06 July 2015, 08:17

HK'S HANG SENG INDEX FALLS 4 PCT IN EARLY AFTERNOON TRADE

06 July 2015, 08:17

HK'S HANG SENG INDEX FALLS 4 PCT IN EARLY AFTERNOON TRADE

06 July 2015, 08:17

FINANCIAL SPREADBETTERS SEE BRITAIN'S FTSE OPENING AS MUCH AS 2.1 PCT LOWER

06 July 2015, 08:15

The Czech Republic has seen a strong acceleration in economic activity over

the past few months, which has been mainly driven by domestic demand. Indeed,

the improving labour market, incrases in wages, fiscal expansion, and low

inflation will likely have resulted in May retail sales (ex auto) increasing by

0.4% mom (SWDA).

On a yoy basis, retail sales should be up a solid 7.0%. It is not only private consumption behind the economic pickup. The government's fiscal expansion and the massive inflow of EU funds have been boosting the construction sector. Its output should rise by a massive 13.8% yoy in May.

The turnaround in interest rates development and thus in mortgage rate expectations have likely contributed to the rise in the construction of buildings.

Domestic economic expansion and an improvement of the situation in Germany should be reflected in the growth of industrial production by 1.0% mom in May. The automotive industry should fare particularly well, as the number of cars produced increased a whopping 9.2% mom (SWDA) in May.

The whole sector should post a 4.9% yoy expansion with the adverse effect of a lower number of working days, says Societe Generale.

On a yoy basis, retail sales should be up a solid 7.0%. It is not only private consumption behind the economic pickup. The government's fiscal expansion and the massive inflow of EU funds have been boosting the construction sector. Its output should rise by a massive 13.8% yoy in May.

The turnaround in interest rates development and thus in mortgage rate expectations have likely contributed to the rise in the construction of buildings.

Domestic economic expansion and an improvement of the situation in Germany should be reflected in the growth of industrial production by 1.0% mom in May. The automotive industry should fare particularly well, as the number of cars produced increased a whopping 9.2% mom (SWDA) in May.

The whole sector should post a 4.9% yoy expansion with the adverse effect of a lower number of working days, says Societe Generale.

