NEWS

22 July 2015, 06:50

As UK inflation is surprising slightly to the downside, the earnings growth

is found to be gathering steam. This factor should make itself felt in the

services component of inflation which is more domestically

determined.

Growth in regular pay rose from 2.7% to 2.8% 3mth yoy whereas growth in total pay including bonus payments jumped from 2.7% to 3.2%. This is one of the most crucial variables to monitor with regard to the MPC's policy path.

This acceleration, whilst probably exaggerated a little in the short term, is likely to be the longdelayed response to the closing of the output gap. As such, it will be reinforcing the case for more serious consideration of the first rate increase, as MPC member Martin Weale in particular has been highlighting.

However, it is not earnings per sector that affect inflation, rather it is unit labour costs and they remain well-behaved because there has finally been some pickup in productivity, says Societe Generale.

Growth in regular pay rose from 2.7% to 2.8% 3mth yoy whereas growth in total pay including bonus payments jumped from 2.7% to 3.2%. This is one of the most crucial variables to monitor with regard to the MPC's policy path.

This acceleration, whilst probably exaggerated a little in the short term, is likely to be the longdelayed response to the closing of the output gap. As such, it will be reinforcing the case for more serious consideration of the first rate increase, as MPC member Martin Weale in particular has been highlighting.

However, it is not earnings per sector that affect inflation, rather it is unit labour costs and they remain well-behaved because there has finally been some pickup in productivity, says Societe Generale.

22 July 2015, 06:48

The rate of UK inflation fell back from 0.1% yoy to 0.0% precisely in June.

That seems innocuous enough but the details provide some insights into the price

outlook. The impact of the rise in the pound last year on UK inflation has been

widely discussed by members of the BoE MPC in particular.

It is clear that the major impact on overall inflation has been via the non-energy industrial goods component. The UK is a price taker on world goods markets as the domestic manufacturing base has contracted and so movements in the exchange rate have a direct impact on goods prices.

"What is expected to be seen in the latest data was that the downward impact on goods price inflation had peaked but in fact it continues to intensify. Thepound has continued to appreciate over the last few months and this could deliver further reductions in goods inflation", says Societe Generale.

It is clear that the major impact on overall inflation has been via the non-energy industrial goods component. The UK is a price taker on world goods markets as the domestic manufacturing base has contracted and so movements in the exchange rate have a direct impact on goods prices.

"What is expected to be seen in the latest data was that the downward impact on goods price inflation had peaked but in fact it continues to intensify. Thepound has continued to appreciate over the last few months and this could deliver further reductions in goods inflation", says Societe Generale.

22 July 2015, 06:46

Even though momentum in the UK economy remains strong, the manufacturing

sector is struggling to benefit from this. Output fell by 0.4% mom in April and

then by a further 0.6% in May. Exports might be getting hurt by the strength of

the pound.

"The business surveys are showing that export orders have weakened of late so this explanation seems highly plausible. If it is correct then further weakness should be expected in the months ahead as the pound has continued to appreciate", says Societe Generale.

The recent surprise fall in the trade in goods deficit should not be completely trusted. This was primarily the result of a fall in imports, which looks like an aberration, rather than by a rise in exports.

"The business surveys are showing that export orders have weakened of late so this explanation seems highly plausible. If it is correct then further weakness should be expected in the months ahead as the pound has continued to appreciate", says Societe Generale.

The recent surprise fall in the trade in goods deficit should not be completely trusted. This was primarily the result of a fall in imports, which looks like an aberration, rather than by a rise in exports.

22 July 2015, 06:43

The PBoC monetary policy and policy to support equity markets and valuation

are supportive of Chinese equities. Hong Kong-listed shares are preferrable.The

room for monetary policy easing remains high, as the inflation and growth mix

has remained benign.

Chinese policy makers have already loosened policy significantly. The reserve requirement ratio for major banks now stands at 18.5% vs a level of 20% a year back, and a peak of 21.5% in June 2011, while recently (27 June 2015) the PBoC reduced the RRR another 50bp for selected banks, though this was not a system-wide cut.

The interest rate in the interbank market has fallen from about 2.9% to 2.45% over the past 20 days. The PBoC has also cut the one-year benchmark lending rate by 25bp to 4.85%, though the effectiveness of this tool has declined.

"More policy measures might come in Q4 2015", says Societe Generale.

Chinese policy makers have already loosened policy significantly. The reserve requirement ratio for major banks now stands at 18.5% vs a level of 20% a year back, and a peak of 21.5% in June 2011, while recently (27 June 2015) the PBoC reduced the RRR another 50bp for selected banks, though this was not a system-wide cut.

The interest rate in the interbank market has fallen from about 2.9% to 2.45% over the past 20 days. The PBoC has also cut the one-year benchmark lending rate by 25bp to 4.85%, though the effectiveness of this tool has declined.

"More policy measures might come in Q4 2015", says Societe Generale.

22 July 2015, 06:39

INDONESIA C.BANK OFFICIAL SAYS ALWAYS IN THE FOREX MARKET, ESPECIALLY WHEN IT

IS UNDERVALUED

22 July 2015, 06:39

In the current distressed market conditions, a large monetary policy response

is the answer, only liquidity injections by the PBoC can stabilise the China

market. Indeed, the central bank appears poised to do more in the foreseeable

future. The PBoC has already begun, with a 0.25bp rate cut and another 50bp cut

in the Reserve Requirement Ratio for select banks.

During earlier equity market crises (1987, 2000/2001, 2008), monetary injections proved a very efficient tool to stabilise markets.

"The 'slowing inflation' regime allows for policy loosening in the coming quarters, if not years, a striking contrast with the policy tightening expected shortly in the US and the UK", says Societe Generale.

The impact of this equity market downturn on the real economy should be limited. According to official statistics, the vast majority of wealth owed by Chinese individuals is held in property, not equities.

However, the mainstream banks and 'shadow' banks are clearly exposed to the leverage created to finance equity investments. Hence there are potentially uncontrolled systemic risks attached to the equity market's correction.

This is worrisome for the central bank and global investors, which is why policymakers have acted to relieve to stabilize equity markets.

During earlier equity market crises (1987, 2000/2001, 2008), monetary injections proved a very efficient tool to stabilise markets.

"The 'slowing inflation' regime allows for policy loosening in the coming quarters, if not years, a striking contrast with the policy tightening expected shortly in the US and the UK", says Societe Generale.

The impact of this equity market downturn on the real economy should be limited. According to official statistics, the vast majority of wealth owed by Chinese individuals is held in property, not equities.

However, the mainstream banks and 'shadow' banks are clearly exposed to the leverage created to finance equity investments. Hence there are potentially uncontrolled systemic risks attached to the equity market's correction.

This is worrisome for the central bank and global investors, which is why policymakers have acted to relieve to stabilize equity markets.

