NEWS

03 July 2015, 05:06

CHINA CSI300 INDEX DOWN OVER 5 PCT

03 July 2015, 05:05

SHANGHAI COMPOSITE INDEX DOWN OVER 5 PCT

03 July 2015, 04:42

CHINA'S YUAN OPENS TRADE AT 6.2044 PER DOLLAR VS LAST CLOSE AT 6.2049

03 July 2015, 04:40

CHINA'S GROWTH BOARD CHINEXT DOWN OVER 5 PCT

03 July 2015, 04:35

JAPAN JUNE SERVICES SECTOR PMI RISES TO 51.8 FROM 51.5 IN MAY, SHOWS FASTEST

PACE OF GROWTH IN 9 MONTHS

03 July 2015, 04:30

AUSTRALIA MAY RETAIL SALES MM* INCREASE TO +0.3 % (FCAST 0.5 %) VS PREV 0.0 %

03 July 2015, 04:25

SHANGHAI COMPOSITE INDEX TO OPEN DOWN 3.0 PCT AT 3,793.71 POINTS

03 July 2015, 04:20

HK’S HANG SENG INDEX TO OPEN UP 0.3 PCT AT 26,349.84 POINTS

03 July 2015, 04:18

RPT - EARTHQUAKE OF MAGNITUDE 6.3 HITS CHINA'S WESTERN XINJIANG - USGS

03 July 2015, 04:15

PBOC SETS YUAN MID-POINT AT 6.1160 / DLR VS LAST CLOSE 6.2049

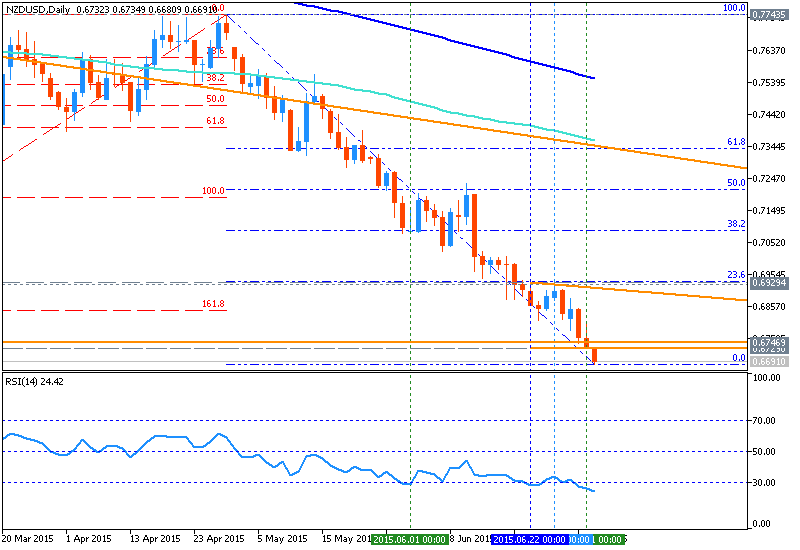

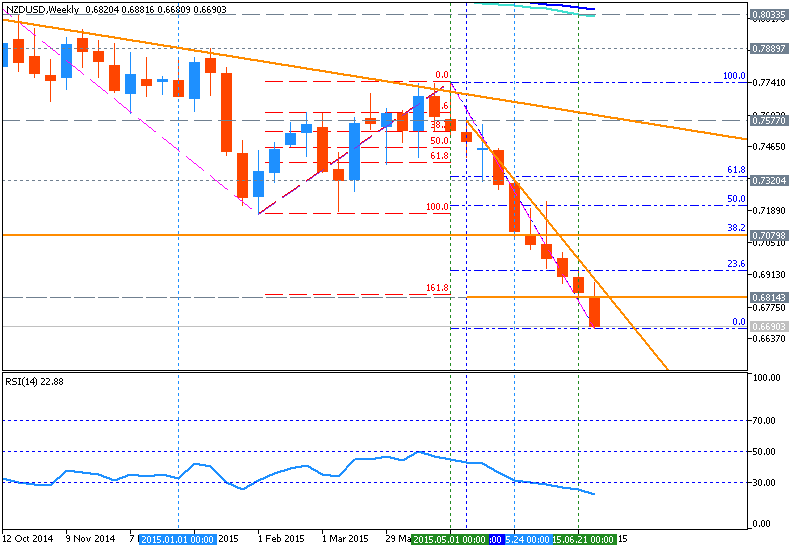

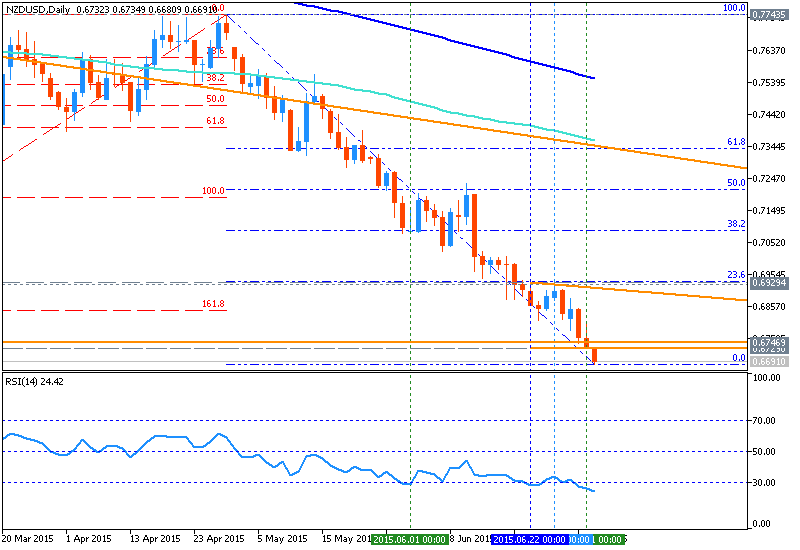

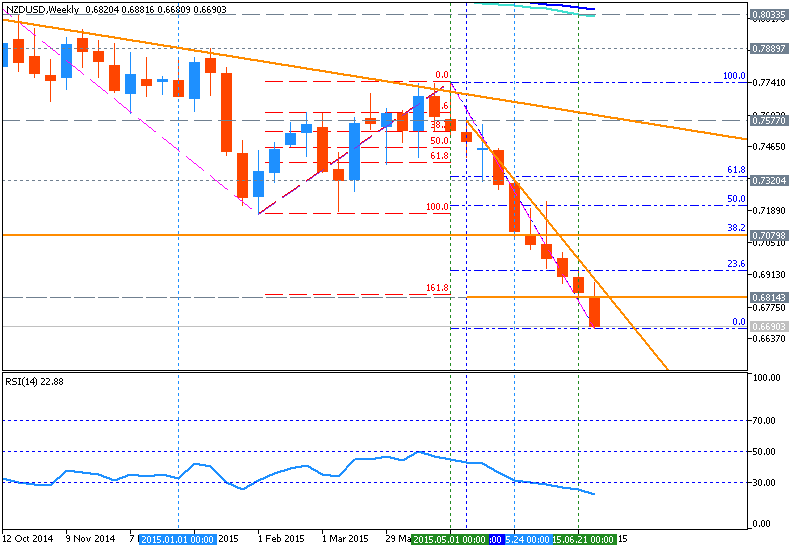

NZDUSD Strategy

NZDUSD Strategy

3 July 2015, 04:11

- "NZD/USD broke below the March-April advance at .6800 on Tuesday to trade at its lowest level in over 5-years"

- Weekly price is below 100-period SMA and 200-period SMA for bearish breakdown

- Daily price is below 100-day SMA and 200-day SMA for bearish market condition

- Weekly price is breaking Fibo key support at 0.6693 for the breakdown to be continuing

- RSI indicator is estimating the breakdown with oversold condition

- "A daily close back above .6955 would turn us positive on the kiw"

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| NZD/USD | .6700 | .6750 | .6770 | .6800 | .6955 |

03 July 2015, 04:11

BOJ offers to buy Y 140 bln JGBs (Residual maturity is more than 25YR)

outright from 7/7

03 July 2015, 04:11

BOJ offers to buy Y 240 bln JGBs (Residual maturity of 10YR to 25YR) outright

from 7/7

03 July 2015, 04:11

BOJ offers to buy 400 bln yen JGBs (Residual maturity of 5YR to 10YR)

outright from 7/7

03 July 2015, 04:10

BOJ offers to buy Y 1.75 trln Treasury Discount Bills outright from 7/7

03 July 2015, 03:17

Westpac Research notes:

Before today we were forecasting 25bp OCR reductions in July and September. On top of the June cut that has already occurred, our forecast implied a total of three OCR cuts in 2015, and a terminal OCR of 2.75%. In our commentary we noted there was a risk of a fourth OCR cut this year.

Over the past week emerging news has shifted that fourth cut from a risk scenario to a likelihood. Accordingly, we are now forecasting 25bp OCR reductions in July, September and October. This will take the OCR to a low of 2.5% this year.Commensurate with our lower OCR forecast, we are now forecasting an average NZD/USD exchange rate of 62 cents in the December quarter of 2015.