06 July 2015, 08:11

CHINA'S SHANGHAI COMPOSITE INDEX FALLS INTO NEGATIVE TERRITORY

6 July 2015, 08:10

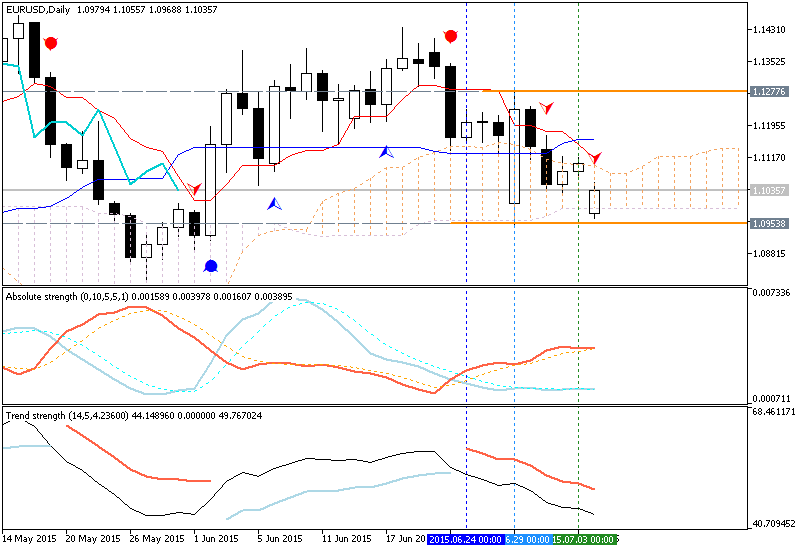

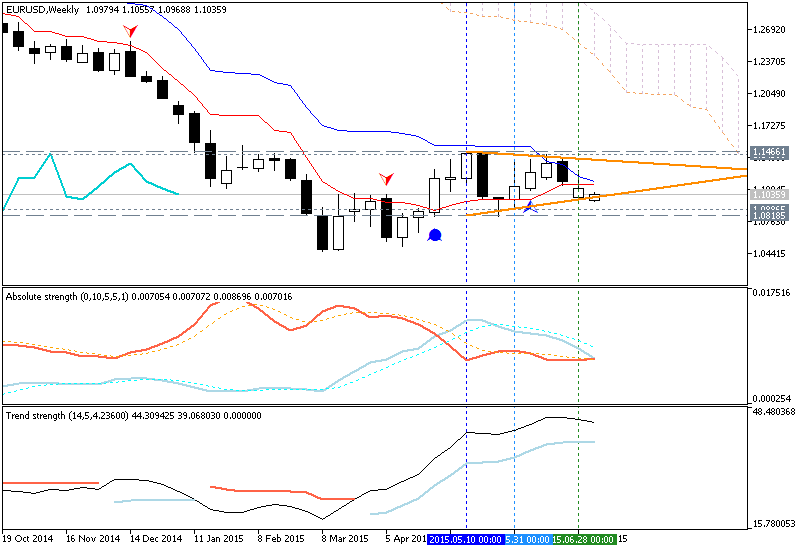

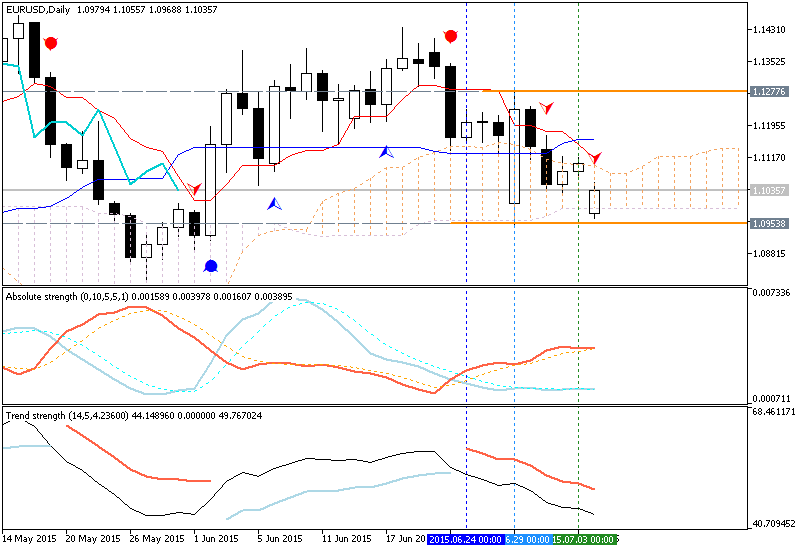

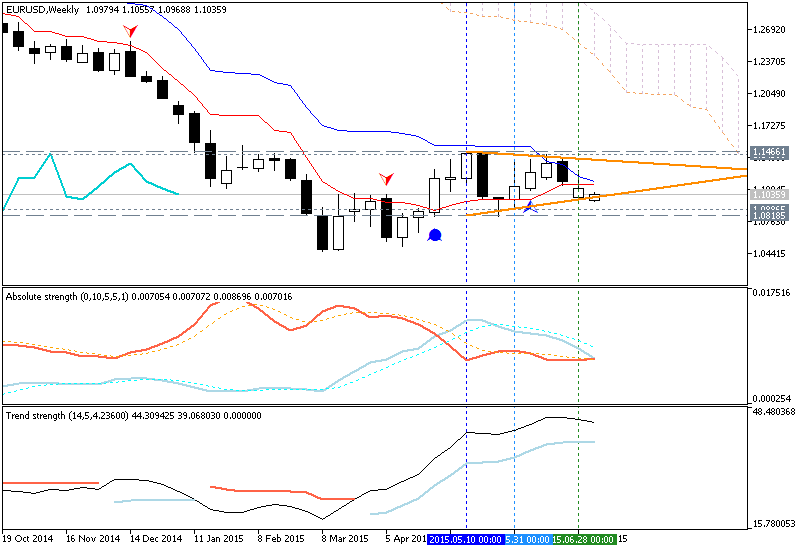

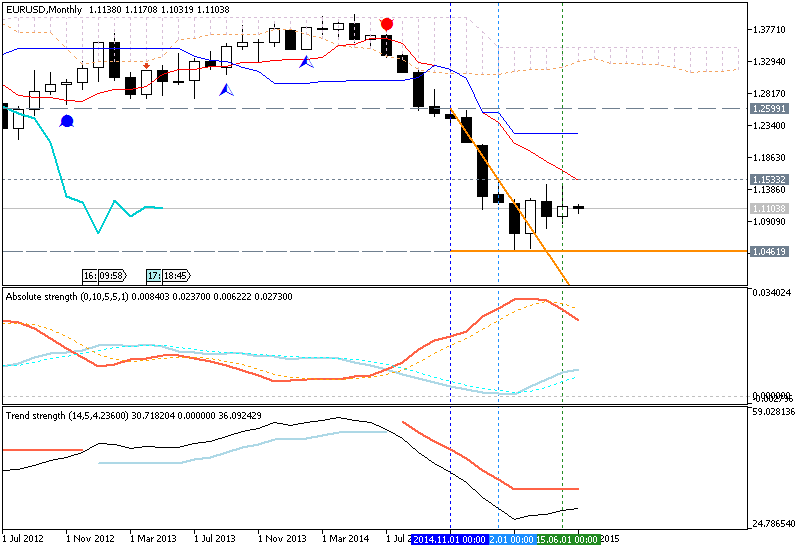

Daily price is on ranging market condition: the price is located below

and near 'reversal' Sinkou Span A line which is the border between primary

bullish and the primary bearish on the chart. The price is ranging between

1.1277 resistance level and 1.0953 key strong support level located below

Ichimoku cloud in primary bearish area of the chart. Chinkou Span line is

located above the price to be ready for good possible breakdown of the price

movement in the near future.

D1 price - ranging market condition:

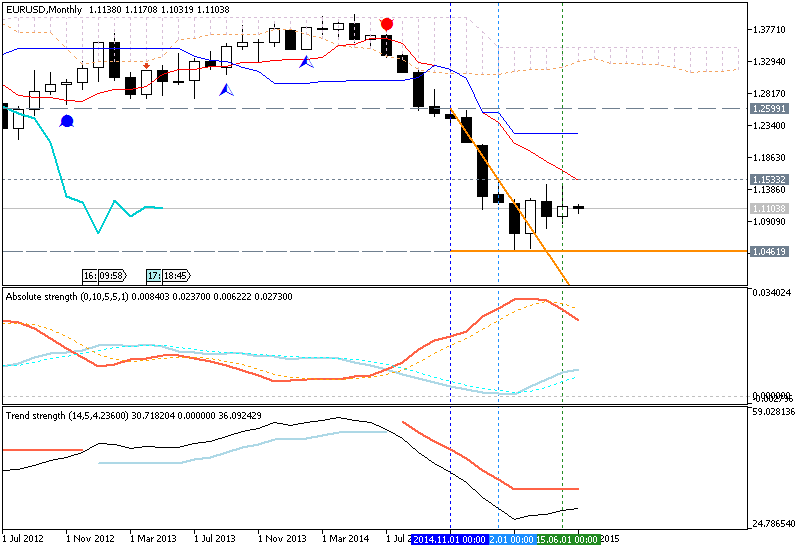

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0953 support level on close D1 bar so the primary bearish trend will be continuing with good possibility to breakdown.

If D1 price will break 1.1277 resistance level so the price will be fully reversed to the bullish market condition.

If not so the price will be on ranging between 1.0953 and 1.1277 levels.

SUMMARY : bearish

SUMMARY : bearish

TREND : ranging bearish

D1 price - ranging market condition:

- Tenkan-sen line crossed with Kijun-sen line of Ichimoku indicator for the primary bearish condition on D1 timeframe.

- Chinkou Span line is located above the price to be ready for good breakdown of the price movement in the near future.

- 'Reversal' Sinkou Span A line as the border between the primary bullish and the primary bearish on the chart is located above and near the price for possible reversal to the primary bearish or primary bullish market conditions.

- AbsoluteStrength indicator is estimating the bearish.

- Nearest key support level is 1.0953 (D1).

- Nearest resistance level is 1.1277 (D1).