22 July 2015, 06:30

INDIA GOVT SURPLUS CASH BALANCE WITH RBI FOR AUCTION WAS 137.47 BLN RUPEES AS

ON JULY 21– CBANK

22 July 2015, 06:25

PHILIPPINES LIKELY TO MISS EXPORT GROWTH TARGET OF 8 TO 10 PCT THIS YEAR

-TRADE SECRETARY

22 July 2015, 06:21

- GBP/USD has broken short term support 1.5550 and declined till 1.5528 yesterday . It is currently trading at 1.5557.

- Intra day bullishness can be seen only above 1.5580 and break above target

1.5600/1.5630/1.5650.

- Overall bullishness can be seen only if it closes above 1.5600.

22 July 2015, 06:16

INDONESIA C.BANK GOV SAYS SEES JULY INFLATION AT 0.46-0.6 PCT M/M

22 July 2015, 05:53

- GBP/JPY has broken short term support at 192.60 and this confirms short term weakness till 190.50 can be seen.

- On the downside minor support is around 191.78 and break below will target

191/190.55.

- Short term bullishness can be seen only above 193 . Any indicative break above that level would extend gains till 193.35/194 in short term.

22 July 2015, 04:51

Kuroda subscribes to a hypothesis that inflation expectations are 'adaptive',

rather than 'rational', meaning that people form future inflation expectations

based on past or current actual inflation. From his speech on 19 April

2015:

"In a recent study, Mr. Jeffrey Fuhrer, Executive Vice President and Senior Policy Advisor at the Federal Reserve Bank of Boston, using U.S. time series data, finds that past inflation accounts for 40 percent of the variation in four-quarter inflation expectations. Looking at data for Japan, similar reduced form regressions tend to find that past inflation accounts for a significantly larger part of variations in inflation expectations. These contrasting results suggest that inflation expectations may be better anchored - that is, less susceptible to developments in past inflation - in the United States than in Japan."

This is important. A central bank can look through short-term fluctuations of actual inflation if inflation expectations are rational rather than adaptive and anchored to the central bank's inflation target. Otherwise, or in Japan's case where inflation expectations are not anchored and are influenced heavily by actual (declining) inflation, the central bank will likely respond to it.

Kuroda's economic belief of the adaptive nature of inflation expectations in Japan and his legal mindset with the anticipated possibility argument probably explain the BOJ's surprise decision to ease policy further in October 2014 as a response to falling oil prices. In his view, any second-round effect of falling oil prices to lower inflation expectations should be the BOJ's responsibility, and the chance of that effect materializing was high given the adaptive nature of inflation expectations in Japan. Going forward, any major shock (for instance, an equity sell-off or currency appreciation) deemed significant enough to depress inflation expectations would likely be a trigger for the BOJ to ease further.

"In a recent study, Mr. Jeffrey Fuhrer, Executive Vice President and Senior Policy Advisor at the Federal Reserve Bank of Boston, using U.S. time series data, finds that past inflation accounts for 40 percent of the variation in four-quarter inflation expectations. Looking at data for Japan, similar reduced form regressions tend to find that past inflation accounts for a significantly larger part of variations in inflation expectations. These contrasting results suggest that inflation expectations may be better anchored - that is, less susceptible to developments in past inflation - in the United States than in Japan."

This is important. A central bank can look through short-term fluctuations of actual inflation if inflation expectations are rational rather than adaptive and anchored to the central bank's inflation target. Otherwise, or in Japan's case where inflation expectations are not anchored and are influenced heavily by actual (declining) inflation, the central bank will likely respond to it.

Kuroda's economic belief of the adaptive nature of inflation expectations in Japan and his legal mindset with the anticipated possibility argument probably explain the BOJ's surprise decision to ease policy further in October 2014 as a response to falling oil prices. In his view, any second-round effect of falling oil prices to lower inflation expectations should be the BOJ's responsibility, and the chance of that effect materializing was high given the adaptive nature of inflation expectations in Japan. Going forward, any major shock (for instance, an equity sell-off or currency appreciation) deemed significant enough to depress inflation expectations would likely be a trigger for the BOJ to ease further.

