure of

economic activity, was only 6.1% in the March quarter.

Adjusted for net taxes, a slow recovery expected in this quarter, as lending rate cuts typically take around six months to transmit to the real economy. A recovery in 2H rests on an additional 30-40bp cut in lending rates and some remission in ex-post real lending rates with core-WPI inflation expected to pick up to 3.5% by March 2016 as oil base effects reverse.

"Our industrial recovery measure - the average of year-over-year IIP growth this month (ie, May 2015) and the corresponding month last year (ie, May 2014) is beginning to show some turnaround. We expect June IIP growth on 12 August to improve to 4.2% from 2.7% in May," says BofA Merrill Lynch.

Adjusted for net taxes, a slow recovery expected in this quarter, as lending rate cuts typically take around six months to transmit to the real economy. A recovery in 2H rests on an additional 30-40bp cut in lending rates and some remission in ex-post real lending rates with core-WPI inflation expected to pick up to 3.5% by March 2016 as oil base effects reverse.

"Our industrial recovery measure - the average of year-over-year IIP growth this month (ie, May 2015) and the corresponding month last year (ie, May 2014) is beginning to show some turnaround. We expect June IIP growth on 12 August to improve to 4.2% from 2.7% in May," says BofA Merrill Lynch.

Further easing expected from BOC

06 August 2015, 00:17

The BOC cut the overnight rate by another 25bp in July. Although the Bank

continues to provide little guidance on the future direction of the policy,

further policy easing is expected, with the base case scenario of yet another

25bp cut in January. Most importantly, the Bank's growth outlook looks highly

optimistic. Indeed, the MPR assumes 2.8% GDP growth in 2016 (Q4/Q4 basis). Given

continuing readjustments of the energy industry and overleveraged consumer

sector, such high growth could be only achieved with a strong pick-up in net

exports, which is unlikely given the recent slowdown in the US trend growth and

reduced sensitivity of Canada exports to US growth.

The MPR also assumes the WTI price at $60/bbl, which likely overestimates the outlook for oil prices given slowing China growth and a potential pick-up in supply from Iran. China's slowdown may also put a further downward pressure on other exported commodities, in addition to oil. At the same time, Governor Poloz has hinted the BOC may consider further easing if growth disappoints.

The MPR also assumes the WTI price at $60/bbl, which likely overestimates the outlook for oil prices given slowing China growth and a potential pick-up in supply from Iran. China's slowdown may also put a further downward pressure on other exported commodities, in addition to oil. At the same time, Governor Poloz has hinted the BOC may consider further easing if growth disappoints.

Americas Roundup: US Dollar hits 2-month high vs Japanese Yen, after U.S. services data- August 6th, 2015

06 August 2015, 00:15

Market Roundup

EUR/USD is supported around 1.0820 levels and currently trading at 1.0906 levels. It has made session high at 1.0914 and lows at 1.0848 levels. The dollar rose against euro on Wednesday as data showed the U.S. services sector expanded at its fastest pace in 10 years, supporting the view the Federal Reserve would raise interest rates in September. The surprisingly strong reading on industries that account for more than two-thirds of the U.S. economy aligned with comments from Atlanta Fed Chief Dennis Lockhart published on Tuesday. In an interview with the Wall Street Journal, Lockhart expressed support for the end of the Fed's near zero rate policy next month. Meanwhile, in the late hours of New York session, the greenback dialed back from its initial gains against euro to trade at 1.0906 levels, after Fed Governor Jerome Powell told CNBC television he has not decided on a rate 'lift-off' in September. To the upside, immediate resistance can be seen at 1.0915. To the downside, immediate support level is located at 1.0870 levels.