MN price is on ranging bearish with 1.0461 support level.

If D1 price will break 1.0953 support level on close D1 bar so the primary bearish trend will be continuing with good possibility to breakdown.

If D1 price will break 1.1277 resistance level so the price will be fully reversed to the bullish market condition.

If not so the price will be on ranging between 1.0953 and 1.1277 levels.

| Resistance | Support |

|---|---|

| 1.1277 (D1) | 1.0953 (D1) |

| 1.1466 (W1) | 1.0818 (W1) |

| 1.2886 (MN1) | 1.0461 (MN1) |

TREND : ranging bearish

06 July 2015, 08:06

Euro area industrial output data is sechduled to release on 7th, July. In

May, the industrial production of Germany is likely to have increased by 0.2%

mom in March, following 0.9% mom in April, according to Societe

Generale.

Despite the weak momentum, the average for Q2 should improve compared with Q1, providing evidence that manufacturing is likely to gradually complement consumption as growth driver this year. A key reason for the weak momentum in the industry lies with still weak global demand and trade.

"Survey indicators, however, point to a small improvement in June and July, and we continue to expect GDP growth in Q2 in the order of 0.5% qoq", estimates SocGen.

Despite the weak momentum, the average for Q2 should improve compared with Q1, providing evidence that manufacturing is likely to gradually complement consumption as growth driver this year. A key reason for the weak momentum in the industry lies with still weak global demand and trade.

"Survey indicators, however, point to a small improvement in June and July, and we continue to expect GDP growth in Q2 in the order of 0.5% qoq", estimates SocGen.

06 July 2015, 08:05

The implied growth rates of Taiwan's trade mom seem too strong to remain

persistent against a backdrop of falling orders and production.

And the Ministry of Finance put "increase in working days" in its press release as one reason for the May strength. June PMI reports across Asia suggest deteriorating activity and demand in the region. Moreover, the improvement in Korea trade in June is mainly due to a technical factor rather than stronger fundamentals.

"Therefore, Taiwan's export growth is expected to have deteriorated again to -9% yoy in June, a combination of a correction of the previous month's strength and weak external demand. Import growth is likely to have fallen back to deep contraction as well, given a strong negative base effect and cooling investments", says Societe Generale.

And the Ministry of Finance put "increase in working days" in its press release as one reason for the May strength. June PMI reports across Asia suggest deteriorating activity and demand in the region. Moreover, the improvement in Korea trade in June is mainly due to a technical factor rather than stronger fundamentals.

"Therefore, Taiwan's export growth is expected to have deteriorated again to -9% yoy in June, a combination of a correction of the previous month's strength and weak external demand. Import growth is likely to have fallen back to deep contraction as well, given a strong negative base effect and cooling investments", says Societe Generale.

06 July 2015, 08:05

HANG SENG CHINA ENTERPRISES INDEX DOWN OVER 4 PCT

06 July 2015, 08:04

CSI300 INFORMATION TECHNOLOGY INDEX DOWN OVER 6 PCT

06 July 2015, 08:04

JAPAN MAY LEADING INDICATOR* DECREASE TO -0.2 VS PREV 1.2

06 July 2015, 08:04

JAPAN MAY COINCIDENT INDICATOR MM* DECREASE TO -1.8 VS PREV 1.9

06 July 2015, 08:04

German's factory order data for May is due on 6th, July.

Societe Generale estimates, "In May, the factory orders is expected to have grown by 0.4% mom, following two months of strong expansion. While domestic orders should rebound from a weak April number (-3.8% mom), foreign orders could again decline more strongly after the stellar 5.5% mom increase in April."

This puts some downside risks to their forecast of orders, adds SocGen. While gradually improving, and with better momentum in domestic orders, factory orders are still weighed down by soft global activity and trade, which should improve gradually in H2.

Societe Generale estimates, "In May, the factory orders is expected to have grown by 0.4% mom, following two months of strong expansion. While domestic orders should rebound from a weak April number (-3.8% mom), foreign orders could again decline more strongly after the stellar 5.5% mom increase in April."

This puts some downside risks to their forecast of orders, adds SocGen. While gradually improving, and with better momentum in domestic orders, factory orders are still weighed down by soft global activity and trade, which should improve gradually in H2.

06 July 2015, 08:01

Taiwan's daily price data suggested that vegetables, fruits and meat prices

all increased over the month. A negative base effect from electricity bills and

declines in fuel prices will probably offset part of the strength and drag the

headline figure down by around 0.2pp.

"Taiwan's CPI inflation is expected to inch higher to -0.6% yoy in June, due to higher food price inflation", says Societe Generale.

Hence, food price inflation is expected to have risen further to 1.1% mom in June raising headline inflation by 0.3pp.

Meanwhile, increases in meat prices and depreciation of the Taiwanese dollar are expected to ease some weakness in the official core CPI inflation. The core CPI inflation is expected to have stopped falling and remain unchanged at 0.6% yoy in June, added Societe Generale.

"Taiwan's CPI inflation is expected to inch higher to -0.6% yoy in June, due to higher food price inflation", says Societe Generale.

Hence, food price inflation is expected to have risen further to 1.1% mom in June raising headline inflation by 0.3pp.

Meanwhile, increases in meat prices and depreciation of the Taiwanese dollar are expected to ease some weakness in the official core CPI inflation. The core CPI inflation is expected to have stopped falling and remain unchanged at 0.6% yoy in June, added Societe Generale.

06 July 2015, 08:01

BOJ REGIONAL ECONOMIC REPORT: ALL REGIONAL ECONOMIES RECOVERING OR GRADUALLY

RECOVERING

06 July 2015, 08:00

BOJ MAINTAINS ASSESSMENT FOR 8 OUT OF 9 REGIONS IN QUARTERLY REPORT

06 July 2015, 08:00

BOJ RAISES ASSESSMENT FOR 1 OUT OF 9 JAPAN REGIONS IN QUARTERLY REPORT

06 July 2015, 07:54

Moody's Investors Service says the recovery in the price of Dubai crude will

provide some support to upstream oil companies, which have seen their margins

contracting significantly over the past year.