22 July 2015, 04:17

OBAMA ADMINISTRATION WILL PRESS CONGRESS TO ENSURE HIGHWAY BILL RESOLUTION

INCLUDES PATH FORWARD TO REAUTHORIZE EXPORT-IMPORT BANK -ADMINISTRATION OFFICIAL

22 July 2015, 04:11

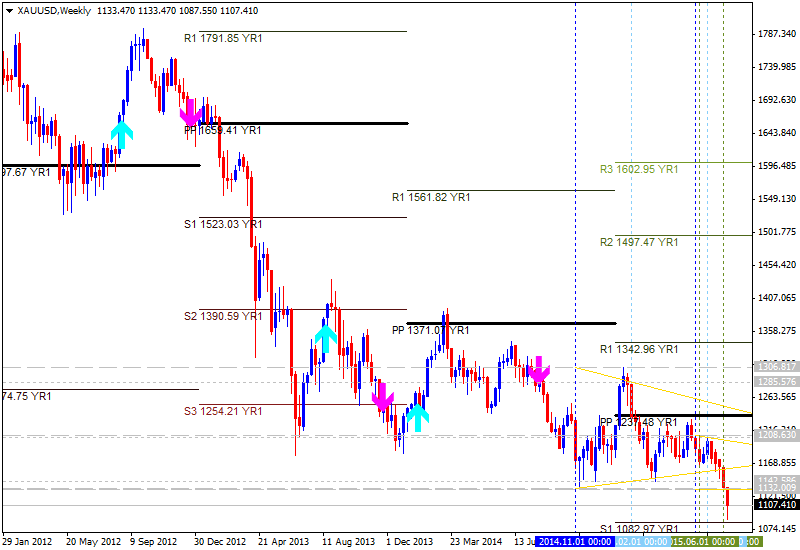

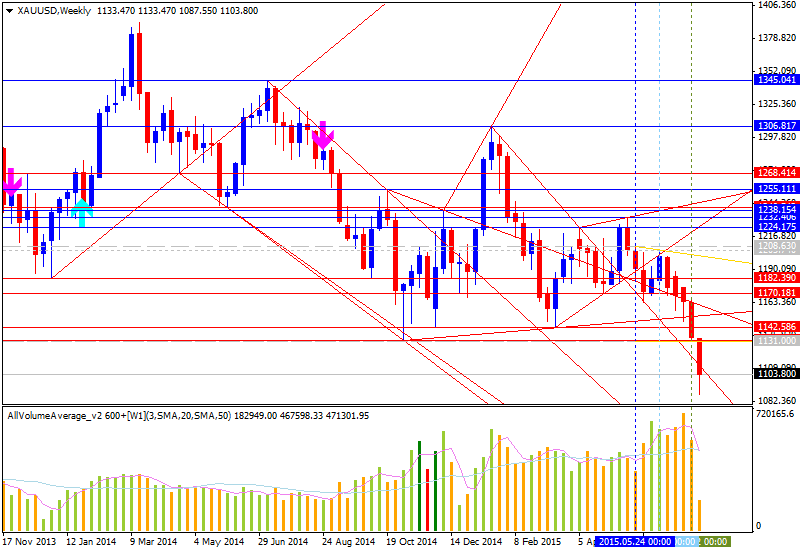

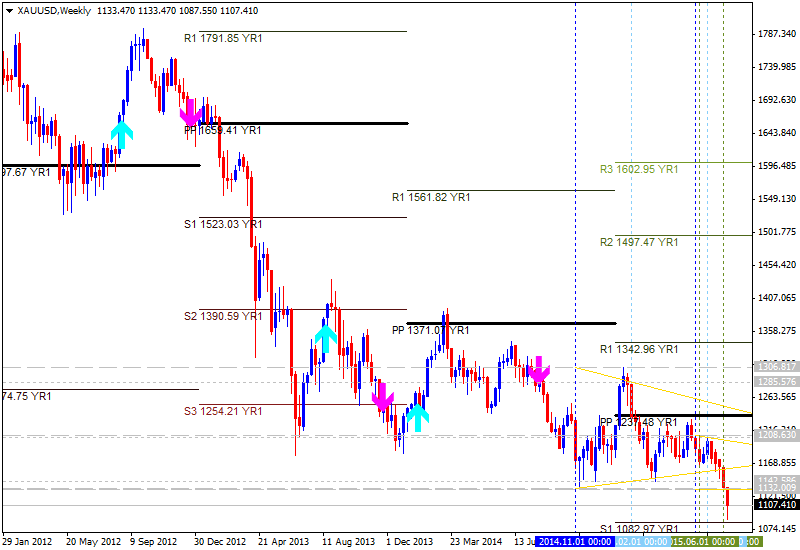

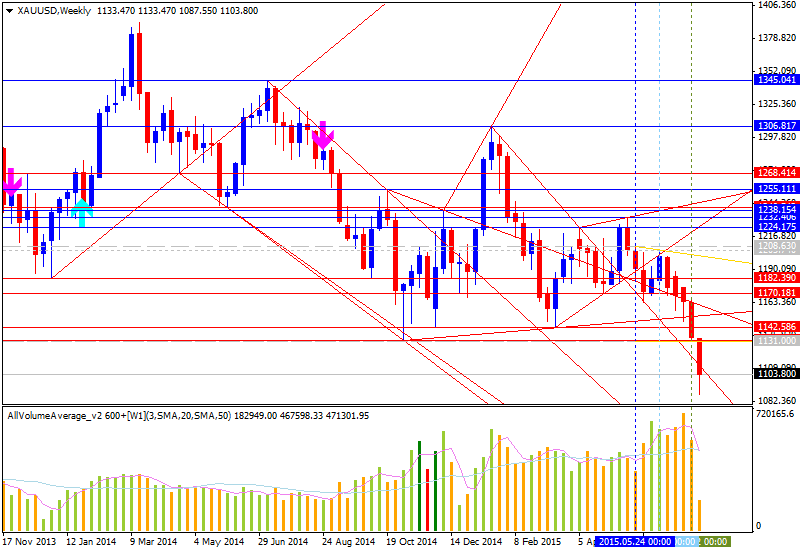

W1 price is located between Yearly Pivot level at 1237.48 and S1 Pivot

at 1082.97:

Trend:

Trend:

- The price is on bearish market condition for ranging between Central Pivot level at 1237.48 and S1 Pivot level at 1082.97;

- The price broke triangle pattern on close weekly bars for the bearish trend to be continuing;

- If weekly price will break S1 Pivot level at 1082.97 from above to below so the primary bearish market condition will be continuing; if price will break PP YR1 at 1237.48 from below to above so we can see the reversal of the price movement to the primary bullish condition; otherwise the price will be ranging within yearly Central Pivot and yearly S1 Pivot;

- “XAU/USD fell to a 5-year low. With the S&P 500 just off all-time highs and the Federal Reserve supposedly contemplating a move to policy normalization (taper tantrum was almost two years ago now) it is not that surprising to see gold doing what is doing”;

- “Under $1000 an ounce XAU/USD starts to look attractive again, but arguably XAU/EUR and XAU/JPY are much more important instruments to watch”;

| Instrument | S1 Pivot | Yearly PP | R1 Pivot |

|---|---|---|---|

| XAU/USD | 1082.97 | 1237.48 | 1342.96 |

- W1 - bearish

- MN1 - bearish

22 July 2015, 04:03

Westpac Research notes:

The six month annualised deviation from trend growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity three to nine months in the future, increased from -0.02 % in May to 0.06% in June.

As we noted last month the change in the growth rate of the Index is indicating that the economy appears to be losing momentum through the middle of 2015. In the first four months of 2015 the average growth rate was 0.21% above trend. That was a welcome lift in momentum from the second half of 2014 when the average growth rate was -0.66% below trend. However, in the last two months the growth rate has eased back again averaging only 0.02% above trend.

With the deviation from trend now back to near zero the promising signs that we saw in the early months of 2015 that growth in the economy might be lifting into 'above trend' territory through the second half of 2015 appear to be waning. That profile is certainly in line with Westpac's forecasts that annualised growth pace in the economy will be stuck around 2.5% in both halves of 2015, largely unchanged from the disappointing result in 2014 of around 2.5%.

The disappointment from the apparent lacklustre prints for growth in the Index which we are seeing around mid-year is that a lack of momentum going into 2016 might start to question the generally held view that 2016 will be a better year than 2014 and 2015. For example our own forecasts pitch growth in 2016 at around 3%, up from 2.5% in 2014 and 2015 whereas the Reserve Bank has been bold enough to forecast a lift in growth to 3.25%.

That growth rate of 3.25% is considered to be in the 'above trend' territory and it is likely that the authorities might start to review that optimistic forecast in spite of the expected boost to demand from the falling Australian dollar and record low interest rates.

The Reserve Bank Board next meets on August 4. The Board has demonstrated recently that at these low levels of rates any further cuts will be gradual and most likely timed for the months of February; May; August and November when the Bank revises its forecasts for growth and inflation. Having cut rates in both February and May the August meeting does become a 'live' event.

We expect that it is very unlikely that the Board will decide to cut rates in August. In May it was still forecasting above trend growth in 2016 of 3.25% and we expect that the catalyst for any decision to cut rates would come from a substantial downward revision to its growth forecast for 2016 to 'below trend' territory. That decision will be largely influenced by the assessed momentum in the economy in the second half of this year and developments in the labour market. With insufficient available evidence on the former and, for now, the unemployment rate having stabilised there is almost no case for an August move.