GBP/USD is supported around 1.5520 levels and currently trading at 1.5603 levels. It has made session high at 1.5645 and low at 1.5588 levels. Sterling gained ground against the dollar on Wednesday, bolstered by bets that a "Super Thursday" of Bank of England publications would take it one step closer to a rise in interest rates. The main driver of afternoon trade in London was U.S. data which damaged the dollar and the case for the Federal Reserve to raise its own rates next month. On Tuesday Atlanta Federal Reserve chief Dennis Lockhart bolstered expectations that the Fed might move on rates as early as September, sending sterling around 1 cent lower against the dollar. But jobs numbers on Wednesday ran in the opposite direction, the pound had recovered the bulk of the previous session's losses and was a third of a percent higher on the day at $1.5610. To the upside, immediate resistance can be seen at 1.5648. To the downside, immediate support level is located at 1.5565 levels.

USD/JPY is supported around 124.00 levels and currently trading at 124.84 levels. It has made session high at 125.00 and low at 124.25 levels. The dollar rose to a two-month high against the Japanese yen on Wednesday, as a stronger-than-forecast private report on the U.S. services sector in July revived bets the Federal Reserve would raise interest rates as early as September. The pace of growth in the U.S. service sector surged in July to its best level in a decade, led by sharp increases in business activity, employment and new orders, an industry report showed on Wednesday. The Institute for Supply Management said its services sector index rose last month to 60.3, its highest reading since August 2005. The greenback was last up 0.4 percent at 124.92 yen. To the upside, immediate resistance can be seen at 125.00. To the downside, immediate support level is located at 125.50 levels.

USD/CAD is supported around 1.3100 levels and currently trading at 1.3181 levels. It has made session high at 1.3196 and low at 1.3110 levels. The Canadian dollar pulled back from an 11-year low against its U.S. counterpart on Wednesday as data showed the country's trade deficit narrowed sharply in June due to soaring exports. The trade shortfall for the month was far less than analysts had expected and, coupled with disappointing U.S. private-sector jobs data, helped push the loonie back below C$1.32 to the greenback. Canada's long-suffering export sector snapped a five-month losing streak in June, showing the strongest surge in more than eight years and cutting the country's trade deficit significantly, Statistics Canada said on Wednesday. The currency's strongest level of the session was C$1.3110, while its weakest was C$1.3213. To the upside, immediate resistance can be seen at 1.3200. To the downside, major support level is located at 1.3132 levels

Equities Recap

European stocks closed higher on Wednesday, backed by strong economic data from china and strong showing by corporate earnings. UK's benchmark FTSE 100 edged higher by 1 percent at close, the pan-European FTSEurofirst 300 closed, up by 1.3 percent, Germany's Dax closed up by 1.7 percent, France's CAC closed up at 1.8 percent, Italy's FTSE MIB closed up by 1.9 percent. Meanwhile, Spain's IBEX 35 was down by 0.7 percent at close.

U.S. stocks closed slightly higher Wednesday. Dow Jones closed down by 0.06 percent, S&P 500 closed up by 0.31 percent, Nasdaq closed up by 0.68 percent.

Treasuries Recap

U.S. Treasury yields rose on Wednesday, with those on longer-dated debt rising more than short-dated yields after weaker-than-expected U.S. jobs data kindled skepticism that the Federal Reserve would hike interest rates in September.

Benchmark 10-year yields hit a nearly one-week high of 2.29 percent.

U.S. 30-year Treasury prices were last down 1-3/32 to yield 2.94 percent, from a yield of 2.89 percent late on 10-year notes were last down 15/32 in price to yield 2.27 percent, from 2.21 percent late on Tuesday.

Two-year notes were mostly flat in price to yield 0.73 percent.

German yields rose on data showing euro zone business growth accelerated at the end of last month as companies largely put the Greek debt crisis behind them, suggesting the bloc's economic recovery is on track.

Benchmark 10-year German Bund yields rose to 0.76 percent, the highest level since July 23, from 0.64 percent the previous session.

Commodities Recap

Oil prices hit multi-month lows on Wednesday after a surge in gasoline stockpiles in the United States as the summer season, the country's biggest demand period for motor fuels, neared its end.