"While oil prices remain weak, the recovery in the price of Dubai crude to $61.3 a barrel in the April to June quarter 2015 will provide some support to the earnings and cash flows of upstream oil companies," says Vikas Halan, a Moody's Vice President and Senior Credit Officer.

In particular, Moody's expects that regional companies producing more oil or oil price-linked liquefied natural gas will likely benefit from the recovery in the price of Dubai crude.

"We also expect that investment-grade exploration and production players, particularly national oil companies, will be better-positioned to weather the cyclical downturn in the oil and gas industry, given their greater financial flexibility, stronger liquidity profiles and better access to capital," says Rachel Chua, a Moody's Associate Analyst.

Halan and Chua were speaking on the release of the latest edition of Moody's Asia Oil & Gas Quarterly, a publication focusing on credit themes in Asia's oil and gas industry.

Moody's publication explains that Dubai crude traded at an average of $61.3/barrel (bbl) in the April to June quarter 2015; representing a 16.4% increase from $52.6/bbl in the preceding quarter, and ended the period at $60.9/bbl. The improvement was in large part due to the stronger demand for refined products.

As for the Singapore complex gross refining margin (GRM), Moody's expects the GRM to average $7.5-$8.0/bbl in 2015, based on Moody's forecast that the GRM will stay at healthy levels during the refinery turnaround season in the second half of 2015 from the average of $8.0 per barrel in Q2 2015.

Moody's says the strong GRM levels will boost the results of refiners in Q2 2015. Refiners will also benefit from inventory valuation gains.

Moody's publication points out that gasoline crack spreads strengthened in Q2 2015, against the backdrop of strong regional demand from South Asia and Indonesia, which in turn absorbed increasing exports from North Asia.

Middle distillate spreads remained stable in Q2 2015, as stronger demand eased the oversupply situation in the market.

Overall, Moody's expects gasoline spreads to remain strong, based on Moody's expectations of higher demand from the Middle East. Middle and heavy distillate spreads will stay under pressure.

"While oil prices remain weak, the recovery in the price of Dubai crude to $61.3 a barrel in the April to June quarter 2015 will provide some support to the earnings and cash flows of upstream oil companies," says Vikas Halan, a Moody's Vice President and Senior Credit Officer.

In particular, Moody's expects that regional companies producing more oil or oil price-linked liquefied natural gas will likely benefit from the recovery in the price of Dubai crude.

"We also expect that investment-grade exploration and production players, particularly national oil companies, will be better-positioned to weather the cyclical downturn in the oil and gas industry, given their greater financial flexibility, stronger liquidity profiles and better access to capital," says Rachel Chua, a Moody's Associate Analyst.

Halan and Chua were speaking on the release of the latest edition of Moody's Asia Oil & Gas Quarterly, a publication focusing on credit themes in Asia's oil and gas industry.

Moody's publication explains that Dubai crude traded at an average of $61.3/barrel (bbl) in the April to June quarter 2015; representing a 16.4% increase from $52.6/bbl in the preceding quarter, and ended the period at $60.9/bbl. The improvement was in large part due to the stronger demand for refined products.

As for the Singapore complex gross refining margin (GRM), Moody's expects the GRM to average $7.5-$8.0/bbl in 2015, based on Moody's forecast that the GRM will stay at healthy levels during the refinery turnaround season in the second half of 2015 from the average of $8.0 per barrel in Q2 2015.

Moody's says the strong GRM levels will boost the results of refiners in Q2 2015. Refiners will also benefit from inventory valuation gains.

Moody's publication points out that gasoline crack spreads strengthened in Q2 2015, against the backdrop of strong regional demand from South Asia and Indonesia, which in turn absorbed increasing exports from North Asia.

Middle distillate spreads remained stable in Q2 2015, as stronger demand eased the oversupply situation in the market.

Overall, Moody's expects gasoline spreads to remain strong, based on Moody's expectations of higher demand from the Middle East. Middle and heavy distillate spreads will stay under pressure.

06 July 2015, 07:52

MOODY'S: RECOVERY IN DUBAI CRUDE PRICE PROVIDES SOME RELIEF TO UPSTREAM

PRODUCERS IN Q2

06 July 2015, 07:51

S.KOREA C.BANK SAYS SELLS 91-DAY MONETARY STABILISATION BONDS AT YIELD OF

1.55 PCT

06 July 2015, 07:49

SEOUL SHARES EXTEND LOSS TO FALL 2 PCT

06 July 2015, 07:44

- USD/JPY down from 122.71 rebound high to 122.32, early spike low

121.70

- BoJ and MoF reassurances, PKO had only a fleeting impact on hind

sight

- Nikkei down to 20,064.02 in PM, down 452.91 points or 2.21% on day, dragging

USD/JPY lower

- Bids still eyed from ahead of 122.00, trail down, stops sub-121.70

06 July 2015, 07:40

Australia's recent data suggests that the job losses in mining and those

sectors associated with mining investment are more than being offset by gains in

residential construction, catering services and other parts of the services

sector there is little reason to expect a change in this dynamic in the near

future.

Notwithstanding the outsized 42k jump in employment in May, net job creation is expected to have remained positive in June, although only just.

"With the forecast of 5k new jobs and ignoring likely revisions employment growth would have slowed to an 11k average monthly gain over the three months to June, down quite sizably from the average 28k in the three months to March", says Societe Generale.

However, the growth of employment in Q2 of 61k qoq (2.1% annualised rate) would not be far behind the 78k qoq (2.7% saar) of Q1. And in year-on-year terms, growth would have run at 1.8%, just ahead of the 1.7% rate of growth in the population of 15 years and up.

"With labour force growth in line with the demographic trend i.e. an unchanged participation rate we expect a 10k rise in unemployment, but this would not be sufficient to raise the rounded unemployment rate from 6.0%", added Societe Generale.

Notwithstanding the outsized 42k jump in employment in May, net job creation is expected to have remained positive in June, although only just.

"With the forecast of 5k new jobs and ignoring likely revisions employment growth would have slowed to an 11k average monthly gain over the three months to June, down quite sizably from the average 28k in the three months to March", says Societe Generale.

However, the growth of employment in Q2 of 61k qoq (2.1% annualised rate) would not be far behind the 78k qoq (2.7% saar) of Q1. And in year-on-year terms, growth would have run at 1.8%, just ahead of the 1.7% rate of growth in the population of 15 years and up.