Despite current market expectations we would also put a limited chance of a move in November. In fact we are comfortable to retain the view that rates will remain on hold for the remainder of this year and throughout 2016.

The six month annualised deviation from trend growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity three to nine months in the future, increased from -0.02 % in May to 0.06% in June.

As we noted last month the change in the growth rate of the Index is indicating that the economy appears to be losing momentum through the middle of 2015. In the first four months of 2015 the average growth rate was 0.21% above trend. That was a welcome lift in momentum from the second half of 2014 when the average growth rate was -0.66% below trend. However, in the last two months the growth rate has eased back again averaging only 0.02% above trend.

With the deviation from trend now back to near zero the promising signs that we saw in the early months of 2015 that growth in the economy might be lifting into 'above trend' territory through the second half of 2015 appear to be waning. That profile is certainly in line with Westpac's forecasts that annualised growth pace in the economy will be stuck around 2.5% in both halves of 2015, largely unchanged from the disappointing result in 2014 of around 2.5%.

The disappointment from the apparent lacklustre prints for growth in the Index which we are seeing around mid-year is that a lack of momentum going into 2016 might start to question the generally held view that 2016 will be a better year than 2014 and 2015. For example our own forecasts pitch growth in 2016 at around 3%, up from 2.5% in 2014 and 2015 whereas the Reserve Bank has been bold enough to forecast a lift in growth to 3.25%.

That growth rate of 3.25% is considered to be in the 'above trend' territory and it is likely that the authorities might start to review that optimistic forecast in spite of the expected boost to demand from the falling Australian dollar and record low interest rates.

The Reserve Bank Board next meets on August 4. The Board has demonstrated recently that at these low levels of rates any further cuts will be gradual and most likely timed for the months of February; May; August and November when the Bank revises its forecasts for growth and inflation. Having cut rates in both February and May the August meeting does become a 'live' event.

We expect that it is very unlikely that the Board will decide to cut rates in August. In May it was still forecasting above trend growth in 2016 of 3.25% and we expect that the catalyst for any decision to cut rates would come from a substantial downward revision to its growth forecast for 2016 to 'below trend' territory. That decision will be largely influenced by the assessed momentum in the economy in the second half of this year and developments in the labour market. With insufficient available evidence on the former and, for now, the unemployment rate having stabilised there is almost no case for an August move.

Despite current market expectations we would also put a limited chance of a move in November. In fact we are comfortable to retain the view that rates will remain on hold for the remainder of this year and throughout 2016.

22 July 2015, 03:23

Two-percent inflation is the BOJ's stated 'goalpost', and the Kuroda BOJ is

strongly committed to achieving it, but investors should not rule out the

possibility that this goalpost becomes more flexible. A 2% inflation target, as

Kuroda said, is an 'international standard', and targeting anything lower would

be self-defeating as any resulting currency appreciation could be deflationary.

Yet is 2% really appropriate in the most demographically challenged economy?

Targeting high inflation usually is a hard sell to the elders.

In Japan, more than 40% of the household population is 65 years or older. Inflation is an economic drag for those dependent on spending from their savings and, importantly, elders are a very large political constituent in Japan. The administration learned a hard lesson of how inflation - whether a result of a VAT hike or weak currency - can hurt consumers (even workers if they have no meaningful wage growth to offset it) and, hence, weaken political stability.

Moving the goalpost explicitly by lowering the target from 2% to, say 1%, would be highly unlikely, but doing so implicitly by operating inflation targeting in a more flexible manner is a possibility. The BOJ appears to have already made a first step for the change, as it recently delayed the projected timing of achieving the target from the initial commitment of roughly two years from the start of QQE in April 2013.

In Japan, more than 40% of the household population is 65 years or older. Inflation is an economic drag for those dependent on spending from their savings and, importantly, elders are a very large political constituent in Japan. The administration learned a hard lesson of how inflation - whether a result of a VAT hike or weak currency - can hurt consumers (even workers if they have no meaningful wage growth to offset it) and, hence, weaken political stability.

Moving the goalpost explicitly by lowering the target from 2% to, say 1%, would be highly unlikely, but doing so implicitly by operating inflation targeting in a more flexible manner is a possibility. The BOJ appears to have already made a first step for the change, as it recently delayed the projected timing of achieving the target from the initial commitment of roughly two years from the start of QQE in April 2013.

22 July 2015, 02:57

Ending deflation requires a coordinated monetary and fiscal reflation policy.

While Japan does not have the luxury of policy flexibility on the fiscal side, a

premature tightening of fiscal policy will likely be avoided under Prime

Minister Abe's leadership. The recent announcement of the government's policy on

fiscal reforms sent a clear message that this government will pursue fiscal

reforms by economic growth as opposed to spending cuts or large tax

increases.

The BOJ will have to play a major role in assisting this government's growth-led fiscal reforms, and will have to remain easy; it will be subordinate to the fiscal authority - given the clear challenge on the fiscal side in Japan - when economic conditions appear to warrant tightening or a normalization of the reflationary policy stance.

China is in a secular economic slowdown amid deleveraging, which is a powerful external headwind to Japan that requires accommodative policy. While slower growth in China can benefit commodity-importing economies such as Japan and the U.S., it will certainly be negative for global export demand, particularly in Asia.

China was already the third-largest importer for the world economy (after the U.S. and Euroland) 10 years ago, and has doubled its imports to US$1.8 trillion per year since then, making it near Euroland's level.

The BOJ will have to play a major role in assisting this government's growth-led fiscal reforms, and will have to remain easy; it will be subordinate to the fiscal authority - given the clear challenge on the fiscal side in Japan - when economic conditions appear to warrant tightening or a normalization of the reflationary policy stance.

China is in a secular economic slowdown amid deleveraging, which is a powerful external headwind to Japan that requires accommodative policy. While slower growth in China can benefit commodity-importing economies such as Japan and the U.S., it will certainly be negative for global export demand, particularly in Asia.

China was already the third-largest importer for the world economy (after the U.S. and Euroland) 10 years ago, and has doubled its imports to US$1.8 trillion per year since then, making it near Euroland's level.

22 July 2015, 02:36

Seasonal patterns are usually best left to the numbers without second

guessing with macro rationale. Nevertheless, there are two reasons why the

impact could be exaggerated this year and one taking away from it.

First, the net supply arguments in Europe are starker given the presence of a price insensitive buyer (ECB) this year. The causality between Bunds and USTs have flipped, which makes European moves more critical for global yields.

Second, liquidity conditions on either side of the Atlantic are worse than they have been recently, exaggerating any flow impact.