Futures of Brent, the global oil benchmark, hit a six-month bottom while that of U.S. crude touched a 4-1/2-month trough, despite a bigger-than-expected drawdown in U.S. crude stockpiles announced by the Energy Information Administration.

U.S. crude futures settled down 59 cents, or 1.3 percent, at $45.15 a barrel, hitting a low last seen in March of $44.83. The market initially rallied nearly $1, reacting to the drawdown in crude stockpiles before retreating on the gasoline numbers.

Futures of Brent closed 40 cents lower at $49.59 a barrel, after falling to a January low of $49.02.

Gasoline futures settled down almost 1 percent, hitting a 5-1/2 month low.

Gold eased on Wednesday, hovering above the recent 5-1/2 year low on earlier pressure from the dollar as U.S. services sector data revived expectations of a U.S. interest rate rise as early as September.

Spot gold was down 0.2 percent at $1,085.35 an ounce by 2:37 p.m. EDT (1837 GMT), while U.S. gold for delivery in December settled down 0.5 percent, at $1,085.60 an ounce.

- US ISM Non-Manufacturing PMI Jul 60.3, f/c 56.2, 56-previous.

- US ISM Non-Manufacturing Employment Index Jul 59.6, 52.7-previous.

- US ADP National Employment Jul 185.0k, f/c 215k, +229k-previous, below low f/c at 190k.

- Fed's Powell 'time is clearly coming' to raise rates, very focused on data b/w now and mid-Sept (CNBC).

- Brazil's Levy says gov't to tackle fiscal imbalances, private sector should have larger role in infrastructure.

- Oil falls in NY afternoon despite large drawdown.

- Brazil Markit Services PMI Jul 39.1, 39.9-previous.

- 23:50 Japan Foreign Bond Investment w/e -21.7b-previous

- 23:50 Japan Foreign Invest JP Stock w/e -82.1b-previous

- 05:00 Japan Coincident Indicator MM* Jun -1.8-previous

- 05:00 Japan Leading Indicator* Jun -0.2-previous

- 01:30 Australia Employment* Jul f/c 10.0k, 7.3k-previous

- 01:30 Australia Full Time Employment* Jul 24.5k-previous

- 01:30 Australia Participation Rate* Jul f/c 64.8%, 64.80%-previous

- 01:30 Australia Unemployment Rate* Jul f/c 6%, 6.00%-previous

- --:-- Japan Bank of Japan monetary policy meeting (to Aug. 7)

EUR/USD is supported around 1.0820 levels and currently trading at 1.0906 levels. It has made session high at 1.0914 and lows at 1.0848 levels. The dollar rose against euro on Wednesday as data showed the U.S. services sector expanded at its fastest pace in 10 years, supporting the view the Federal Reserve would raise interest rates in September. The surprisingly strong reading on industries that account for more than two-thirds of the U.S. economy aligned with comments from Atlanta Fed Chief Dennis Lockhart published on Tuesday. In an interview with the Wall Street Journal, Lockhart expressed support for the end of the Fed's near zero rate policy next month. Meanwhile, in the late hours of New York session, the greenback dialed back from its initial gains against euro to trade at 1.0906 levels, after Fed Governor Jerome Powell told CNBC television he has not decided on a rate 'lift-off' in September. To the upside, immediate resistance can be seen at 1.0915. To the downside, immediate support level is located at 1.0870 levels.

GBP/USD is supported around 1.5520 levels and currently trading at 1.5603 levels. It has made session high at 1.5645 and low at 1.5588 levels. Sterling gained ground against the dollar on Wednesday, bolstered by bets that a "Super Thursday" of Bank of England publications would take it one step closer to a rise in interest rates. The main driver of afternoon trade in London was U.S. data which damaged the dollar and the case for the Federal Reserve to raise its own rates next month. On Tuesday Atlanta Federal Reserve chief Dennis Lockhart bolstered expectations that the Fed might move on rates as early as September, sending sterling around 1 cent lower against the dollar. But jobs numbers on Wednesday ran in the opposite direction, the pound had recovered the bulk of the previous session's losses and was a third of a percent higher on the day at $1.5610. To the upside, immediate resistance can be seen at 1.5648. To the downside, immediate support level is located at 1.5565 levels.