"With labour force growth in line with the demographic trend i.e. an unchanged participation rate we expect a 10k rise in unemployment, but this would not be sufficient to raise the rounded unemployment rate from 6.0%", added Societe Generale.

06 July 2015, 07:31

The China swap programme converted CNY135bn in outstanding bank loans, which

are in total social financing data, into local government bonds, which are not

in the credit growth probably dipped further, partly due to a technical factor.

New bank lending is expected to come in at CNY880bn in June, compared with

CNY900bn in May. However,that might not imply less new bank funding because of

the debt-to-bond swap for local governments.

"China's money growth to soften again in June, mostly due to base effects. M2 growth likely dropped to 10.4% yoy from 10.8% yoy in May. Last June, M2 growth jumped to 14.7% yoy from 13.5% yoy on an outsized increase in deposits, which is unlikely to repeat given the relaxation of the loan-to-deposit ratio requirement", says Societe Generale.

Together with a strong base, the growth of loan stock probably dropped notably from 13.6% yoy to around 13% yoy. Meanwhile, the other channel of credit supply, corporate bonds and nonbank credit, is unlikely to have picked up. The only bright spot should be equity financing, but that is not used in the calculation of total credit growth however.

"China's money growth to soften again in June, mostly due to base effects. M2 growth likely dropped to 10.4% yoy from 10.8% yoy in May. Last June, M2 growth jumped to 14.7% yoy from 13.5% yoy on an outsized increase in deposits, which is unlikely to repeat given the relaxation of the loan-to-deposit ratio requirement", says Societe Generale.

Together with a strong base, the growth of loan stock probably dropped notably from 13.6% yoy to around 13% yoy. Meanwhile, the other channel of credit supply, corporate bonds and nonbank credit, is unlikely to have picked up. The only bright spot should be equity financing, but that is not used in the calculation of total credit growth however.

06 July 2015, 07:31

The China swap programme converted CNY135bn in outstanding bank loans, which

are in total social financing data, into local government bonds, which are not

in the credit growth probably dipped further, partly due to a technical factor.

New bank lending is expected to come in at CNY880bn in June, compared with

CNY900bn in May. However,that might not imply less new bank funding because of

the debt-to-bond swap for local governments.

"China's money growth to soften again in June, mostly due to base effects. M2 growth likely dropped to 10.4% yoy from 10.8% yoy in May. Last June, M2 growth jumped to 14.7% yoy from 13.5% yoy on an outsized increase in deposits, which is unlikely to repeat given the relaxation of the loan-to-deposit ratio requirement", says Societe Generale.

Together with a strong base, the growth of loan stock probably dropped notably from 13.6% yoy to around 13% yoy. Meanwhile, the other channel of credit supply, corporate bonds and nonbank credit, is unlikely to have picked up. The only bright spot should be equity financing, but that is not used in the calculation of total credit growth however.

"China's money growth to soften again in June, mostly due to base effects. M2 growth likely dropped to 10.4% yoy from 10.8% yoy in May. Last June, M2 growth jumped to 14.7% yoy from 13.5% yoy on an outsized increase in deposits, which is unlikely to repeat given the relaxation of the loan-to-deposit ratio requirement", says Societe Generale.

Together with a strong base, the growth of loan stock probably dropped notably from 13.6% yoy to around 13% yoy. Meanwhile, the other channel of credit supply, corporate bonds and nonbank credit, is unlikely to have picked up. The only bright spot should be equity financing, but that is not used in the calculation of total credit growth however.

06 July 2015, 07:24

China's money growth to soften again in June, mostly due to base effects. M2

growth likely dropped to 10.4% yoy from 10.8% yoy in May. Last June, M2 growth

jumped to 14.7% yoy from 13.5% yoy on an outsized increase in deposits, which is

unlikely to repeat given the relaxation of the loan-to-deposit ratio

requirement.

Total credit growth probably dipped further, partly due to a technical factor. New bank lending is expected to come in at CNY880bn in June, compared with CNY900bn in May. However,that might not imply less new bank funding because of the debt-to-bond swap for local governments. The swap programme converted CNY135bn in outstanding bank loans, which are in the total social financing data (TSF), into local government bonds - which are not in the TSF.

Together with a strong base, the growth of loan stock probably dropped notably from 13.6% yoy to around 13% yoy. Meanwhile, the other channel of credit supply, corporate bonds and nonbank credit, is unlikely to have picked up. The only bright spot should be equity financing, but that is not used in the calculation of total credit growth however.

Total credit growth probably dipped further, partly due to a technical factor. New bank lending is expected to come in at CNY880bn in June, compared with CNY900bn in May. However,that might not imply less new bank funding because of the debt-to-bond swap for local governments. The swap programme converted CNY135bn in outstanding bank loans, which are in the total social financing data (TSF), into local government bonds - which are not in the TSF.

Together with a strong base, the growth of loan stock probably dropped notably from 13.6% yoy to around 13% yoy. Meanwhile, the other channel of credit supply, corporate bonds and nonbank credit, is unlikely to have picked up. The only bright spot should be equity financing, but that is not used in the calculation of total credit growth however.

06 July 2015, 07:05

June FOMC meeting states that the hurdle for a lift-off in rates is quite

low, but the pace will be very gradual. The FOMC's 1.9% growth forecast for this

year implies average growth of 2.5% during Q2-Q4 and according to the "dots"

this is good enough for at least one rate hike.

While the FOMC appears to be ready to lift rates relatively soon, may be for September, the Committee is collectively trying to shift market focus to the pace of tightening and promising that it will be very gradual.

This message is expected to be reinforced in the FOMC minutes, with the caveat that "gradual" is not the same as the "measured" pace of tightening during the 2004-2006 tightening cycle. Yellen communicated this during the press conference, insisting the rates are not on a pre-set course and the path will be adjusted as the data evolves.

The speed of the tightening cycle might be being tied to the labor market and inflation. Things to look for in the FOMC minutes include any additional color on the timing of the lift-off and any discussion on how to communicate ahead of the first rate move. On the first issue, any precise commitment is not expected, but it would be helpful to see whether the one-hikercamp which includes dots #3 through #7 assumes the first rate hike in December or before.