The key reasons for our change of OCR forecast are:

Of course, there have also been recent developments that lean against OCR cuts. These include the plunging exchange rate, which will provoke inflation, and the housing market. Emerging data suggests that the combination of proposed tax changes, new LVR rules, and lower mortgage rates has been positive for house prices on balance - the Auckland market in particular continues to power ahead.

All of these developments must be considered in the context of a central bank that is under pressure to lift inflation towards 2%, is wary of further downside surprises to inflation, and is sounding rather dismissive of the inflation risks posed by rising house prices. It is this context that leads us to comfortably conclude that a 2.5% OCR by year-end is the best forecast at present.

At the July OCR Review we expect the RBNZ to cut the OCR by 25 basis points and explicitly signal further OCR reductions, perhaps by repeating the phrase "We expect further easing may be appropriate."

Before today we were forecasting 25bp OCR reductions in July and September. On top of the June cut that has already occurred, our forecast implied a total of three OCR cuts in 2015, and a terminal OCR of 2.75%. In our commentary we noted there was a risk of a fourth OCR cut this year.

Over the past week emerging news has shifted that fourth cut from a risk scenario to a likelihood. Accordingly, we are now forecasting 25bp OCR reductions in July, September and October. This will take the OCR to a low of 2.5% this year.Commensurate with our lower OCR forecast, we are now forecasting an average NZD/USD exchange rate of 62 cents in the December quarter of 2015.

The key reasons for our change of OCR forecast are:

- A marked deterioration in NZ economic sentiment, evidenced by our Consumer

Confidence, Regional Economic Confidence and Employment Confidence surveys, as

well as ANZ's Business Outlook survey. We've also detected a distinct souring of

business confidence in our visits to businesses and regions around the

country.

- This week's sharp reduction in global dairy prices. The RBNZ is currently

acutely focussed on dairy prices.

- The sharp sell-off in Chinese equity prices. We are not convinced that

Chinese equity prices are a good reflection of the Chinese economy's trajectory.

However, financial market volatility is important for confidence. Lower

confidence could impact commodity prices and New Zealand businesses' investment

and employment decisions.

- Heightened tensions in Greece, which may also affect confidence.

Of course, there have also been recent developments that lean against OCR cuts. These include the plunging exchange rate, which will provoke inflation, and the housing market. Emerging data suggests that the combination of proposed tax changes, new LVR rules, and lower mortgage rates has been positive for house prices on balance - the Auckland market in particular continues to power ahead.

All of these developments must be considered in the context of a central bank that is under pressure to lift inflation towards 2%, is wary of further downside surprises to inflation, and is sounding rather dismissive of the inflation risks posed by rising house prices. It is this context that leads us to comfortably conclude that a 2.5% OCR by year-end is the best forecast at present.

At the July OCR Review we expect the RBNZ to cut the OCR by 25 basis points and explicitly signal further OCR reductions, perhaps by repeating the phrase "We expect further easing may be appropriate."

03 July 2015, 03:11

JAPAN FINMIN ASO: BUSINESS LEADERS ARE GRADUALLY COMING OUT OF DEFLATIONARY

MINDSET

03 July 2015, 03:10

The BoE is not expected to change policy when the Monetary Policy Council

meets next Thursday. Of course, we won't know anything about the dialogue that

unfolded until minutes to the meeting arrive on July 22nd. The next meeting on

August 6th, however, commences the practice of releasing the quarterly Inflation

Report simultaneously to the BoE decision.

In this environment, clearly the BoE is focused upon Eurozone risks stemming from Greek debt negotiations and therefore the Greek referendum results will be a point of reference in next week's BoE dialogue. Every central banker on the planet is telling that they are forward looking but data dependent which is akin to walking forward while constantly looking back over your shoulder; every now and then you'll walk into a lamp pole.

In this environment, clearly the BoE is focused upon Eurozone risks stemming from Greek debt negotiations and therefore the Greek referendum results will be a point of reference in next week's BoE dialogue. Every central banker on the planet is telling that they are forward looking but data dependent which is akin to walking forward while constantly looking back over your shoulder; every now and then you'll walk into a lamp pole.

03 July 2015, 03:09

AUSTRALIA'S S&P/ASX 200 INDEX DOWN 0.48 PCT AT 5,573.10 POINTS IN EARLY

TRADE

03 July 2015, 03:04

S.KOREA 2015 FISCAL DEFICIT-TO-GDP RATIO TO BE 3.0 PCT, UP FROM 2.1 PCT SEEN

EARLIER - FIN MIN

03 July 2015, 03:02

S.KOREA FIN MIN SAYS SUPPLEMENTARY BUDGET INCLUDES 6.2 TRLN WON OF NEW

SPENDING PLANS

03 July 2015, 03:01

S.KOREA PROPOSES 16.1 TRLN WON STIMULUS PACKAGE TO PROP UP ECONOMY HIT BY

MERS, WEAK EXPORT

03 July 2015, 03:01

SEOUL SHARES OPEN UP 0.01 PCT

03 July 2015, 03:00

SOUTH KOREAN WON OPENS ONSHORE TRADE AT 1,112.5 PER DOLLAR VS 1,125.0 AT

PREVIOUS CLOSE

03 July 2015, 03:00

TOKYO'S NIKKEI SHARE AVERAGE OPENS DOWN 0.22 PCT AT 20,476.69

03 July 2015, 02:47

Market Roundup

No Significant Events

Currency Summaries

EUR/USD

The pair pulled back to 1.1119 from 1.1046 after the release of US data, The dollar has lost its momentum, as the June payrolls data showed a clear picture that the country added 223,000 jobs, slightly below expectations, Average hourly earnings were at 0.0% against forecast at 0.2% , Factory orders were (-1.0%) against forecast of (-0.5%).This pair is volatile due to daily dose of headlines coming from Greece. 4 hours chart indicate overall trend is bearish, while the technical indicators indicate mild bearish tone. Overall trend of this pair is bearish unless until, it trades below resistance level at 1.1280.

GBP/USD

The pair failed to break the support level at 1.5566, in the early US session, which is 61.8% Fib R in the daily chart. The pair spiked to 1.5640 from 1.5569 after release of soft economic data from US. A minor recovery was seen in the GBP due to negative US data which pushed pair back to 1.5640 level, before the pair fell back to 1.5620 after Sterling failed to capitalize on weaker dollar. It remains to be seen whether the pair manages to break the resistance at 1.5640 ahead in the early Asian market, or later in Uk market.US market will be having a day off on account of independence day.

AUD/USD

AUD/USD hit low at 0.7589 during early US session, the pair's lowest since June. Australian dollar spiked higher against U.S. dollar, after weak US economic data. Nonfarm Payrolls (Jun) printed 223k against forecast of 230k ,Average hourly earnings were at 0.0% against forecast at 0.2% , Factory orders were (-1.0%) against forecast of (-0.5%).although economic data figure came negative, the dollar demand as safe-haven amid Greek debt concerns has remained. The short term outlook of this pair looks bearish.

USD/CAD

USD/CAD has moved down from from a 3-month high of 1.2635 reached during early US session due to disappointing US nonfarm payrolls and factory orders,The pair dramatically pulled back from 1.2635 after weaker than expected US economic data. The pair has stayed put at 1.2540 in the late US session. Overall the trend of this pair remains bullish in the short and medium term.as it is expected to resume its bullish trend. the immediate support can be seen at 1.2528 (61.8% Retracement level) Major resistance can be found at 1.2631(Jul 2nd high).

- US Non-Farm Payrolls Jun +223k, f/c 230k, +254k-prev

- US Average Earnings MM Jun 0%, f/c 0.2%, 0.2%-prev

- US Labor Force Partic Jun 62.6%, 62.9%-prev, lowest since Oct 1977

- Greek PM Tsipras says banks will reopen after a deal

- ECB to next discuss emergency Greek funding on Monday

- Greece's Pappas says to resume talks w/lenders immediately after vote, there will be agreement regardless of vote outcome

- Fitch says many challenges if resolution needed on Greek banks

- Moody's reviews 5 Greek Banks' Caa3 deposit and senior unsecured debt ratings

- IMF warns Greece needs debt extension, may require write-down, at a minimum maturities on existing European loans will need to be extended significantly

- ECB minutes: broad agreement mon policy measures bearing fruit, euro area seen moving in right direction and inflation improving

- ECB's Draghi says need single supervisor to see off risks

- US Private Payrolls Jun +223k, f/c 225k, +250k-prev

- US Unemployment Rate Jun 5.3%, f/c 5.4%, 5.5%-prev

- US Nondef Cap Ex-Air MM May -0.4%, 0.4%-prev

- US Factory Ex-Transp MM May 0.1%, -0.1%-prev

- CA RBC Mfg PMI SA Jun 51.3, 49.8-prev

Looking Ahead - Economic Data (GMT)

Looking Ahead - Events, Other Releases (GMT)- 23:30 AU AIG Services Index Jun 49.6-prev

- 01:30 AU Retail Sales MM* May f/c 0.5%, 0.00%-prev

- 01:35 JP Markit Services PMI Jun 51.5

- 01:35 JP Markit/JMMA Comp PMI Jun 51.60

- 1:45 CN HSBC Services PMI Jun 53.5-prev

No Significant Events

Currency Summaries

EUR/USD

The pair pulled back to 1.1119 from 1.1046 after the release of US data, The dollar has lost its momentum, as the June payrolls data showed a clear picture that the country added 223,000 jobs, slightly below expectations, Average hourly earnings were at 0.0% against forecast at 0.2% , Factory orders were (-1.0%) against forecast of (-0.5%).This pair is volatile due to daily dose of headlines coming from Greece. 4 hours chart indicate overall trend is bearish, while the technical indicators indicate mild bearish tone. Overall trend of this pair is bearish unless until, it trades below resistance level at 1.1280.