A risk factor, however, could be the impact of high corporate supply. Corporate supply in the US has had a much more noticeable impact on outright level of rates this year. And with corporate strategists expecting a continued heavy issuance calendar both in the US and Europe, this poses the biggest risk to the tactical bullish stance.

First, the net supply arguments in Europe are starker given the presence of a price insensitive buyer (ECB) this year. The causality between Bunds and USTs have flipped, which makes European moves more critical for global yields.

Second, liquidity conditions on either side of the Atlantic are worse than they have been recently, exaggerating any flow impact.

A risk factor, however, could be the impact of high corporate supply. Corporate supply in the US has had a much more noticeable impact on outright level of rates this year. And with corporate strategists expecting a continued heavy issuance calendar both in the US and Europe, this poses the biggest risk to the tactical bullish stance.

22 July 2015, 02:12

Predicting central bank policy starts with looking at the 'distance' between

policy targets and current states. After years of debating the appropriateness

of explicitly defining the inflation target, the BOJ finally entered a new

regime of inflation targeting at 2% in January 2013. Two months later, under new

Governor Haruhiko Kuroda's leadership, the BOJ embarked on a large scale QQE

program, aiming to achieve the target roughly within two

years.

Inflation rates, measured here as CPI excluding fresh food (called Japan's core CPI), responded to the BOJ's QQE and rose to 3.4% year over year in May 2014 but then fell to 0.1% a year later despite the bank's surprise additional easing in October 2014. Though much of the large swing in core CPI can be attributed to oil prices and a 3-percentage-point increase of consumption tax (VAT) rates in April 2014, underlying inflation also remains weak.

Based on the seemingly long distance from the current inflation rate to the target level of 2%, one could simply argue that the BOJ should ease more. The forecasted inflation rate also suggests so; the consensus forecast for core CPI is about 1.0% a year from now, which is reasonable yet is well below the target.

Inflation rates, measured here as CPI excluding fresh food (called Japan's core CPI), responded to the BOJ's QQE and rose to 3.4% year over year in May 2014 but then fell to 0.1% a year later despite the bank's surprise additional easing in October 2014. Though much of the large swing in core CPI can be attributed to oil prices and a 3-percentage-point increase of consumption tax (VAT) rates in April 2014, underlying inflation also remains weak.

Based on the seemingly long distance from the current inflation rate to the target level of 2%, one could simply argue that the BOJ should ease more. The forecasted inflation rate also suggests so; the consensus forecast for core CPI is about 1.0% a year from now, which is reasonable yet is well below the target.

22 July 2015, 01:59

As developed market rates stay elevated following the Q2 selloff, the macro

arguments for both higher (better DM growth data, Greece resolution, approaching

Fed hike) and lower yields (declining oil prices, stronger dollar, more

aggressive ECB) have been well debated and established.

"However, a less advertised point is that we have now entered some of the strongest seasonal patterns in global fixed income markets, both in terms of market moves and issuance dynamics. We believe these could play a critical role (possibly more so than in prior years), and keeps us tactically bullish relative to consensus on long-end yields in USTs and Bunds," says BofA Merrill Lynch.

A look at seasonals across the US, Eurozone and the UK since 2000 indicate two clear results.

1) Bond yields are 20-25% more likely to rally in July and August than any other month in all three countries .

2) The magnitude of the rally is substantial - Bund yields decline on average by 10- 12bp in both July and August, while USTs and Gilts rally significantly more in August.

One intuitive explanation to this seasonal rally in government bond yields could be that it is an extension of the "Sell in May and go away" strategy in equities. However, While equity markets in these three countries are more likely to sell-off in June, there is little conclusive evidence on directionality in equity markets in July and August.

The consistent summer rally is closely linked to seasonality of supply in fixed income markets. Note that net supply below refers to gross fixed coupon supply net of coupons, redemptions and central bank purchases.

Net supply is consistently negative in July and August in the Eurozone. In fact, these two months have accounted on average for a 30% reduction in net issuance since 2009.

In the US, net issuance over these two months although positive, combines for only 4% of the annual issuance. Digging deeper, a significant factor driving low net supply in these two months is high coupon payments. Nearly 25% of the annual coupon payments in both the US and the Eurozone are paid out in Jul-Aug. Arguably, coupon payments are more likely to be reinvested in similar duration assets than maturities.

Working through the numbers also helps settle the old debate on what matters most for the direction of rates - gross vs. net issuance. Gross issuance in the Eurozone in July (when EZ rates rally the most) and in the US in August (when USTs rally the most) is about average (8% of yearly supply) making net numbers more relevant, albeit at least for these two months.

"However, a less advertised point is that we have now entered some of the strongest seasonal patterns in global fixed income markets, both in terms of market moves and issuance dynamics. We believe these could play a critical role (possibly more so than in prior years), and keeps us tactically bullish relative to consensus on long-end yields in USTs and Bunds," says BofA Merrill Lynch.

A look at seasonals across the US, Eurozone and the UK since 2000 indicate two clear results.

1) Bond yields are 20-25% more likely to rally in July and August than any other month in all three countries .

2) The magnitude of the rally is substantial - Bund yields decline on average by 10- 12bp in both July and August, while USTs and Gilts rally significantly more in August.

One intuitive explanation to this seasonal rally in government bond yields could be that it is an extension of the "Sell in May and go away" strategy in equities. However, While equity markets in these three countries are more likely to sell-off in June, there is little conclusive evidence on directionality in equity markets in July and August.

The consistent summer rally is closely linked to seasonality of supply in fixed income markets. Note that net supply below refers to gross fixed coupon supply net of coupons, redemptions and central bank purchases.

Net supply is consistently negative in July and August in the Eurozone. In fact, these two months have accounted on average for a 30% reduction in net issuance since 2009.

In the US, net issuance over these two months although positive, combines for only 4% of the annual issuance. Digging deeper, a significant factor driving low net supply in these two months is high coupon payments. Nearly 25% of the annual coupon payments in both the US and the Eurozone are paid out in Jul-Aug. Arguably, coupon payments are more likely to be reinvested in similar duration assets than maturities.

Working through the numbers also helps settle the old debate on what matters most for the direction of rates - gross vs. net issuance. Gross issuance in the Eurozone in July (when EZ rates rally the most) and in the US in August (when USTs rally the most) is about average (8% of yearly supply) making net numbers more relevant, albeit at least for these two months.

22 July 2015, 01:43

As developed market rates stay elevated following the Q2 selloff, the macro

arguments for both higher (better DM growth data, Greece resolution, approaching

Fed hike) and lower yields (declining oil prices, stronger dollar, more

aggressive ECB) have been well debated and established.