"The unemployment rate will eventually drop to about 4.3% by the end of this cycle, rather than leveling off at 5.0% as suggested by the FOMC's projections. Alongside this projected unemployment drop we also envision an acceleration in hourly wage growth to 2.6% by the end of this year and 3.0% by the end of 2016. It is not clear how sensitive the rate path will be to such developments, but the risks around the Fed's "dot plot" to be skewed to the upside", says Societe Generale.

A September hike followed by a six months pause, which would allow the market to slowly adjust to the new reality of a tightening cycle. Regarding the communication ahead of the lift-off, the April minutes already included a discussion on the issue but most participants seemed uncomfortable with the idea of pre-annouoncing the liftoff.

Lastly, any further insight on the technical aspects of the lift-off, specifically the size of the overnight reverse repo facility. Chair Yellen indicated at the 17 June press conference that the FOMC plans to begin with a relatively large facility at lift-off, but plans to scale it back relatively quickly.

While the FOMC appears to be ready to lift rates relatively soon, may be for September, the Committee is collectively trying to shift market focus to the pace of tightening and promising that it will be very gradual.

This message is expected to be reinforced in the FOMC minutes, with the caveat that "gradual" is not the same as the "measured" pace of tightening during the 2004-2006 tightening cycle. Yellen communicated this during the press conference, insisting the rates are not on a pre-set course and the path will be adjusted as the data evolves.

The speed of the tightening cycle might be being tied to the labor market and inflation. Things to look for in the FOMC minutes include any additional color on the timing of the lift-off and any discussion on how to communicate ahead of the first rate move. On the first issue, any precise commitment is not expected, but it would be helpful to see whether the one-hikercamp which includes dots #3 through #7 assumes the first rate hike in December or before.

"The unemployment rate will eventually drop to about 4.3% by the end of this cycle, rather than leveling off at 5.0% as suggested by the FOMC's projections. Alongside this projected unemployment drop we also envision an acceleration in hourly wage growth to 2.6% by the end of this year and 3.0% by the end of 2016. It is not clear how sensitive the rate path will be to such developments, but the risks around the Fed's "dot plot" to be skewed to the upside", says Societe Generale.

A September hike followed by a six months pause, which would allow the market to slowly adjust to the new reality of a tightening cycle. Regarding the communication ahead of the lift-off, the April minutes already included a discussion on the issue but most participants seemed uncomfortable with the idea of pre-annouoncing the liftoff.

Lastly, any further insight on the technical aspects of the lift-off, specifically the size of the overnight reverse repo facility. Chair Yellen indicated at the 17 June press conference that the FOMC plans to begin with a relatively large facility at lift-off, but plans to scale it back relatively quickly.

06 July 2015, 07:02

SRI LANKA RUPEE OPENS 0.07 PERCENT WEAKER AT 133.60 PER DLR, STOCK INDEX

OPENS 0.05 PERCENT UP

06 July 2015, 06:47

The US manufacturing ISM report released last week suggests that the factory

sector is rebounding from its earlier weakness. The non-manufacturing ISM index

has fared muchbetter all along and is expected to remain at a level consistent

with strong GDP growth.

A 1.2 point increase in June to 56.9 which would reverse about 50% of May's decline and keep the composite well within its recent ranges, says Societe Generale. The outperformance of the service sector can be explained by two factors minimal sensitivity to the dollar's strength and more limited spillover from the weakness in oil & gas investments.

These factors have been weighing on manufacturing activity but should begin to dissipate in the coming months. Weak consumer demand was also a factor supressing demand for both goods and services in Q1, but this is now reversing. 56.9 forecast for the non-manufacturing ISM would put the composite of the two surveys at 56.5. This is consistent with GDP growth of 3.5%, close to 3.3% forecast for second quarter growth, says Societe Generale.

A 1.2 point increase in June to 56.9 which would reverse about 50% of May's decline and keep the composite well within its recent ranges, says Societe Generale. The outperformance of the service sector can be explained by two factors minimal sensitivity to the dollar's strength and more limited spillover from the weakness in oil & gas investments.

These factors have been weighing on manufacturing activity but should begin to dissipate in the coming months. Weak consumer demand was also a factor supressing demand for both goods and services in Q1, but this is now reversing. 56.9 forecast for the non-manufacturing ISM would put the composite of the two surveys at 56.5. This is consistent with GDP growth of 3.5%, close to 3.3% forecast for second quarter growth, says Societe Generale.

06 July 2015, 06:47

TOKYO'S NIKKEI SHARE AVERAGE EXTENDS FALL, DOWN 2.00 PCT

06 July 2015, 06:39

The Greek referendum appears to have led to a large victory of the 'No' vote.

At 1am CET, with 90% of the vote counted, the 'No' was largely ahead with 61.5%

of votes. A "reject"vote at the referendum marks a first step towards Grexit and

now 65% chance of Grexit is seen.

Avoiding Grexit is possible but will be difficult. Although French policymakers have signalled their willingness to reach a deal, there is no indication that the Troika stands ready to offer Greece a better deal in terms of reform effort, all the more as Greece will need a much larger bailout package (€60-80bn) than what was previously discussed.

In the coming weeks, political uncertainty will remain despite the large victory of the 'No'. First, Greek Constitutional Court will have to legitimate the referendum. Secondly, thepro-European President Pavlopoulos might opt to resign this week, triggering new elections, to be held probably in late July or early August.

A full formal exit is unlikely to happen in the next few days or weeks. Both sides will try to resume negotiations in the coming days. Euro area policymakers are expected to make a statement that places the ball in the court of Athens. If this process fails, both sides are expected to coordinate their actions to manage the exit, says Societe Generale.

Avoiding Grexit is possible but will be difficult. Although French policymakers have signalled their willingness to reach a deal, there is no indication that the Troika stands ready to offer Greece a better deal in terms of reform effort, all the more as Greece will need a much larger bailout package (€60-80bn) than what was previously discussed.

In the coming weeks, political uncertainty will remain despite the large victory of the 'No'. First, Greek Constitutional Court will have to legitimate the referendum. Secondly, thepro-European President Pavlopoulos might opt to resign this week, triggering new elections, to be held probably in late July or early August.