USD/JPY is supported around 124.00 levels and currently trading at 124.84 levels. It has made session high at 125.00 and low at 124.25 levels. The dollar rose to a two-month high against the Japanese yen on Wednesday, as a stronger-than-forecast private report on the U.S. services sector in July revived bets the Federal Reserve would raise interest rates as early as September. The pace of growth in the U.S. service sector surged in July to its best level in a decade, led by sharp increases in business activity, employment and new orders, an industry report showed on Wednesday. The Institute for Supply Management said its services sector index rose last month to 60.3, its highest reading since August 2005. The greenback was last up 0.4 percent at 124.92 yen. To the upside, immediate resistance can be seen at 125.00. To the downside, immediate support level is located at 125.50 levels.

USD/CAD is supported around 1.3100 levels and currently trading at 1.3181 levels. It has made session high at 1.3196 and low at 1.3110 levels. The Canadian dollar pulled back from an 11-year low against its U.S. counterpart on Wednesday as data showed the country's trade deficit narrowed sharply in June due to soaring exports. The trade shortfall for the month was far less than analysts had expected and, coupled with disappointing U.S. private-sector jobs data, helped push the loonie back below C$1.32 to the greenback. Canada's long-suffering export sector snapped a five-month losing streak in June, showing the strongest surge in more than eight years and cutting the country's trade deficit significantly, Statistics Canada said on Wednesday. The currency's strongest level of the session was C$1.3110, while its weakest was C$1.3213. To the upside, immediate resistance can be seen at 1.3200. To the downside, major support level is located at 1.3132 levels

Equities Recap

European stocks closed higher on Wednesday, backed by strong economic data from china and strong showing by corporate earnings. UK's benchmark FTSE 100 edged higher by 1 percent at close, the pan-European FTSEurofirst 300 closed, up by 1.3 percent, Germany's Dax closed up by 1.7 percent, France's CAC closed up at 1.8 percent, Italy's FTSE MIB closed up by 1.9 percent. Meanwhile, Spain's IBEX 35 was down by 0.7 percent at close.

U.S. stocks closed slightly higher Wednesday. Dow Jones closed down by 0.06 percent, S&P 500 closed up by 0.31 percent, Nasdaq closed up by 0.68 percent.

Treasuries Recap

U.S. Treasury yields rose on Wednesday, with those on longer-dated debt rising more than short-dated yields after weaker-than-expected U.S. jobs data kindled skepticism that the Federal Reserve would hike interest rates in September.

Benchmark 10-year yields hit a nearly one-week high of 2.29 percent.

U.S. 30-year Treasury prices were last down 1-3/32 to yield 2.94 percent, from a yield of 2.89 percent late on 10-year notes were last down 15/32 in price to yield 2.27 percent, from 2.21 percent late on Tuesday.

Two-year notes were mostly flat in price to yield 0.73 percent.

German yields rose on data showing euro zone business growth accelerated at the end of last month as companies largely put the Greek debt crisis behind them, suggesting the bloc's economic recovery is on track.

Benchmark 10-year German Bund yields rose to 0.76 percent, the highest level since July 23, from 0.64 percent the previous session.

Commodities Recap

Oil prices hit multi-month lows on Wednesday after a surge in gasoline stockpiles in the United States as the summer season, the country's biggest demand period for motor fuels, neared its end.

Futures of Brent, the global oil benchmark, hit a six-month bottom while that of U.S. crude touched a 4-1/2-month trough, despite a bigger-than-expected drawdown in U.S. crude stockpiles announced by the Energy Information Administration.