"A less advertised point is that we have now entered some of the strongest seasonal patterns in global fixed income markets, both in terms of market moves and issuance dynamics. We believe these could play a critical role (possibly more so than in prior years), and keeps us tactically bullish relative to consensus on long-end yields in USTs and Bunds," says BofA Merrill Lynch.

"A less advertised point is that we have now entered some of the strongest seasonal patterns in global fixed income markets, both in terms of market moves and issuance dynamics. We believe these could play a critical role (possibly more so than in prior years), and keeps us tactically bullish relative to consensus on long-end yields in USTs and Bunds," says BofA Merrill Lynch.

22 July 2015, 01:35

As developed market rates stay elevated following the Q2 selloff, the macro

arguments for both higher (better DM growth data, Greece resolution, approaching

Fed hike) and lower yields (declining oil prices, stronger dollar, more

aggressive ECB) have been well debated and established. However, a less

advertised point is that we have now entered some of the strongest seasonal

patterns in global fixed income markets, both in terms of market moves and

issuance dynamics.

"We believe these could play a critical role (possibly more so than in prior years), and keeps us tactically bullish relative to consensus on long-end yields in USTs and Bunds," says BofA Merrill Lynch.

"We believe these could play a critical role (possibly more so than in prior years), and keeps us tactically bullish relative to consensus on long-end yields in USTs and Bunds," says BofA Merrill Lynch.

22 July 2015, 01:10

RBC Capital Markets notes:

Market focus today turns to Q2 CPI and RBA Governor Stevens' speech in Sydney. Higher fuel prices and lagged effects of the weaker AUD should conspire to push headline CPI inflation up from 1.3%y/y to 1.7% in Q2.

Domestically generated inflationary pressures, however, remain weak given the sluggish pace of wage growth and stagnant unit labour costs. We expect this will be reflected in the core measures, including a 0.2ppt deceleration in the trimmed mean metric to 2.1%y/y (RBC in line with consensus on both measures). For us, the upshot of such an outcome for this report is that inflation indicators should continue to provide more than enough leeway for further easing, which we expect will next occur in Q4.

Market focus today turns to Q2 CPI and RBA Governor Stevens' speech in Sydney. Higher fuel prices and lagged effects of the weaker AUD should conspire to push headline CPI inflation up from 1.3%y/y to 1.7% in Q2.

Domestically generated inflationary pressures, however, remain weak given the sluggish pace of wage growth and stagnant unit labour costs. We expect this will be reflected in the core measures, including a 0.2ppt deceleration in the trimmed mean metric to 2.1%y/y (RBC in line with consensus on both measures). For us, the upshot of such an outcome for this report is that inflation indicators should continue to provide more than enough leeway for further easing, which we expect will next occur in Q4.

22 July 2015, 00:59

Market Roundup

Looking Ahead - Economic Data (GMT)

Looking Ahead - Events, Other Releases (GMT)

Currency Summaries

EUR/USD

EUR/USD is supported around 1.0809 levels and currently trading at 1.0953 levels. It has made session high at 1.0967 and low at 1.0949 levels. The pair rebounded from 3- month lows against the US Dollar in the early US session, the pair gained more than 100 pips since the opening of New york session and hit daily high at 1.0968 (38.2% retracement level). The pair retreated back after hitting daily resistance level at 1.0968 and moving downwards to test support level at 1.0915 (23.6% retracement level), despite the rally, the pair is set to fall in the in the coming days, as the US rate hike speculation mounts pressure on Euro. The Euro was up by 1.1% against the US dollar at 1.0943, to the upside, immediate resistance can be seen at 1.0971. To the downside, major support level is located at 1.0819. Overall trend of this pair remains bearish in the short and medium term.

GBP/USD

GBP/USD is supported around 1.5527 levels and currently trading at 1.5562 levels. It has made session high at 1.55576 and low at 1.5534 levels. The cable is trading in a very choppy range moving between 1.5578 and 1.5538 ranges. Despite the major pairs advancing against the dollar, the cable failed to advance against the dollar in the US session. Traders are awaiting BoE Governor Mark Carney's tone in the BOE minutes scheduled later in the day, all eyes will be on BoE Governor Mark Carney, as he surprisingly made hawkish comments last week that, interest rates may be raised as early as November this year. To the upside, immediate resistance can be seen at 1.5601. To the downside, major support level is located at 1.5550.

USD/CHF

USD/CHF is supported around 0.9554 levels and currently trading at 0.9579 levels. It has made session high at 0.9584 and low at 0.9558 levels. The pair started to fall after, Euro started to rebound from 3-month low against the dollar. In the New York session the pair fell from 0.9601 and hit daily lows at 0.9561. The pair hit daily lows, after 3-days continues rally, dollar lost its momentum due surprise greenback sell off by traders and weaker Dollar index. The Swiss franc almost gained 50pips in the New york session, later it bounced off after hitting daily support level at 0.9561 (23.6% retracement level) to gain from losses suffered earlier. The dollars bullish momentum is set to continue as the rate hike talks from the Fed's will put this pair under bullish pressure in the coming days. To the upside, immediate resistance can be seen at 1.5601. To the downside, major support level is located at 1.5550.

USD/JPY

USD/JPY is supported around 123.24 levels and currently trading at 123.87 levels. It has made session high at 124.91 and low at 123.74 levels. Dollar lost its momentum against yen after holding steading gains for over a month. The pair fell from 124.15 levels to hit daily lows at 123.73. The dollar was broadly lower after, dollar index turned lower against basket of five currencies. The dollar almost lost 50 pips against Japanese yen in the New York session. Dollar is set to advance against Japanese yen as, rate hike talks from Fed will put strong bullish pressure on this pair. Federal Reserve Chair Janet Yellen said last week that the Fed is likely to raise rates at some point this year. To the upside, immediate resistance can be seen at 124.46. To the downside, major support level is located at 123.51. Overall trend of this pair remains bullish in long term.

- US June Manufacturing capacity use rate revised to 75.8% from 77.2%.

- US June IP revised to +0.2% from +0.3%.

- Philadelphia Fed wage & benefit cost index 24.3 in July v 35.1 in June.

- Philadelphia Fed non-Manufacturing full-time employment index -5.4 in July v 27.0 in June.

- BOE's Carney reiterates decision on when to raise rates likely to come to sharper relief at turn of year.

- BOJ's Kuroda: Japan's inflation to accelerate "considerably" in coming months.

- BOJ's Kuroda: see no need for extra quantitative easing now.

- NY Fed Liberty Street blog on rising USD effect on GDP.

- S&P revises Greece sovereign credit outlook up to stable from negative; current rating is CCC+.

- Greek bailout talks to be wrapped up by Aug 20 (Govt spokeswoman).

- UK Finance Ministry will reduce number of MPC meetings from 12 to 8.

- Brazil poll: Rousseff popularity still falling, impeachment favored.