A full formal exit is unlikely to happen in the next few days or weeks. Both sides will try to resume negotiations in the coming days. Euro area policymakers are expected to make a statement that places the ball in the court of Athens. If this process fails, both sides are expected to coordinate their actions to manage the exit, says Societe Generale.

06 July 2015, 06:39

INDIA'S NSE INDEX DOWN 1.2 PCT AT PRE-OPEN

06 July 2015, 06:33

The logistical organisation needs to be put in place swiftly and smoothly

while social order needs to be maintained at Greece.

As seen in Argentina, introducing IOUs could risk backfiring into full force devaluation. In the case of Greece, creating a parallel currency could be seen as a first step to Grexit and not as a temporary solution as in California. Conversely, if the IOUs introduced fail to be seen as a credible means of exchange or do not offer attractive characteristics, they would rapidly disappear in the private sector.

The IOUs would be at risk of breaching the EU Treaty. Indeed, Article 128 states that "the banknotes issues by the ECB and the NCBs shall be the only such notes to have the status of legal tender within the Union". As long as Greece remains within the EU, the IOUs could be used as a medium of exchange but would not have the privilege of a legal currency.

As seen in Argentina, introducing IOUs could risk backfiring into full force devaluation. In the case of Greece, creating a parallel currency could be seen as a first step to Grexit and not as a temporary solution as in California. Conversely, if the IOUs introduced fail to be seen as a credible means of exchange or do not offer attractive characteristics, they would rapidly disappear in the private sector.

The IOUs would be at risk of breaching the EU Treaty. Indeed, Article 128 states that "the banknotes issues by the ECB and the NCBs shall be the only such notes to have the status of legal tender within the Union". As long as Greece remains within the EU, the IOUs could be used as a medium of exchange but would not have the privilege of a legal currency.

06 July 2015, 06:31

INDIAN BANKS BORROWED 200 MLN RUPEES VIA MARGINAL STANDING FACILITY ON JULY 3

- RBI

06 July 2015, 06:31

INDIA RUPEE OPENS AT 63.62 PER DOLLAR VS 63.44/45 AFTER GREECE REFERENDUM

06 July 2015, 06:30

INDIA GOVT SURPLUS CASH BALANCE WITH RBI FOR AUCTION WAS NIL AS ON JULY 3 –

CBANK

06 July 2015, 06:27

Indeed, the Greek government is already running a primary budget deficit and

no other form of funding will be available in the coming weeks. It is worth

noting that if the ECB was to decide to reduce or stop allowing Greek banks to

roll-over Greek TBills, the issuance of IOUs would become even more crucial for

the government.

The IOUs may also be used to help alleviate the financial stresses on Greek banks, such as the issuance of promissory notes in IOU terms in return for the redenomination in IOUs of part of banks' liabilities. In this case, the IOUs would most likely end up as the new Greek currency, says Societe Generale.

Indeed, living with closed banks and frozen deposits cannot last long. The government would eventually offer (with a discount) the chance to convert blocked time-deposits in euros into cash deposits in IOUs. The government would just have to print new banknotes and coins to allow free deposit withdrawals.

The idea of a parallel currency is not uncommon. In particular, IOUs have been used during periods of financial and economic stress, with extreme examples as some US states andArgentina. The academic literature presents several forms of parallel currency, with some creating a new form of securities, backed by the government's ability to pay back its debt and others backed by future taxes.

Unlike the former, the second category would have the advantage of not increasing the amount of debt owed by the Greek government. For example, the Greek government couldpay part of civil servant wages, benefits and pensioners in IOUs and part in euros. The IOUs could become a sought after asset if they offered a discount on tax payments. The IOU would be used in the Greek territory only. It could be used to trade basic needs

CHINA CSI300 HEALTHCARE INDEX, TRANSPORT INDEX SLIP INTO NEGATIVE TERRITORY

The IOUs may also be used to help alleviate the financial stresses on Greek banks, such as the issuance of promissory notes in IOU terms in return for the redenomination in IOUs of part of banks' liabilities. In this case, the IOUs would most likely end up as the new Greek currency, says Societe Generale.

Indeed, living with closed banks and frozen deposits cannot last long. The government would eventually offer (with a discount) the chance to convert blocked time-deposits in euros into cash deposits in IOUs. The government would just have to print new banknotes and coins to allow free deposit withdrawals.

The idea of a parallel currency is not uncommon. In particular, IOUs have been used during periods of financial and economic stress, with extreme examples as some US states andArgentina. The academic literature presents several forms of parallel currency, with some creating a new form of securities, backed by the government's ability to pay back its debt and others backed by future taxes.

Unlike the former, the second category would have the advantage of not increasing the amount of debt owed by the Greek government. For example, the Greek government couldpay part of civil servant wages, benefits and pensioners in IOUs and part in euros. The IOUs could become a sought after asset if they offered a discount on tax payments. The IOU would be used in the Greek territory only. It could be used to trade basic needs

06 July 2015, 06:20

- Momentum studies, 5, 10 & 20 DMA's head north, 5th day of higher

lows

- Positive setup targets a sustained 1.2619 break, 76.4% of Mar/May

fall

- Initial support seen at 1.2551, 1.2538 levels

- Resistance at 1.2619, 76.4% Fibonacci then last week's 1.2632 high

CHINA CSI300 HEALTHCARE INDEX, TRANSPORT INDEX SLIP INTO NEGATIVE TERRITORY

06 July 2015, 06:14

CORRECTED-CHINA CENTRAL BANK APPROVES CHINA CONSTRUCTION BANK TO ISSUE 50 BLN

YUAN IN MORTGAGE-BACKED SECURITIES - LOCAL MEDIA (SOURCED TO LOCAL MEDIA, NOT

C.BANK)

06 July 2015, 06:10

Greek banks are supposed to open on Tuesday. After the 'No' vote, Greeks

banks will likely remain closed for a longer period and capital controls and

cash withdrawals will probably be tightened, less than €60 per day and per

person. The ECB might only suspend ELA with the implicit backing of EU leaders,

i.e. only when the Eurogroup and EU leaders make it clear that no solution can

be found and that Grexit could no longer be avoided.