GBP/USD

The pair failed to break the support level at 1.5566, in the early US session, which is 61.8% Fib R in the daily chart. The pair spiked to 1.5640 from 1.5569 after release of soft economic data from US. A minor recovery was seen in the GBP due to negative US data which pushed pair back to 1.5640 level, before the pair fell back to 1.5620 after Sterling failed to capitalize on weaker dollar. It remains to be seen whether the pair manages to break the resistance at 1.5640 ahead in the early Asian market, or later in Uk market.US market will be having a day off on account of independence day.

AUD/USD

AUD/USD hit low at 0.7589 during early US session, the pair's lowest since June. Australian dollar spiked higher against U.S. dollar, after weak US economic data. Nonfarm Payrolls (Jun) printed 223k against forecast of 230k ,Average hourly earnings were at 0.0% against forecast at 0.2% , Factory orders were (-1.0%) against forecast of (-0.5%).although economic data figure came negative, the dollar demand as safe-haven amid Greek debt concerns has remained. The short term outlook of this pair looks bearish.

USD/CAD

USD/CAD has moved down from from a 3-month high of 1.2635 reached during early US session due to disappointing US nonfarm payrolls and factory orders,The pair dramatically pulled back from 1.2635 after weaker than expected US economic data. The pair has stayed put at 1.2540 in the late US session. Overall the trend of this pair remains bullish in the short and medium term.as it is expected to resume its bullish trend. the immediate support can be seen at 1.2528 (61.8% Retracement level) Major resistance can be found at 1.2631(Jul 2nd high).

03 July 2015, 02:32

CHINA STOCK REGULATOR TO INVESTIGATE POSSIBLE MARKET MANIPULATION AFTER SHARE

PRICES SLUMP -OFFICIAL MICROBLOG

03 July 2015, 02:18

U.S. CALLS FOR HUMANITARIAN PAUSE IN YEMEN CONFLICT DURING RAMADAN - STATE

DEPARTMENT

03 July 2015, 02:12

As the pivotal September FOMC meeting draws ever closer, the magnitude and

quality of job gains becomes all the more important. Key from the June post FOMC

meeting press conference of Chair Yellen was: (1) her strong belief that labour

market conditions had improved markedly in recent years; (2) equally that there

was a need to see further improvement in conditions before the process of

interest rate normalisation commenced.

In the June employment report, we will find evidence broadly in favour of ongoing cumulative improvement, albeit (continuing the 2015 trend) at a slower pace than was seen during 2014. The June nonfarm payrolls result was healthy, coming in at 223k - a touch below market expectations. And the unemployment rate fell to just 5.3%, as the participation rate reversed its May rise - falling 0.3ppts in the month.

More important than these spot outcomes is the multi-month trend in job creation and the degree of perceived labour market slack. Despite the 60k downward revision to April and May, the average monthly nonfarm payrolls job gain for 2015 still stands at 208k. While lower than 2014's 260k average, it equates to an annualised job gain of 1.8%, well and truly eclipsing population growth over the same period of 1.3%. With respect to labour market slack, the key benchmark for FOMCdeliberation remains the unemployment rate.

The apparent tension between seemingly full employment and relatively soft nominal wage gains is resolved when one considers the other major measure of slack: the employment-to-population ratio. Having been brought to historic lows not only by the job losses of the post-GFC recession but also by the sharp decline in participation to end-2013, it has only edged higher since. This result implies there remains a large pool of marginally-attached workers which could be brought back into the labour market, if conditions were favourable. That many of these could-be workers are in primeworking age groups highlights both their availability and potential productive use by the economy.

For the FOMC, the challenge is to continue to foster healthy job gains without causing the returns that firms receive from employing to be depleted by wage pressures. Consequently, having seen the unemployment rate fall to 5.3% and given job gains are continuing, conditions are conducive to begin interest rate normalisation. Through this data-dependent (likely very slow process), committee members aim to foster further sustainable growth in activity and jobs, incentivising participation and productivity. A September commencement and cautious normalisation remains most likely

In the June employment report, we will find evidence broadly in favour of ongoing cumulative improvement, albeit (continuing the 2015 trend) at a slower pace than was seen during 2014. The June nonfarm payrolls result was healthy, coming in at 223k - a touch below market expectations. And the unemployment rate fell to just 5.3%, as the participation rate reversed its May rise - falling 0.3ppts in the month.

More important than these spot outcomes is the multi-month trend in job creation and the degree of perceived labour market slack. Despite the 60k downward revision to April and May, the average monthly nonfarm payrolls job gain for 2015 still stands at 208k. While lower than 2014's 260k average, it equates to an annualised job gain of 1.8%, well and truly eclipsing population growth over the same period of 1.3%. With respect to labour market slack, the key benchmark for FOMCdeliberation remains the unemployment rate.

The apparent tension between seemingly full employment and relatively soft nominal wage gains is resolved when one considers the other major measure of slack: the employment-to-population ratio. Having been brought to historic lows not only by the job losses of the post-GFC recession but also by the sharp decline in participation to end-2013, it has only edged higher since. This result implies there remains a large pool of marginally-attached workers which could be brought back into the labour market, if conditions were favourable. That many of these could-be workers are in primeworking age groups highlights both their availability and potential productive use by the economy.

For the FOMC, the challenge is to continue to foster healthy job gains without causing the returns that firms receive from employing to be depleted by wage pressures. Consequently, having seen the unemployment rate fall to 5.3% and given job gains are continuing, conditions are conducive to begin interest rate normalisation. Through this data-dependent (likely very slow process), committee members aim to foster further sustainable growth in activity and jobs, incentivising participation and productivity. A September commencement and cautious normalisation remains most likely

03 July 2015, 01:55

BOJ: banks' reserve balance at 173.7 trln at end of day

03 July 2015, 01:55

BOJ: Current account balance at 228.7 trln at end of day

03 July 2015, 01:45

Volatile trading in mainland Chinese equity markets, policy risk given no

pre-set schedule for decisions, and macro releases that themselves may influence

policy risks will all potentially have China contributing to the global market

tone next week.

Chinese CPI inflation will be released in June and the debate is whether China is facing deflation risks. So far there is zero support for deflation arguments in the hard data. Only one CPI category - transportation and communication - has been experiencing falling year-ago prices. Falling monthly CPI is often misinterpreted because it is not seasonally adjusted and typically does decline in March through June with monthly price pressures more skewed toward the July-August time period and December through to February.

China might also release company financing figures. They'll be a reminder of how tiny equity financing is for Chinese firms (about 5% of aggregate financing) with most funding needs met through local currency loans and bond markets. This point is often lost in the discussion on Chinese equity markets. China's capital markets are still overwhelmingly skewed toward debt and with that goes underutilization of equity within firms' capital structures relative to most more developed capital markets.

Chinese CPI inflation will be released in June and the debate is whether China is facing deflation risks. So far there is zero support for deflation arguments in the hard data. Only one CPI category - transportation and communication - has been experiencing falling year-ago prices. Falling monthly CPI is often misinterpreted because it is not seasonally adjusted and typically does decline in March through June with monthly price pressures more skewed toward the July-August time period and December through to February.

China might also release company financing figures. They'll be a reminder of how tiny equity financing is for Chinese firms (about 5% of aggregate financing) with most funding needs met through local currency loans and bond markets. This point is often lost in the discussion on Chinese equity markets. China's capital markets are still overwhelmingly skewed toward debt and with that goes underutilization of equity within firms' capital structures relative to most more developed capital markets.

03 July 2015, 01:32

S&P - REMAINS UNCLEAR WHEN BAHA MAR WILL OPEN, OR IF IT WILL BE ABLE TO

SUSTAIN EMPLOYMENT OF THE MORE THAN 2,000 EMPLOYEES ALREADY HIRED

03 July 2015, 01:16

Having risen to 58.9% of GDP in 2014 from 53.3% in 2013 (both based on

revised estimates published earlier this year), gross public debt has risen

further, to 62.5% in May 2015, although net debt actually fell from 34.1% in

December 2014 to 33.6% in May 2015.

A quick look at the conditioning factors of gross debt suggests that each of the key components - issuance, interest payments, exchange adjustment and nominal growth - have worsened year-to-date compared with the 2014 numbers for the same period.

"In a baseline scenario where we expect the government to manage its fiscal house better in H2 than in H1 and the economy to contract less, we estimate public debt could still rise by 6.9 pp this year to 65.8% of GDP (as against our earlier projection of debt rising to 64.5%)",says Societe Generale.