U.S. crude futures settled down 59 cents, or 1.3 percent, at $45.15 a barrel, hitting a low last seen in March of $44.83. The market initially rallied nearly $1, reacting to the drawdown in crude stockpiles before retreating on the gasoline numbers.

Futures of Brent closed 40 cents lower at $49.59 a barrel, after falling to a January low of $49.02.

Gasoline futures settled down almost 1 percent, hitting a 5-1/2 month low.

Gold eased on Wednesday, hovering above the recent 5-1/2 year low on earlier pressure from the dollar as U.S. services sector data revived expectations of a U.S. interest rate rise as early as September.

Spot gold was down 0.2 percent at $1,085.35 an ounce by 2:37 p.m. EDT (1837 GMT), while U.S. gold for delivery in December settled down 0.5 percent, at $1,085.60 an ounce.

Fed signals low bar for September hike

05 August 2015, 23:54

The dollar extended its rally since the June FOMC meeting as the market

priced increased chances of a September hike. The July FOMC statement

highlighted the bar for hikes is not high with the Committee only needing to see

"some further improvement in labor market improvement" before they will be

comfortable raising rates. This validated and extended market pricing, and while

weak Q2 wage data raised questions about a September hike, this is the most

likely outcome.

With Greek and China risks subsiding for now, this has refocused market attention on policy divergence again, providing a broadly USD-supportive environment. The next two employment reports will be key in driving market expectations with a relative dearth of Fed speakers between now and September.

"Our call for a +200k print in the July report supports our September call. Outside the US, our European economics team sees increasing risk of a dovish ECB turn as tighter financial conditions will challenge hitting the inflation target, forcing them to keep their finger on the trigger. Lastly, while the situation in China has stabilized, we continue to see any further deterioration as impacting the USD less than other G10 currencies, particularly EUR and AUD. So, while an adverse China outcome may delay the Fed, the USD could still benefit," says BofA Merrill Lynch.

With Greek and China risks subsiding for now, this has refocused market attention on policy divergence again, providing a broadly USD-supportive environment. The next two employment reports will be key in driving market expectations with a relative dearth of Fed speakers between now and September.

"Our call for a +200k print in the July report supports our September call. Outside the US, our European economics team sees increasing risk of a dovish ECB turn as tighter financial conditions will challenge hitting the inflation target, forcing them to keep their finger on the trigger. Lastly, while the situation in China has stabilized, we continue to see any further deterioration as impacting the USD less than other G10 currencies, particularly EUR and AUD. So, while an adverse China outcome may delay the Fed, the USD could still benefit," says BofA Merrill Lynch.

Macro outlook should put US rate hikes on the horizon

05 August 2015, 23:42

Greek issues have receded from the headlines, and the market focus is

expected to return to core worries around the broader global macro outlook. In

particular, the USD is expected to move higher as the July 29th FOMC statement

indicated that US monetary policymakers were still seeing progress towards

conditions supporting that first Fed rate hike in September. The contrast

between a Federal Reserve hiking rates, compared to most central banks around

the world cutting rates or executing unconventional easing, is expected to be

USD-positive. Of course, such Fed action depends crucially on further

improvement in the growth picture, especially the labor market.

The data flow has been somewhat mixed, especially in terms of wage growth. Meanwhile, the ECB continues to fight disinflation concerns with mixed success through their current quantitative easing program. China's slowdown continues to roil markets, as seen in the move in Chinese equities. Markets are increasingly concerned about stabilization in growth, and weakening activity has particularly hit commodity-focused currencies such as AUD.

"Our China economics team still expects a more limited negative impact from equities to the economy, the key factor will be government credibility going forward in terms of restoring confidence," notes BofA Merrill Lynch.