Looking Ahead - Economic Data (GMT)

- 01:30 Australia CPI QQ* Q2 f/c 0.8%, 0.2%-previous

- 01:30 Australia CPI YY* Q2 f/c 1.7%, 1.3%-previous

- 01:30 Australia RBA Weighted Median CPI QQ* Q2 f/c 0.5%, 0.6%-previous

- 01:30 Australia RBA Weighted Median CPI YY* Q2 f/c 2.3%, 2.4%-previous

- 01:30 Australia RBA Trimmed Mean CPI QQ* Q2 f/c 0.6%, 0.6%-previous

- 01:30 Australia RBA Trimmed Mean CPI YY* Q2 f/c 2.2%, 2.3%-previous

Looking Ahead - Events, Other Releases (GMT)

- 03:05 Australia RBA Governor Stevens speaks at the Anika Foundation Luncheon

Currency Summaries

EUR/USD

EUR/USD is supported around 1.0809 levels and currently trading at 1.0953 levels. It has made session high at 1.0967 and low at 1.0949 levels. The pair rebounded from 3- month lows against the US Dollar in the early US session, the pair gained more than 100 pips since the opening of New york session and hit daily high at 1.0968 (38.2% retracement level). The pair retreated back after hitting daily resistance level at 1.0968 and moving downwards to test support level at 1.0915 (23.6% retracement level), despite the rally, the pair is set to fall in the in the coming days, as the US rate hike speculation mounts pressure on Euro. The Euro was up by 1.1% against the US dollar at 1.0943, to the upside, immediate resistance can be seen at 1.0971. To the downside, major support level is located at 1.0819. Overall trend of this pair remains bearish in the short and medium term.

GBP/USD

GBP/USD is supported around 1.5527 levels and currently trading at 1.5562 levels. It has made session high at 1.55576 and low at 1.5534 levels. The cable is trading in a very choppy range moving between 1.5578 and 1.5538 ranges. Despite the major pairs advancing against the dollar, the cable failed to advance against the dollar in the US session. Traders are awaiting BoE Governor Mark Carney's tone in the BOE minutes scheduled later in the day, all eyes will be on BoE Governor Mark Carney, as he surprisingly made hawkish comments last week that, interest rates may be raised as early as November this year. To the upside, immediate resistance can be seen at 1.5601. To the downside, major support level is located at 1.5550.

USD/CHF

USD/CHF is supported around 0.9554 levels and currently trading at 0.9579 levels. It has made session high at 0.9584 and low at 0.9558 levels. The pair started to fall after, Euro started to rebound from 3-month low against the dollar. In the New York session the pair fell from 0.9601 and hit daily lows at 0.9561. The pair hit daily lows, after 3-days continues rally, dollar lost its momentum due surprise greenback sell off by traders and weaker Dollar index. The Swiss franc almost gained 50pips in the New york session, later it bounced off after hitting daily support level at 0.9561 (23.6% retracement level) to gain from losses suffered earlier. The dollars bullish momentum is set to continue as the rate hike talks from the Fed's will put this pair under bullish pressure in the coming days. To the upside, immediate resistance can be seen at 1.5601. To the downside, major support level is located at 1.5550.

USD/JPY

USD/JPY is supported around 123.24 levels and currently trading at 123.87 levels. It has made session high at 124.91 and low at 123.74 levels. Dollar lost its momentum against yen after holding steading gains for over a month. The pair fell from 124.15 levels to hit daily lows at 123.73. The dollar was broadly lower after, dollar index turned lower against basket of five currencies. The dollar almost lost 50 pips against Japanese yen in the New York session. Dollar is set to advance against Japanese yen as, rate hike talks from Fed will put strong bullish pressure on this pair. Federal Reserve Chair Janet Yellen said last week that the Fed is likely to raise rates at some point this year. To the upside, immediate resistance can be seen at 124.46. To the downside, major support level is located at 123.51. Overall trend of this pair remains bullish in long term.

22 July 2015, 00:56

RBC Capital Markets notes:

Tonight's existing home sales report is one of the few notable releases out of the US this week. Our economists are calling for a modest improvement in June home sales to 5.40mn, up from 5.35mn, which is supported by the steady improvement in pending home sales (up in last five consecutive months). Later this week (Fri) they look for another constructive sign on the housing market-a robust new home sales report. In both cases, we could see another cycle high print, which fits with our US teams' view of a strong contribution from housing in Q2.

Tonight's existing home sales report is one of the few notable releases out of the US this week. Our economists are calling for a modest improvement in June home sales to 5.40mn, up from 5.35mn, which is supported by the steady improvement in pending home sales (up in last five consecutive months). Later this week (Fri) they look for another constructive sign on the housing market-a robust new home sales report. In both cases, we could see another cycle high print, which fits with our US teams' view of a strong contribution from housing in Q2.

22 July 2015, 00:35

In the MPC minutes out this afternoon, it is unlikely anyone on the MPC would

have chosen this meeting to vote for a hike. Recall the meeting took place amid

considerable uncertainty in Europe in the week just after the Greek's 'No' vote

in the referendum, and prior to the tentative agreement for a third bailout.

Importantly though, a 9-0 vote this month could give way to a 6-3 vote in

August, as more recent comments from MPC officials (including Carney) suggest

domestic improvements (esp wage growth) are the main focus, and Greece has done

little to distract from that.

22 July 2015, 00:22

Gold has taken a hit. This precious metal suffered its eighth straight day of

losses Monday bringing it to its lowest level in over five years. Analysts

attribute this meltdown to a number of factors ranging from a reduced need for

inflation hedges and the end of the Greek drama to a strong U.S. dollar and

looming interest rate hike.

As for involving gold into your portfolio, the yellow metal has been an effective diversifier in times of rampant Central Bank stimulus, perennial banking crises and geopolitical instability but, not so much during the current "normalization" period we are in. In fact a "real return" or asset class return minus inflation has not come from "real" assets like commodities but from stocks and bonds instead, says Voya Global Perspectives.

As for involving gold into your portfolio, the yellow metal has been an effective diversifier in times of rampant Central Bank stimulus, perennial banking crises and geopolitical instability but, not so much during the current "normalization" period we are in. In fact a "real return" or asset class return minus inflation has not come from "real" assets like commodities but from stocks and bonds instead, says Voya Global Perspectives.

22 July 2015, 00:11

Westpac Research notes:

NZ swap yields 1 day: NZ 2yr swap rates should open down 1bp at 2.88%, while the 10yr should open down 1bp at 3.73%.

NZ swap yields 1-3 month: Short maturity NZ interest rates should fall further during the next few months. The RBNZ has started a fresh easing phase, which should deliver another 75bp over the July and September meetings. We thus target a 2yr swap rate of 2.65% during the next few months (an OCR of 2.50% by September plus 15bp risk premium). The 10yr yield will be partly influenced by the RBNZ's sharp easing cycle but continue to be hostage to expectations of Fed policy tightening, a tricky call. We target 3.70%

NZ swap yields 1 day: NZ 2yr swap rates should open down 1bp at 2.88%, while the 10yr should open down 1bp at 3.73%.