With the fiscal trajectory less clear despite the ongoing austerity efforts and interest rate risks continuing to tilt upwards, the fiscal challenges continue to mount and public debt is not seen falling any time over the next few years. Moreover, rising public debt will likely present fresh challenges to contain interest payments and the overall fiscal deficit.

A quick look at the conditioning factors of gross debt suggests that each of the key components - issuance, interest payments, exchange adjustment and nominal growth - have worsened year-to-date compared with the 2014 numbers for the same period.

"In a baseline scenario where we expect the government to manage its fiscal house better in H2 than in H1 and the economy to contract less, we estimate public debt could still rise by 6.9 pp this year to 65.8% of GDP (as against our earlier projection of debt rising to 64.5%)",says Societe Generale.

With the fiscal trajectory less clear despite the ongoing austerity efforts and interest rate risks continuing to tilt upwards, the fiscal challenges continue to mount and public debt is not seen falling any time over the next few years. Moreover, rising public debt will likely present fresh challenges to contain interest payments and the overall fiscal deficit.

03 July 2015, 00:52

Developments in Greece and China further complicate the Fed's decision-making

process. Although contagion has remained muted so far, 'international

developments' imply greater uncertainty for the global backdrop. This comes at a

time of incoming US data (construction, car sales, manufacturing confidence)

that is generally solid, but may not yet have provided the 'decisive' evidence

the FOMC is looking for.

This week's payroll data was a case in point: although payroll growth remained respectable and could be viewed as having returned to a more sustainable path, it was slightly weaker than expected, including on wage growth.

Indeed, various communications from FOMC members since the June meeting suggest some confusion within the committee itself as to how to interpret the various incoming data.

"In our view, this means the Fed's decision-making process will be strongly influenced by incoming data, providing limited guidance regarding the timing of the first hike",says Barclays.

This week's payroll data was a case in point: although payroll growth remained respectable and could be viewed as having returned to a more sustainable path, it was slightly weaker than expected, including on wage growth.

Indeed, various communications from FOMC members since the June meeting suggest some confusion within the committee itself as to how to interpret the various incoming data.

"In our view, this means the Fed's decision-making process will be strongly influenced by incoming data, providing limited guidance regarding the timing of the first hike",says Barclays.

03 July 2015, 00:45

In parallel to the political drama in Greece, China's authorities took

decisive easing measures last weekend, including benchmark rate cuts, RRR cuts

and a relaxation of margin regulations. This was a direct response to China's

ongoing equity market sell-off, the severity of which began to raise concerns

toward the end of last week.

However, following a brief rebound on Monday, prices started to slide again. This is happening against a growth backdrop that continues to look soft, as illustrated by the flat manufacturing PMI this week.

Chinese policymakers are expected to manage the financial stability risks and to respond with additional easing in coming months, particularly as subdued inflation implies that real lending rates remain high. Furthermore, the success of the recent local government debt swaps also depends on an accommodative monetary stance.

In addition to rate cuts, the PBoC is likely to increasingly focus on 'targeted easing' measures, including direct lending to policy banks.

"We continue to expect these and other measure to buttress activity over time, but highlight that China's economic performance remains a key uncertainty for the global outlook in the coming months",said Barclays in a report on Friday.

However, following a brief rebound on Monday, prices started to slide again. This is happening against a growth backdrop that continues to look soft, as illustrated by the flat manufacturing PMI this week.

Chinese policymakers are expected to manage the financial stability risks and to respond with additional easing in coming months, particularly as subdued inflation implies that real lending rates remain high. Furthermore, the success of the recent local government debt swaps also depends on an accommodative monetary stance.

In addition to rate cuts, the PBoC is likely to increasingly focus on 'targeted easing' measures, including direct lending to policy banks.

"We continue to expect these and other measure to buttress activity over time, but highlight that China's economic performance remains a key uncertainty for the global outlook in the coming months",said Barclays in a report on Friday.

03 July 2015, 00:42

Greece's referendum vote this Sunday is ultimately a decision on its

membership in the euro, even if PM Tsipras denies this. We find it very

difficult to imagine how, after a 'no' vote, Greece and its creditors could

successfully negotiate a new financial support programme, which would be

necessary to keep Greece in the euro.

Having already defaulted on debt to the IMF, Greece would then also default on its debt to the ECB on 20 July, fully cutting Greek banks off from any ECB liquidity support and worsening the economic situation further. Whether or not an 'exit' from the euro is officially declared, some form of parallel currency would have to emerge (eg, starting with government IOUs to pay for wages and services). This would more likely than not lead eventually to a full redenomination at some point.

Indeed, given how far political relations and economic developments have deteriorated, turning the situation around will be a significant challenge, even in the case of a 'yes' vote.

"We remain hopeful of a 'yes' vote and a subsequent agreement between Greece and its creditors, but the history of missed deadlines, failed negotiations, setting of new deadlines and repeated failures suggest one should retain a healthy dose of scepticism",says Barclays.

The markets' limited reaction to the negative news from Greece since last Friday would seem to suggest that investors have decided that Greece contagion will remain contained.

An eventual Greek exit would raise issues of a new type (eg, a loss of the 'irreversibility' logic and the need for official write-downs on Greek debt, including target-2 imbalances etc). These issues could trigger political dynamics that are difficult to predict and that could become a new source of contagion.

Having already defaulted on debt to the IMF, Greece would then also default on its debt to the ECB on 20 July, fully cutting Greek banks off from any ECB liquidity support and worsening the economic situation further. Whether or not an 'exit' from the euro is officially declared, some form of parallel currency would have to emerge (eg, starting with government IOUs to pay for wages and services). This would more likely than not lead eventually to a full redenomination at some point.

Indeed, given how far political relations and economic developments have deteriorated, turning the situation around will be a significant challenge, even in the case of a 'yes' vote.

"We remain hopeful of a 'yes' vote and a subsequent agreement between Greece and its creditors, but the history of missed deadlines, failed negotiations, setting of new deadlines and repeated failures suggest one should retain a healthy dose of scepticism",says Barclays.

The markets' limited reaction to the negative news from Greece since last Friday would seem to suggest that investors have decided that Greece contagion will remain contained.

An eventual Greek exit would raise issues of a new type (eg, a loss of the 'irreversibility' logic and the need for official write-downs on Greek debt, including target-2 imbalances etc). These issues could trigger political dynamics that are difficult to predict and that could become a new source of contagion.

03 July 2015, 00:11

REUTERS POLL - MEDIAN FED FUNDS TARGET AMONG PRIMARY DEALERS IS 0.625 PCT BY

END OF 2015, 1.625 BY END OF 2016

03 July 2015, 00:03

INTERVIEW-PERU GROWTH IN MAY LIKELY SLOWER THAN THE 4.25 PCT YR/YR PACE

POSTED IN APRIL-FINMIN

03 July 2015, 00:00

SOUTH KOREA JUN FX RESERVES* INCREASE TO 374.75 BLN $ VS PREV 371.51 BLN $

02 July 2015, 11:55

GREECE'S FINANCE MINISTER SAYS DESPERATELY WANTS TO STAY IN EURO - BLOOMBERG

TV

02 July 2015, 11:54

SPAIN 2030 INFLATION-LINKED BOND AVERAGE YIELD 1.552 PCT

02 July 2015, 11:53

SPAIN 2018 BOND AVERAGE YIELD 0.691 PCT

02 July 2015, 11:53

GREECE'S FINANCE MINISTER SAYS DOES NOT HAVE MORAL RIGHT TO SIGN 'EXTEND AND

PRETEND' DEAL WITH CREDITORS - BLOOMBERG TV

02 July 2015, 11:53

SCOTIABANK: CHF IS EXPECTED TO WEAKEN OVER THE MEDIUM TERM HOWEVER IT REMAINS

VULNERABLE TO SAFE-HAVEN GAINS IN PERIODS OF BROADER TURBULENCE

02 July 2015, 11:52

GREEK FINANCE MINISTER SAYS THAT HE WOULD RESIGN IF YES IS OUTCOME OF

REFERENDUM ON SUNDAY -BLOOMBERG TV

02 July 2015, 11:50

Today NFP report is to be published at 12:30 GMT from US.

What is NFP report?

What is NFP report?

- NFP or non-farm payroll report is the monthly statistics on labor condition in the US released by US department of labor statistics. The report comprises goods, construction and manufacturing sector companies.

- This report influences the financial markets deeply across asset class.

- Headline number for total hires last month was 280,000. June ADP employment number bounced back to 237,000, highest since last December.

- Today payrolls are expected at 230,000.

- Second most vital component is wage growth which saw a rebound by 2.2% in the last report; market is expecting another solid gain today.

- Labor force participation rate is showing no signs of rebound. It was at 62.9%, in last report.

- Unemployment rate is expected to drop to 5.4%, from 5.5%.

- Average weekly hours were previous 34.5. No major change is expected.

- Volatility is sure to be on the card, post release.

- Today's report is most crucial as better report would give rise to hike

expectation from US Federal Reserve as early as September.

- Report is very crucial for dollar too. Dollar index, which is value

of dollar against basket of currencies is standing at crucial juncture. As of

now it is testing the highs, made on Monday after Greek referendum announcement

over the weekend.