The data flow has been somewhat mixed, especially in terms of wage growth. Meanwhile, the ECB continues to fight disinflation concerns with mixed success through their current quantitative easing program. China's slowdown continues to roil markets, as seen in the move in Chinese equities. Markets are increasingly concerned about stabilization in growth, and weakening activity has particularly hit commodity-focused currencies such as AUD.

"Our China economics team still expects a more limited negative impact from equities to the economy, the key factor will be government credibility going forward in terms of restoring confidence," notes BofA Merrill Lynch.

US ISM non-manufacturing index rises to 60.3 in July

05 August 2015, 23:22

The Institute of Supply Management (ISM) non-manufacturing index surged 4.3

points to 60.3 in July (from 56.0 in June), handsomely topping the consensus

forecast for a modest uptick to 56.2. Details of the report were equally

encouraging, with all but one subcomponent gaining on the month. After sliding

lower in recent months, the employment subcomponent rebounded strongly in July

(+6.9 points), rising to the highest level since the onset of recovery. Business

activity (+3.4 points) and new orders (+5.5 points) also recorded hefty

gains.

After adjusting for seasonality, export and import subcomponents rose by 3.3 and 2.9 points, respectively. The backlog orders increased by 5.8 points on the month. Of the 18 non-manufacturing industries surveyed, 16 reported growth and only two (mining and other services) reported having contracted in July.

There is definitely no summer lull in the U.S. services sector. Today's ISM non-manufacturing report was good news all-around with broad-based gains alongside an impressive headline, which passed the 60-point threshold for the first time in 10 years.

With this week's release of both manufacturing and non-manufacturing surveys, the data continues to point to a growing divergence between the two sectors. Faced with the surging greenback and uneven global growth, U.S. factory activity has shifted into lower gear this year. Meanwhile, these headwinds are less of an issue for non-manufacturing industries that are more domestically-oriented. Buoyancy in the non-manufacturing index suggests that service sector activity continues to expand at a fast clip.

Going forward, domestic demand will continue to benefit from multiple tailwinds, including rising employment and incomes, and accelerating activity in the housing market. Today's large gain in employment subcomponent suggests that the service sector, which already generates the bulk of new jobs, will continue to drive above-trend employment growth. This bodes well for Friday's payroll report, which is expected to show another +200k gain.

After adjusting for seasonality, export and import subcomponents rose by 3.3 and 2.9 points, respectively. The backlog orders increased by 5.8 points on the month. Of the 18 non-manufacturing industries surveyed, 16 reported growth and only two (mining and other services) reported having contracted in July.

There is definitely no summer lull in the U.S. services sector. Today's ISM non-manufacturing report was good news all-around with broad-based gains alongside an impressive headline, which passed the 60-point threshold for the first time in 10 years.

With this week's release of both manufacturing and non-manufacturing surveys, the data continues to point to a growing divergence between the two sectors. Faced with the surging greenback and uneven global growth, U.S. factory activity has shifted into lower gear this year. Meanwhile, these headwinds are less of an issue for non-manufacturing industries that are more domestically-oriented. Buoyancy in the non-manufacturing index suggests that service sector activity continues to expand at a fast clip.

Going forward, domestic demand will continue to benefit from multiple tailwinds, including rising employment and incomes, and accelerating activity in the housing market. Today's large gain in employment subcomponent suggests that the service sector, which already generates the bulk of new jobs, will continue to drive above-trend employment growth. This bodes well for Friday's payroll report, which is expected to show another +200k gain.