NZ swap yields 1-3 month: Short maturity NZ interest rates should fall further during the next few months. The RBNZ has started a fresh easing phase, which should deliver another 75bp over the July and September meetings. We thus target a 2yr swap rate of 2.65% during the next few months (an OCR of 2.50% by September plus 15bp risk premium). The 10yr yield will be partly influenced by the RBNZ's sharp easing cycle but continue to be hostage to expectations of Fed policy tightening, a tricky call. We target 3.70%

22 July 2015, 00:04

New England

- The New England labor market posted a moderate gain in June, creating 9.7k

new jobs - half of its May tally.

- Mass. (+10.5k) led the way, with Vt. (+1.0k) also adding to the headline.

Performance was more muted elsewhere. Payrolls edged up by 0.6k in Conn.,

remained flat in Me., and contracted in N.H. (-2.1k) and R.I.

(-0.3k).

- Both construction (+1.8k) and manufacturing (+1.4k) posted decent gains on

the month. In the service sector new jobs were concentrated in prof. &

technical (+4.6k), administrative & support services (+2.5k), leisure &

hospitality (+1.5k), and transportation (+1.8k).

- Jobless rates declined by 0.3 pp to 5.7% in Conn. on weak labor force growth, and 0.1pp to 5.9% in R.I. Joblessness was unchanged elsewhere in the region

- Coming on the heels of a blockbuster 60k gain in May, job creation in the

Mid-Atlantic region decelerated to 15.4k in June.

- Job gains were concentrated entirely in the Empire State (+25.5k), while

payrolls edged lower in Pa. (-2.7k) and N.J. (-7.4k). This was the first month

of job losses in N.J. in exactly one year.

- The bulk of new jobs were in healthcare (+11.8k), government (+3.7k),

finance (+3.6k), and prof. & technical services (+4.7k). By contrast, hiring

was flat in manufacturing and pulled back in construction (-3.6k), retail trade

(-6.8k) and education (-4.1k).

- The jobless rate declined in N.Y. (-0.2pp to 5.5%) and N.J. (-0.4pp to 6.1%), and remained unchanged in Pa.

- After two exceptional months the Upper South Atlantic lost 2.7k jobs in

June.

- Va.'s winning streak continued (+13.4k), with Del. also adding jobs (+1.2k).

However, Md. (-6.2k), W.Va. (-4.5k), D.C. (-3.5k) and N.C. (-3.1k) lost

jobs.

- Government (-12.5k) led losses, not unusual for this time of the year.

Education & health (-5.4k) also declined, while retail (+11k) and financial

services (+4.0k) were the lone outperformers.

- Once again, jobless rates continued to fall in D.C. (-0.3pp) and Md. (-0.1pp), while remaining unchanged in Va. Rates in Del. and N.C. ticked up by 0.1pp, with W.Va. unemployment up 0.2pp to 7.4% - the highest in the region.

- The Lower South Atlantic added 19.9k jobs in June, roughly the same as the previous month.

- S.C. led the way, with 10.5k jobs added, pushing the growth rate to 2.9%

y/y. Fla.'s gain slowed to just 7k - the slowest since Jan. - while Georgia

added only 2.3k.

- Retail accounted for more than half the gains (+10.7k), with education &

health (+5.8k) and leisure & hospitality (+4.3k) contributing the rest.

Meanwhile, professional & business services (-4k) lost jobs. Ditto for

construction (-2.5k), which saw a third monthly contraction.

- The jobless rates fell by 0.2 percentage points across the region. Florida's rate (5.5%) is nearing the national, while labor markets in Ga. (6.1%) and S.C. (6.6%) are somewhat looser

21 July 2015, 23:48

PIMCO Publications notes:

First, as Asian economies transition from savers to spenders and from exporters to consumers, they are contributing meaningfully to the narrowing of global imbalances - a potential driver of sustainable regional growth.

Second, Asian fiscal and monetary policymakers - from Japanese Prime Minister Abe to People's Bank of China (PBOC) authorities in Beijing - are keenly focused on tailoring economic policies to specific objectives, including Japan's goal to reflate to its 2% inflation target and China's efforts to see the yuan included in the IMF's special drawing rights (SDR) basket of currencies. On this theme of economic policy, we expect the opening of the Chinese capital account to be a seminal part of the secular economic story, with significant implications for investors around the world.

Some of the risks noted in our secular outlook will likely have an impact on the Asia-Pacific region: We need look no further than Chinese equity markets over the last few weeks to see that enormous volatility exists; indeed, the possibility of bursting bubbles, and even recessions, cannot be ruled out. Moreover, while many Asian economies are focused on increased regulatory oversight, convergence between regulatory frameworks has been limited, creating challenges in cross-border initiatives.

Given these long-term themes and risks, we see several implications for Asian investors to consider:

1. Explore better betas and customized multi-asset solutions

2 . Combine secular sovereign and corporate "winners" with the strength of the U.S. dollar

3 . Be thoughtful about income

4. Consider alternatives and harvest illiquidity premiums

5. Keep a secular eye on India

6. Gain strategic (not just tactical) exposure to China

First, as Asian economies transition from savers to spenders and from exporters to consumers, they are contributing meaningfully to the narrowing of global imbalances - a potential driver of sustainable regional growth.

Second, Asian fiscal and monetary policymakers - from Japanese Prime Minister Abe to People's Bank of China (PBOC) authorities in Beijing - are keenly focused on tailoring economic policies to specific objectives, including Japan's goal to reflate to its 2% inflation target and China's efforts to see the yuan included in the IMF's special drawing rights (SDR) basket of currencies. On this theme of economic policy, we expect the opening of the Chinese capital account to be a seminal part of the secular economic story, with significant implications for investors around the world.

Some of the risks noted in our secular outlook will likely have an impact on the Asia-Pacific region: We need look no further than Chinese equity markets over the last few weeks to see that enormous volatility exists; indeed, the possibility of bursting bubbles, and even recessions, cannot be ruled out. Moreover, while many Asian economies are focused on increased regulatory oversight, convergence between regulatory frameworks has been limited, creating challenges in cross-border initiatives.

Given these long-term themes and risks, we see several implications for Asian investors to consider:

1. Explore better betas and customized multi-asset solutions

2 . Combine secular sovereign and corporate "winners" with the strength of the U.S. dollar

3 . Be thoughtful about income

4. Consider alternatives and harvest illiquidity premiums

5. Keep a secular eye on India

6. Gain strategic (not just tactical) exposure to China