- Dollar index is currently trading at 96.3, a clear break on NFP would push it to the next level of resistance around 97.7-98.

02 July 2015, 11:48

SPAIN SELLS 2052 MLN EUROS IN 2025 BOND

02 July 2015, 11:48

SPAIN SELLS 601 MLN EUROS IN 2020 BOND

02 July 2015, 11:48

SPAIN SELLS 940* MLN EUROS IN 2018 BOND

02 July 2015, 11:47

S&P- OVERALL ECONOMIC IMPACT OF A GREXIT WOULD BE SEVERE FOR GREECE BUT

MORE CONTAINED FOR THE REST OF THE

02 July 2015, 11:47

- Monday 0.7585 vs 1week 0.7650 NY 13.6/14.35, 10 September 0.7300 NY

12.5

- 28 July .7715 vs 31 July 0.7275 NY 11.0 vs 13.25 v/n. 2m 7750 at

10.95

- 1month vs 3month atm 0.125 for 1month on 850mln v/n. 3month atm

11.35

- 6month vs 1year 0.075, 1year atm 11.225. 6month AUD vs NZD/USD 1.2

(NZD)

- NZD 30 July 0.65 vs 11 September 0.65 NY 1.0. 1month 0.65000 at 13.95

Tok

- 1week AUD vs NZD/USD 13.5/14.5 Tok cut (RBA next Tuesday)

02 July 2015, 11:46

S&P- REAL GDP IN GREECE WOULD FALL 20 PCT BELOW THE BASELINE AFTER FOUR

YEARS

02 July 2015, 11:45

S&P-"WE BELIEVE THE ECONOMIC IMPACT OF A GREXIT ON THE REST OF THE

EUROZONE WOULD BE SOMEWHAT CONTAINED"

02 July 2015, 11:44

S&P-EXPECT THAT A DISTRESSED GREXIT FROM EUROPEAN SINGLE CURRENCY WOULD

HAVE SEVERE CONSEQUENCES FOR GREEK ECONOMY,ITS BANKS, NONFINANCIAL COMPANIES

02 July 2015, 11:38

- Curve spiked Monday, then retested highs Tuesday as 122.00

Breached

- Range players sold in to strength - volumes lower as spot

recovered

- 1month now 7.95 vs 9.2 Monday/9.1 Tuesday. 7.35 was last week's

low

- 3month traded 8.1 to 9.0 Friday/Monday' and now 8.3. 1year 8.7 to 9.1 and

now 8.9

- Risk remains downside, but 1month RR off highs 0.5 today (0.6

Monday')

- More downside volume potential if range holds after NFP. 4bln 122.70-123 expiries

02 July 2015, 11:35

- EUR volumes spiked Monday, but well off highs as spot stagnates

since

- 1month to 21.0 from 14.5 Friday and now 15.0. 1month 11.6 to 15.25 and now

12.5

- 3month 11.4 to 13.2 and now 11.9. 1year 10.2 to 11.5 and now

10.7

- 1month 25D RR spiked 2.25 from 1.1 EUR puts and now 1.5

- Unless US data hits spot, volumes to stay heavy as long US weekend

impacts

- Greece woes/referendum provides some underlying support

2 July 2015, 11:33

On Thursday the greenback edged higher as investors awaited a flurry of U.S.

data later in the day, including the closely watched government nonfarm payrolls

report, which could underline expectations for a rate hike.

Data to be released today:

8:30 am Employment change (000's) Jun

8:30 am Unemployment rate Jun

8:30 am Initial jobless claims June 27

10:00 am Factory orders May

The dollar index was slightly higher at 96.377.

The greenback edged lower against the euro with EUR/USD climbing 0.13% to 1.1067.

The dollar broke through the psychological level of 123 yen to settle at 123.55 in early European trade.

European stocks edged higher Thursday, with investors still nervously watching Greece’s negotiations with its creditors.

The Stoxx Europe 600 was up 0.1% in early trade. The index rose 1.5% on Wednesday after Greek Prime Minister Alexis Tsipras pitched a compromise to extend Greece’s bailout.

In bond markets, safe-haven German debt dropped some of its recent gains. The 10-year German Bund yield climbed 0.04 percentage point to 0.85%. Yields rise as prices fall.

Data to be released today:

8:30 am Employment change (000's) Jun

8:30 am Unemployment rate Jun

8:30 am Initial jobless claims June 27

10:00 am Factory orders May

The dollar index was slightly higher at 96.377.

The greenback edged lower against the euro with EUR/USD climbing 0.13% to 1.1067.

The dollar broke through the psychological level of 123 yen to settle at 123.55 in early European trade.

European stocks edged higher Thursday, with investors still nervously watching Greece’s negotiations with its creditors.

The Stoxx Europe 600 was up 0.1% in early trade. The index rose 1.5% on Wednesday after Greek Prime Minister Alexis Tsipras pitched a compromise to extend Greece’s bailout.

In bond markets, safe-haven German debt dropped some of its recent gains. The 10-year German Bund yield climbed 0.04 percentage point to 0.85%. Yields rise as prices fall.

02 July 2015, 11:30

STERLING RISES VS DOLLAR AFTER UK CONSTRUCTION PMI

02 July 2015, 11:30

UNITED KINGDOM JUN MARKIT/CIPS CONS PMI INCREASE TO 58.1 (FCAST 56.5 ) VS

PREV 55.9

02 July 2015, 11:25

OVER TO LONDON - NZD/USD -0.55%, EUR/USD +0.15%, USD/JPY +0.19%, USD/MYR

+0.85%, NIKKEI +0.98%, SSEC -2.21%, MSCI AXJ +0.31%, UST 10Y 2.4255, WTI +0.26%

02 July 2015, 11:17

TURKISH CENTRAL BANK SAYS INJECTS 12 BLN LIRA IN ONE-WEEK REPO, BIDS 23.69

BLN LIRA

02 July 2015, 11:17

Euro group offered a third bailout package which was confirmed in its

yesterday's meeting on a conditional basis, "only and on the basis of the

outcome of the referendum" on Sunday.

Greek Prime Minister Tsipras has sent a new proposal to negotiate as part of a request for a third bailout, indicating that he was prepared to accept the majority of spending cuts demanded by the country's creditors.

But the resultant effect seems to be disregarded in FX markets. The euro slipped lower against the major currencies on yesterday and it would be expected to be weaker but not a steep declines like yesterday, even as European equities were boosted by fresh hopes for a deal between Greece and its creditors.

EUR/USD was dropped to 1.1050 levels from 1.1145 on the day when Greece defaulted to IMF.

We believe it is worth speculating in ATM binary -0.49 delta puts for targets upto 133 and even surpassing 133.80 levels as we see no positive reasons (both fundamentally or technically) to cushion euro so far.

Greek Prime Minister Tsipras has sent a new proposal to negotiate as part of a request for a third bailout, indicating that he was prepared to accept the majority of spending cuts demanded by the country's creditors.

But the resultant effect seems to be disregarded in FX markets. The euro slipped lower against the major currencies on yesterday and it would be expected to be weaker but not a steep declines like yesterday, even as European equities were boosted by fresh hopes for a deal between Greece and its creditors.

EUR/USD was dropped to 1.1050 levels from 1.1145 on the day when Greece defaulted to IMF.

We believe it is worth speculating in ATM binary -0.49 delta puts for targets upto 133 and even surpassing 133.80 levels as we see no positive reasons (both fundamentally or technically) to cushion euro so far.

02 July 2015, 11:17

TURKISH ECONOMY MINISTER ZEYBEKCI SAYS ECONOMY, BUDGET SHOULD BE MAIN TOPICS

IN COALITION TALKS

02 July 2015, 11:05

Though 88% of the economist expected a wait and watch move from Swedish

central bank, risk bank surprised then with a 10 basis points rate cut and

additional 45 billion purchase of bonds.

As dollar seems to be returning to focus on monetary policy divergence, risk-reward favors buying dollar against Krona.

Trade recommendation -

- Today's move might have surprised market participants, but it seems very much likely that Risk bank will continue its easing since inflation is still very low around 0.1%.

- Today's move by Risk bank has brought down the main refinancing rate to -0.35%.

- It will also purchase additional securities worth SEK 45 billion, which will begin in September and will be completed by end of year.

As dollar seems to be returning to focus on monetary policy divergence, risk-reward favors buying dollar against Krona.

Trade recommendation -

- Buy USD/SEK at current level with stop around 8 and target around 9.2 as first and around 10 as second. Averaging the trade with dips buying is recommended.

02 July 2015, 11:04

TURKISH ECONOMY MINISTER ZEYBEKCI SAYS SEES 2015 EXPORTS $158.5 BLN, IMPORTS

$216 BLN

02 July 2015, 11:04

TURKISH ECONOMY MINISTER ZEYBEKCI SAYS SEES 2015 CURRENT ACCOUNT DEFICIT $38

BLN, NEAR 5 PCT OF GDP

02 July 2015, 11:03

Fitch Ratings says in a new report that recent sales of properties from the

possession of lenders are pointing to greater market liquidity and transparency

in the Portuguese housing market as the economy continues to recover.