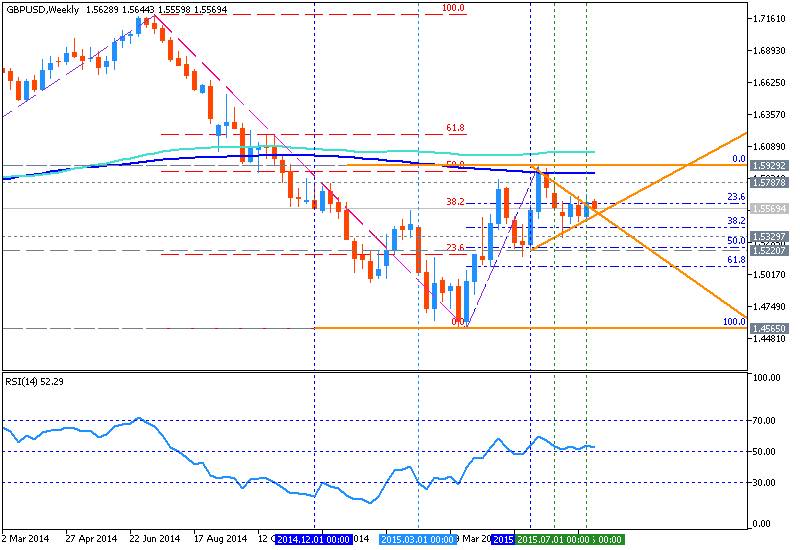

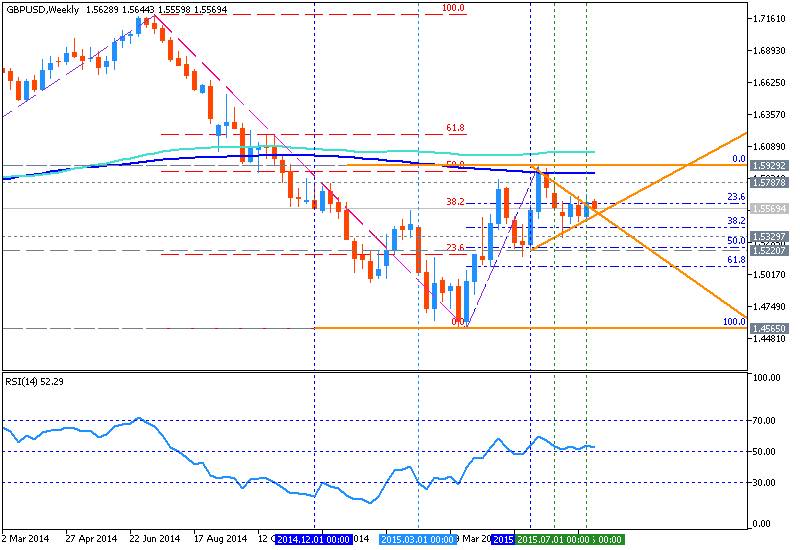

GBPUSD Weekly Outlook - daily close above 1.5700 and weakness under 1.5470

5 August 2015, 22:11

W1 price is located below 200 period SMA (200-SMA) and below 100

period SMA (100-SMA) for the primary bullish with secondary ranging within

consoludation channel of Fibo resistance at 1.5929 and 50.0% Fibo support level

at 1.5250:

If the price will break 50.0% Fibo support level at 1.5250 so the

secondary correction within the primary bearish will be started.

If the price will break 50.0% Fibo support level at 1.5250 so the

secondary correction within the primary bearish will be started.

If the price will break Fibo resistance level at 1.5929 from below to above so we may see the reversal of the price movement from the primary bearish to the bullish market condition.

If not so the price will be ranging between between the levels.

Trend:

W1 - ranging bearish

- symmetric triangle pattern is going to be crossed by the price from below to above for the bullish trend to be continuing;

- “GBP/USD has settled into a range below the 61.8% retracement of the June/July decline at 1.5700”;

- "Weakness under 1.5470 is needed to trigger another leg lower in the pound";

- “A daily close above 1.5700 would turn us positive on GBP/USD”.

If the price will break Fibo resistance level at 1.5929 from below to above so we may see the reversal of the price movement from the primary bearish to the bullish market condition.

If not so the price will be ranging between between the levels.

Trend:

W1 - ranging bearish

05 August 2015, 21:59

US TAX-FREE MONEY MARKET FUND ASSETS INCREASE BY $370.20 MLN TO $245.79

BLN-IMONEYNET