The distressed sale discount to the indexed original valuation, referred to as the quick-sale adjustment (QSA), has been on a declining trend. In 2014, the average QSA reached 31.9%, down from 40.1% in 2010, indicating increased market liquidity. The data also suggests enhanced accuracy of revaluation upon lender possession.

In 2Q15, the proportion of loans in early-stage arrears drifted lower, while late-stage arrears, excluding defaults, are below 1% for the third consecutive quarter. The pace of newly defaulted loans and the stock of outstanding defaulted loans increased only slightly in 2Q15.

New mortgage lending remained depressed in 1Q15, but crept above its three-year low. Fitch expects lending volumes to remain stable throughout 2015.

Fitch's 'Mortgage Market Index - Portugal' is part of the agency's quarterly series of index reports. It includes information on the performance of residential mortgages, predominantly from RMBS transactions, but also those held on bank balance sheets. The report sets the housing market against the macroeconomic background and provides commentary on emerging trends.

The data behind the Mortgage Market Index report is also shown in the RMBS Compare which is an Excel-based tool for displaying the performance of individual transactions against each other and Fitch's benchmark indices. It also includes indicators of the broader mortgage markets, home prices and macroeconomic background.

The distressed sale discount to the indexed original valuation, referred to as the quick-sale adjustment (QSA), has been on a declining trend. In 2014, the average QSA reached 31.9%, down from 40.1% in 2010, indicating increased market liquidity. The data also suggests enhanced accuracy of revaluation upon lender possession.

In 2Q15, the proportion of loans in early-stage arrears drifted lower, while late-stage arrears, excluding defaults, are below 1% for the third consecutive quarter. The pace of newly defaulted loans and the stock of outstanding defaulted loans increased only slightly in 2Q15.

New mortgage lending remained depressed in 1Q15, but crept above its three-year low. Fitch expects lending volumes to remain stable throughout 2015.

Fitch's 'Mortgage Market Index - Portugal' is part of the agency's quarterly series of index reports. It includes information on the performance of residential mortgages, predominantly from RMBS transactions, but also those held on bank balance sheets. The report sets the housing market against the macroeconomic background and provides commentary on emerging trends.

The data behind the Mortgage Market Index report is also shown in the RMBS Compare which is an Excel-based tool for displaying the performance of individual transactions against each other and Fitch's benchmark indices. It also includes indicators of the broader mortgage markets, home prices and macroeconomic background.

02 July 2015, 11:02

HK’S HANG SENG INDEX CLOSES UP 0.1 PCT AT 26,282.32 POINTS

02 July 2015, 11:01

FITCH: PORTUGUESE HOUSING MARKET MORE LIQUID AND TRANSPARENT

02 July 2015, 11:00

TURKISH JUNE TRADE DEFICIT FALLS 21.96 PERCENT TO $6.28 BILLION - CUSTOMS AND

TRADE MINISTRY

02 July 2015, 11:00

BRAZIL JUN IPC-FIPE INFLATION IDX* DECREASE TO 0.47 % (FCAST 0.51 %) VS PREV

0.62 %

02 July 2015, 10:59

The US Employment Report for June is releasing today, featuring the nonfarm

payrolls and the unemployment rate. The previous report, for May, was

particularly strong, employment growth accelerated in May. That report destroyed

speculations that the Fed was not going to hike until 2016 and brought a

September rate hike back on the table.

The consensus expectation for the nonfarm payrolls is 233K. However, that survey was taken largely before the better-than-expected ADP and ISM data.

Rabo bank suggests 240K assuming that today's employment sub-index of the ISM for the services sector remains unchanged

The consensus expectation for the nonfarm payrolls is 233K. However, that survey was taken largely before the better-than-expected ADP and ISM data.

Rabo bank suggests 240K assuming that today's employment sub-index of the ISM for the services sector remains unchanged

02 July 2015, 10:58

TURKISH ECONOMY MINISTER ZEYBEKCI SAYS SEES $3.6 BLN FALL IN EXPORTS THIS

YEAR DUE TO DEVELOPMENTS IN IRAQ, RUSSIA, UKRAINE

02 July 2015, 10:58

TURKISH ECONOMY MINISTER ZEYBEKCI SAYS SEES POSITIVE DEVELOPMENTS IN EXPORTS

FROM H2

02 July 2015, 10:58

TURKISH ECONOMY MINISTER ZEYBEKCI SAYS EXPECTS ONLY SMALL U.S. RATE HIKES BY

YEAR-END, SEES LIMITED IMPACT ON TURKEY

02 July 2015, 14:20

Market Roundup

- DXY up to 3 week highs at 96.406. EUR/USD steady and plays in between 1.1032 to 1.1088 levels.

- NZD/USD makes new 5 year low at 0.6670.

- SEK slips to 3 week low on surprise rate cut. EUR/SEK up to 9.37 from 9.24.

- Swedish Central Bank cuts repo rate to -0.35%, purchase of govt bonds extended by 45bln SEK.

- Swedish Central Bank says prepared to intervene in FX if upturn in inflation threatened.

- Spain Finance minister- If Greece votes 'no' the EZ will continue to be open to talks.

- French Finance minister- If 'yes' wins in referendum we'll get back to work to reach deal.

- French Finance minister- If not 'no' if referendum, that could lead to Grexit.

2 July 2015, 14:13

Oil prices stabilized on Thursday after a sharp drop in the previous session

as data showed an unexpected increase in U.S. oil stockpiles last week due to

increased production.

August Nymex crude oil edged up 0.17% to $57.05 a barrel after ending the previous session down 4.2%.

August Brent climbed 0.52% to $62.33 after falling 2.5% in the previous session.

The U.S. Energy Information Administration said in its weekly report on Wednesday that crude stockpiles rose by 2.4 million barrels in the week to June 26. Oil prices plunged after the news with WTI falling by more than 4% on Wednesday and Brent dropping by 2.5%.

The consensus prediction had been for a decline of 2 million barrels.

At 465.4 million barrels, U.S. crude oil inventories remain near levels not seen for this time of year in at least the last 80 years, adding to fears over a global supply glut.

Since April, it was the first supply build.

“Traditionally, refineries run additional crude in the summer months to meet the driving season’s increased demand for gasoline, hence draw was anticipated,” said Michael Poulsen, oil analyst at Global Risk Management.

August Nymex crude oil edged up 0.17% to $57.05 a barrel after ending the previous session down 4.2%.

August Brent climbed 0.52% to $62.33 after falling 2.5% in the previous session.

The U.S. Energy Information Administration said in its weekly report on Wednesday that crude stockpiles rose by 2.4 million barrels in the week to June 26. Oil prices plunged after the news with WTI falling by more than 4% on Wednesday and Brent dropping by 2.5%.

The consensus prediction had been for a decline of 2 million barrels.

At 465.4 million barrels, U.S. crude oil inventories remain near levels not seen for this time of year in at least the last 80 years, adding to fears over a global supply glut.

Since April, it was the first supply build.

“Traditionally, refineries run additional crude in the summer months to meet the driving season’s increased demand for gasoline, hence draw was anticipated,” said Michael Poulsen, oil analyst at Global Risk Management.

02 July 2015, 13:58

GREEK PRESIDENT CANCELS PLANNED TRIP TO BERLIN ON TUESDAY - SOURCE

02 July 2015, 13:51

Today's non-farm payroll report from US is very vital for the Aussie dollar

pair, which as of now stands very close to key support level, which held strong

for first half of the year and seen as last one standing in front of bears.

Dollar index is testing key resistance around 96-96.5 area.

- Australian economy showing mixed signs. Some economic indicators are pointing at stabilization, if not recovery such as Labour market statistics or housing sector. Other indicator such as exports, commodity prices, mining investments continue to point at further economic downturn ahead.

- Australian dollar on other hand is currently trading at 0.76 against dollar, which as of now looks like that it is going to move further down. However, nothing is a done deal, until it's done. The support held on almost half a year. It deserves all the respect until broken.

Dollar index is testing key resistance around 96-96.5 area.

- Today's better than expected NFP report might not be able to push Aussie beyond 0.75, since that would be more than 2 ATR (15) move. However it can certainly set the stage for move downwards over the coming days. Support area stands as 0.756-0.75.

02 July 2015, 13:39

KENYA SEES 20 TEXTILE FIRMS INVESTING AROUND $80 MLN AFTER U.S. TRADE DEAL

EXTENDED - MINISTER

02 July 2015, 13:38

- RES 4 : 0.77699 (Jun 24th high)

- RES 3: 0.7745 (200 day 4HMA)

- RES 2 : 0.7704 (55 day 4H EMA)

- RES 1: 0.7641 (7 day 4H EMA)

- SUP 2: 0.7590 (Jun 6th low)

- SUP 3: 0.7530 (Apr 2nd low)

- SUP 4: 0.7500

- SUP 4 : 0.7445 (161.8% retracement of 0.75977 and 0.78475)

02 July 2015, 13:37

BRITAIN'S CAMERON THINKS THERE WOULD BE A LEGAL CASE TO STRIKE ISLAMIC STATE

IN SYRIA IF NECESSARY - SPOKESWOMAN

02 July 2015, 13:36

PM CAMERON WANTS LAWMAKERS TO THINK ABOUT POSSIBILITY OF BRITAIN TAKING PART

IN MILITARY ACTION AGAINST ISLAMIC STATE IN SYRIA - SPOKESWOMAN

02 July 2015, 13:30

GREEK STATE MINISTER PAPPAS SAYS GOVT WOULD NOT CONSIDER A HAIRCUT ON

DEPOSITS

02 July 2015, 13:30

GREEK STATE MINISTER SAYS TO RESUME TALKS WITH LENDERS IMMEDIATELY AFTER

VOTE, THERE WILL BE AN AGREEMENT REGARDLESS OF VOTE OUTCOME

02 July 2015, 13:21

In today's updated quarterly forecasts, the Riksbank raised its headline

inflation estimate for 2015 from 0.1% to 0.3% and for 2016 from 1.9% to 2.1%.

The GDP growth forecast wasraised for this year to 3.2% from 2.7% and for next

year to 3.4% from 3.3%.

The central bank may also have taken a more sombre view of events in Greece and the implications for the EUR. It warned in the accompanying statement that consequences of the situation in Greece for the euro area as a whole and for Sweden are difficult to judge.

Like Switzerland, future performance of the Krona against the currencies of Sweden's major trading partners (the euro area accounts for 50% of all Swedish exports) will be crucial to the policy path and the central bank expanding its toolbox which could include FX intervention.

USD/SEK vaulted 8.45 and EUR/SEK spiked over the 200dma of 9.3211 after the rate announcement. For USD/SEK, a break of 8.5973 is required before envisaging a return to 8.80 and the April high of 8.8847.

For EUR/SEK, an extension of the rebound over 9.3210 is not evident without EUR/USD retreating below 1.10 on Greece and Fed rate hike expectations, says Societe Generale.

The central bank may also have taken a more sombre view of events in Greece and the implications for the EUR. It warned in the accompanying statement that consequences of the situation in Greece for the euro area as a whole and for Sweden are difficult to judge.

Like Switzerland, future performance of the Krona against the currencies of Sweden's major trading partners (the euro area accounts for 50% of all Swedish exports) will be crucial to the policy path and the central bank expanding its toolbox which could include FX intervention.

USD/SEK vaulted 8.45 and EUR/SEK spiked over the 200dma of 9.3211 after the rate announcement. For USD/SEK, a break of 8.5973 is required before envisaging a return to 8.80 and the April high of 8.8847.

For EUR/SEK, an extension of the rebound over 9.3210 is not evident without EUR/USD retreating below 1.10 on Greece and Fed rate hike expectations, says Societe Generale.

02 July 2015, 13:18

European Central Bank (ECB) for the first time added a series of corporate

names to the list of eligible securities.

ECB getting tired of Government bonds?

With addition of corporate names to its list, European Central Bank (ECB) has broadened the scope of quantitative easing.

However these purchases might have much more direct impact in a country's stock market and business rather than generalized purchase of government securities.

Until today ECB was buying just government and agency debt.

Will this disrupt business competition?

The names that were added to ECB's hot list are likely to receive much cheaper funding. As of now it added Italian infrastructure companies such as ENEL, SNAM.

This move is unlikely to disrupt business functions as these companies run monopolies.

This change in stance is highly significant. Expect the list to be further updated with corporate names from

ECB getting tired of Government bonds?

With addition of corporate names to its list, European Central Bank (ECB) has broadened the scope of quantitative easing.

However these purchases might have much more direct impact in a country's stock market and business rather than generalized purchase of government securities.

Until today ECB was buying just government and agency debt.

Will this disrupt business competition?

The names that were added to ECB's hot list are likely to receive much cheaper funding. As of now it added Italian infrastructure companies such as ENEL, SNAM.

This move is unlikely to disrupt business functions as these companies run monopolies.

This change in stance is highly significant. Expect the list to be further updated with corporate names from

02 July 2015, 13:17

JP MORGAN: LONG 6M USD/CNH 6.10 PUT, P/L -6 BP

02 July 2015, 13:16

JP MORGAN: LONG 1Y EUR/KRW VS USD/KRW ATM, EQUAL USD VEGA, P/L -0.3 VOL

02 July 2015, 13:16

JP MORGAN: LONG 2M NZD/JPY VS. SHORT 2M USD/JPY, EQUAL JPY VEGA, P/L -1.1 VOL

02 July 2015, 13:15

JP MORGAN: LONG EUR/USD 1Y 35D PUT VS SHORT 6M 35D PUT, 1.5X1 NOTLS: 6M LEG

CLOSED, NOW RUNNING LONG 1Y LEG DELTA, P/L -43BP

02 July 2015, 13:14

The GBP strength likely reflects the removal of a significant portion of UK

political uncertainty just as euro area political risks have intensified.

Although UK economic growth should remain higher than that of the euro area,

underpinning gradual EURGBP depreciation, tight fiscal policy suggests the pace

will be relatively moderate.

"Recent UK labour market data have been encouraging, but Q1 activity data were poor and annual UK GDP growth in 2015 and 2016 is forecasted at 2.2% and 2.1%, respectively", says Barclays.

Looking ahead, low inflation, tight fiscal policy and institutional risks suggest that the pace of GBP outperformance versus the EUR will be moderate.

"Furthermore, monetary policy is likely to be more accommodative and BoE rate hike is expected in Q1 16, versus market pricing of May 2016, and the subsequent pace of tightening is expected to be 25bp every six months instead of 25bp per quarter", added Barclays.

"Recent UK labour market data have been encouraging, but Q1 activity data were poor and annual UK GDP growth in 2015 and 2016 is forecasted at 2.2% and 2.1%, respectively", says Barclays.

Looking ahead, low inflation, tight fiscal policy and institutional risks suggest that the pace of GBP outperformance versus the EUR will be moderate.

"Furthermore, monetary policy is likely to be more accommodative and BoE rate hike is expected in Q1 16, versus market pricing of May 2016, and the subsequent pace of tightening is expected to be 25bp every six months instead of 25bp per quarter", added Barclays.

02 July 2015, 13:13

JP MORGAN: HOLD USD/JPY SHORT 3-MONTH 25D PUT VS. LONG 2-YEAR 10D PUT IN 1X2

NOTIONAL, P/L -19BP

02 July 2015, 13:13

JP MORGAN HOLD USD/JPY SHORT 3-MONTH 25D PUT VS. LONG 2-YEAR 10D PUT IN 1X2

NOTIONAL, P/L -19BP

02 July 2015, 13:12

JP MORGAN: HOLD EUR/JPY SHORT 2YX3Y VARIANCE SWAP (3Y VARIANCE SWAP FORWARD

START IN 2Y), IN JPY PAYOUT

02 July 2015, 13:12

NOW IS THE MOMENT FOR THE GREEK PEOPLE TO CHOOSE THEIR FUTURE -EU'S JUNCKER

SPOKESMAN

2 July 2015, 13:11

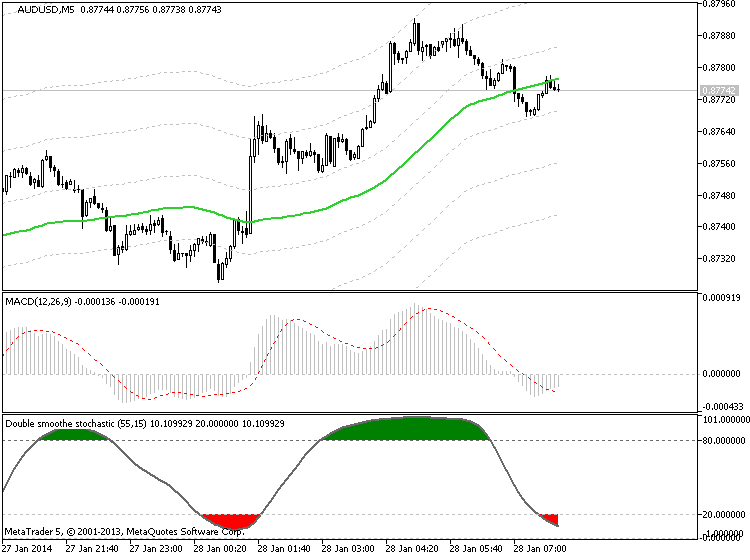

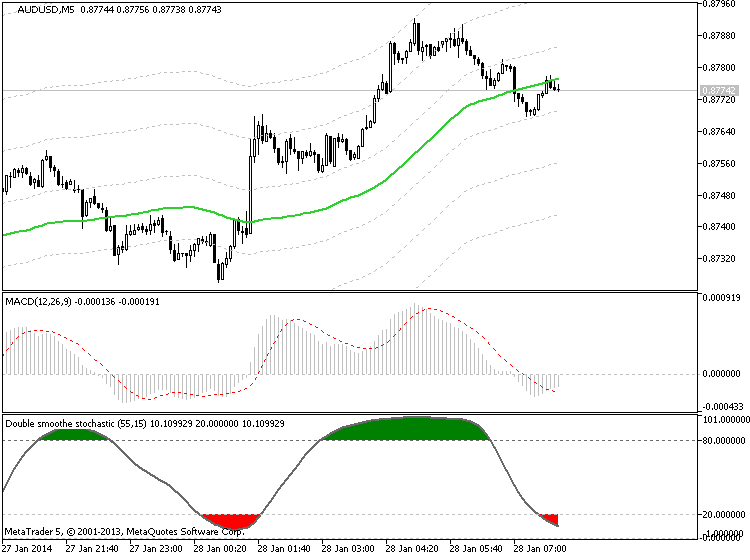

Anyone with any experience in the forex markets and in

technical analysis strategies has likely heard a great deal about the Moving

Average Convergence Divergence (MACD). But what exactly does the MACD tell us -

and how is it calculated? Without an understanding of these areas, it can be

difficult to see trading signals as they emerge. Here, will deconstruct the MACD

indicator and explain how and why it is commonly used.

“In its most basic form,” said Haris Constantinou, markets analyst, “the MACD is a momentum indicator that is designed to follow existing trends and find new ones.” The MACD does this by showing the differences and relationships between a two-level combination of moving averages and price activity itself.

MACD Calculations

To determine and calculate the MACD, we must subtract a 26 period Exponential Moving Average (EMA) from a 12 period EMA. Then, a 9 period EMA of the MACD is plotted, and this becomes the Signal Line for the indicator. The Signal Line is plotted over the MACD and this will be used as the trigger reading for trading signals (both buy signals and sell signals). These elements form the basis of the MACD construction, and it is important to have a strong understanding of these elements if you plan on using the indicator in your daily trading.

Three Common Approaches to the MACD

Now that we understand the basics of how the MACD is calculated, it is a good idea to look at some of the common ways that the MACD is viewed by traders so that we can get a sense of how exactly the indicator is used to identify trading opportunities. There are a few different ways the indicator can be interpreted, and the three of the most common methods proven to be the most effective for traders include

“In its most basic form,” said Haris Constantinou, markets analyst, “the MACD is a momentum indicator that is designed to follow existing trends and find new ones.” The MACD does this by showing the differences and relationships between a two-level combination of moving averages and price activity itself.

MACD Calculations

To determine and calculate the MACD, we must subtract a 26 period Exponential Moving Average (EMA) from a 12 period EMA. Then, a 9 period EMA of the MACD is plotted, and this becomes the Signal Line for the indicator. The Signal Line is plotted over the MACD and this will be used as the trigger reading for trading signals (both buy signals and sell signals). These elements form the basis of the MACD construction, and it is important to have a strong understanding of these elements if you plan on using the indicator in your daily trading.

Three Common Approaches to the MACD

Now that we understand the basics of how the MACD is calculated, it is a good idea to look at some of the common ways that the MACD is viewed by traders so that we can get a sense of how exactly the indicator is used to identify trading opportunities. There are a few different ways the indicator can be interpreted, and the three of the most common methods proven to be the most effective for traders include

- Crossovers,

- Divergences,

- and in identifying Overbought / Oversold conditions

02 July 2015, 13:11

EU'S JUNCKER FULLY SUPPORTS GREEKS' DETERMINATION TO BE PART OF EURO AREA,

BUT NO FURTHER TALKS TILL AFTER REFERENDUM -SPOKESMAN

02 July 2015, 13:11

JP MORGAN: BUY GBP/NOK 30-SEP 12.70-13.20 CALL SPREAD

02 July 2015, 13:10

JP MORGAN: BUY GBP/NZD 3M 2.37-2.45 CALL SPREAD

02 July 2015, 13:10

DANSKE BANK: LONG USDCAD, ENTRY 1.2455, STOP LOSS 1.2355, TARGET 1.2667

02 July 2015, 13:09

JP MORGAN: SHORT NZD/CAD, CHF/JPY, CHF/TRY AND PLN/HUF

02 July 2015, 13:09

JP MORGAN: STAY LONG USD/JPY, USD/TWD, EUR/AUD, EUR/PLN, EUR/CZK, TRY/ZAR,

BRL/MXN

02 July 2015, 13:09

PATTERN TRAPPER: LONG USDCAD ABOVE 1.2459

02 July 2015, 13:06

DANSKE BANK: LONG USDCHF, ENTRY 0.9453, STOP LOSS 0.9415, TARGET 0.9543

02 July 2015, 13:05

JPY depreciation has been driven more by global and technical factors. JPY

appreciation into late January was driven by the EUR selloff and falls in global

bond yields on expectations of QE by the ECB.

These "ECB QE trades" were reversed in late April, initially sparking a sharp correction in Bunds, and JPY REER also began to depreciate, led by cross-yen markets. EURJPY was the clear leader, in terms of both magnitude and timing, consistent with the euro-centric nature of YTD dynamics, setting the stage for a broader JPY depreciation in subsequent weeks.

JPY depreciation accelerated on a combination of position unwinding in EUR/JPY and a cascade of options-related USD/JPY buying as it broke former ranges, sparking a sequence of reverse knock-out option barriers as holders of these positions and the dealer community bought USD/JPY

The pair's short term resistance is around 123.50 (20 day MA) and break above would extend gains till 124.15/124.40.

On the downside any break below 123 will drag the pair further down till 122.70/122.40/122.

It is good to buy around 123.35-40 with SL around 123 for the TP of 124.15/124.40.

These "ECB QE trades" were reversed in late April, initially sparking a sharp correction in Bunds, and JPY REER also began to depreciate, led by cross-yen markets. EURJPY was the clear leader, in terms of both magnitude and timing, consistent with the euro-centric nature of YTD dynamics, setting the stage for a broader JPY depreciation in subsequent weeks.

JPY depreciation accelerated on a combination of position unwinding in EUR/JPY and a cascade of options-related USD/JPY buying as it broke former ranges, sparking a sequence of reverse knock-out option barriers as holders of these positions and the dealer community bought USD/JPY

02 July 2015, 13:03

- RES 4: 125.84 (Jun 5th high)

- RES 3 :125

- RES 2 : 124.50 (Jun 17th high)

- RES 1: 123.65 (61.8 % retracement of 124.43 and 122.47)

- SUP 1 :123.40 (7 day H EMA)

- SUP 1: 122 (Jun 28th low)

- SUP 2 : 121.50 (61.8% retracement of 125.84 and 118.87)

- SUP 3: 121.25 (161.8% retracement of 122.47 and 124.36)

The pair's short term resistance is around 123.50 (20 day MA) and break above would extend gains till 124.15/124.40.

On the downside any break below 123 will drag the pair further down till 122.70/122.40/122.

It is good to buy around 123.35-40 with SL around 123 for the TP of 124.15/124.40.

02 July 2015, 13:01

EUROGROUP'S DIJSSELBLOEM: SITUATION IN GREECE IS "DRAMATICALLY DETERIORATING

DAY BY DAY"

02 July 2015, 13:00

DANSKE BANK: SHORT AUDUSD, ENTRY 0.7710, STOP LOSS 0.7780, TARGET 0.7533

02 July 2015, 12:56

ACE TRADER: LONG GBPUSD, ENTRY 1.5606, STOP LOSS 1.5550, TARGET 1.5675

02 July 2015, 12:54

DANSKE BANK: LONG USDJPY, ENTRY 122.93, STOP LOSS 122.53, TARGET 124.38

02 July 2015, 12:52

PATTERN TRAPPER: SHORT EURUSD BELOW 1.1136

02 July 2015, 12:49

DANSKE BANK: SHORT EURUSD, ENTRY 1.1058, STOP LOSS 1.1112, TARGET 1.0955

02 July 2015, 12:44

DIJSSELBLOEM: GREEK "NO" WOULD PUT GREECE AND EUROPE IN "VERY DIFFICULT

POSITION"

02 July 2015, 12:31

POLAND'S MAIN OPPOSITION PARTY CANDIDATE FOR PM SZYDLO SAYS IF SHE WINS

ELECTIONS HER GOVERNMENT WILL NOT INTRODUCE EURO

02 July 2015, 12:28

DIJSSELBLOEM: GREEK "NO" VOTE WILL NOT LEAD TO IMPROVED NEGOTIATING POSITION

02 July 2015, 12:28

Even the latest twists and turns of Greek Prime Minister Tsipras did not give

rise to any serious fluctuations on the gold market yesterday.

Good US employment figures had a greater impact, on the other hand, as they resulted in an appreciating US dollar and rising US bond yields. This morning gold has dropped to a 3½-month low of $1,161 per troy ounce. It risks falling even further if US labour market data prove surprisingly positive this afternoon, says Commerzbank.

Good US employment figures had a greater impact, on the other hand, as they resulted in an appreciating US dollar and rising US bond yields. This morning gold has dropped to a 3½-month low of $1,161 per troy ounce. It risks falling even further if US labour market data prove surprisingly positive this afternoon, says Commerzbank.

02 July 2015, 12:27

CORRECTED-S&P ON IMPACT OF GREXIT - REAL GDP IN GREECE WOULD FALL 20 PCT

BELOW THE BASELINE AFTER FOUR YEARS (CORRECTS TO SAY GDP WOULD FALL IF GREXIT)