As long as the line of communication remains open between Greece and the EU, the ECB is expected to maintain ELA access to Greek banks. Indeed, the consequences of shutting down its last line of financing would be a collapse of the Greek banking sector.

Suspending ELA would force the Greek government to issue a new currency almost immediately and to nationalise its banking sector. This would be a disorderly Grexit.

ECB might sooner or later decide to issue a statement similar to that of Cyprus in 2013, the statement issued on 21 March 2013 specified that if a programme was not in place by 25 March, the ELA would no longer be available. Due to this statement, the long discussion ended with a political agreement on 25 March. The ECB first maintained access to ELA and on 2 May 2013 decided to accept the Cypriot government's securities for standard monetary operations.

Instead of a full programme, the ECB may require Greece to request a programme for the recapitalisation of it(s) bank(s): a specific procedure exists for the transitional period until 31December 2015 before the start of the Single Resolution Mechanism (SRM) and the Single Resolution Fund (SRF): a bail-in equal to 8% of total liabilities will be applied before directrecapitalisation by the ESM2.

This would represent €31bn, with the bulk in time deposits. A bail-in and/or a bank default would most likely be problematic. Such a statement would save time and also set the agenda for policymakers, says Societe Generale.

As long as the line of communication remains open between Greece and the EU, the ECB is expected to maintain ELA access to Greek banks. Indeed, the consequences of shutting down its last line of financing would be a collapse of the Greek banking sector.

Suspending ELA would force the Greek government to issue a new currency almost immediately and to nationalise its banking sector. This would be a disorderly Grexit.

ECB might sooner or later decide to issue a statement similar to that of Cyprus in 2013, the statement issued on 21 March 2013 specified that if a programme was not in place by 25 March, the ELA would no longer be available. Due to this statement, the long discussion ended with a political agreement on 25 March. The ECB first maintained access to ELA and on 2 May 2013 decided to accept the Cypriot government's securities for standard monetary operations.

Instead of a full programme, the ECB may require Greece to request a programme for the recapitalisation of it(s) bank(s): a specific procedure exists for the transitional period until 31December 2015 before the start of the Single Resolution Mechanism (SRM) and the Single Resolution Fund (SRF): a bail-in equal to 8% of total liabilities will be applied before directrecapitalisation by the ESM2.

This would represent €31bn, with the bulk in time deposits. A bail-in and/or a bank default would most likely be problematic. Such a statement would save time and also set the agenda for policymakers, says Societe Generale.

06 July 2015, 06:05

The performance of India's state bank sector remained challenged in FY15 (to

end-March 2015), with continued pressure on asset quality and weak capital,

according to Fitch Ratings' Indian Banks Report Card FY15 published on 6 July

2015. Capital needs are likely to increase substantially each year up until

FY19. There are few indications of a meaningful recovery in earnings in the

short term, though stressed assets are likely to have peaked and NPL accretion

is easing.

A difficult year for Indian banks in FY15 was characterised by weak credit demand despite a gradually improving macro picture. State banks in particular continued to face asset-quality pressures, falling profitability and weakened capitalisation on an adjusted basis. System-wide loan growth, at 9.7%, was the lowest over the past decade, and concentrated mainly in retail and farm credit. The system NPL ratio rose to 4.6% of total assets from 4.1% in FY14, though the bulk of the deterioration was accounted for by restructured loans, as expected. Consequently, the broader stressed-assets ratio (which includes performing restructured loans) spiked to 11.1%, from 10%.

Asset-quality pressures continued to be much higher for the state banks, as reflected in distinctly higher NPL ratios. Capital buffers have consequently deteriorated owing to the continued growth in NPLs and low provisioning. Indian banks' reported Tier 1 capital adequacy ratio improved to 9.7% (up from 9.3% in FY14), while the gap between private and state banks' Tier 1 ratios widened to 440bp.

Capital requirements for the system are substantial, and a particular problem for state banks which require the dominant share. Government's recent announcement to provide state banks more core equity than budgeted will be positive for stability, but reliance on external capital should remain high with Basel III implementation.

Nonetheless, the outlook for FY16 is more positive for Indian bank credit. The system-wide stressed-assets ratio is likely to begin falling against the backdrop of a more favourable economic environment. Gross NPL accretion has already shown signs of deceleration, and we forecast GDP growth to gain momentum and rise to 7.8%. This should also be positive for credit growth as interest rates come down - given what has been surprisingly weak demand for credit. Corporate leverage remains high, and the impact of the large stock of stressed assets is likely to continue hampering profitability.

A difficult year for Indian banks in FY15 was characterised by weak credit demand despite a gradually improving macro picture. State banks in particular continued to face asset-quality pressures, falling profitability and weakened capitalisation on an adjusted basis. System-wide loan growth, at 9.7%, was the lowest over the past decade, and concentrated mainly in retail and farm credit. The system NPL ratio rose to 4.6% of total assets from 4.1% in FY14, though the bulk of the deterioration was accounted for by restructured loans, as expected. Consequently, the broader stressed-assets ratio (which includes performing restructured loans) spiked to 11.1%, from 10%.

Asset-quality pressures continued to be much higher for the state banks, as reflected in distinctly higher NPL ratios. Capital buffers have consequently deteriorated owing to the continued growth in NPLs and low provisioning. Indian banks' reported Tier 1 capital adequacy ratio improved to 9.7% (up from 9.3% in FY14), while the gap between private and state banks' Tier 1 ratios widened to 440bp.

Capital requirements for the system are substantial, and a particular problem for state banks which require the dominant share. Government's recent announcement to provide state banks more core equity than budgeted will be positive for stability, but reliance on external capital should remain high with Basel III implementation.

Nonetheless, the outlook for FY16 is more positive for Indian bank credit. The system-wide stressed-assets ratio is likely to begin falling against the backdrop of a more favourable economic environment. Gross NPL accretion has already shown signs of deceleration, and we forecast GDP growth to gain momentum and rise to 7.8%. This should also be positive for credit growth as interest rates come down - given what has been surprisingly weak demand for credit. Corporate leverage remains high, and the impact of the large stock of stressed assets is likely to continue hampering profitability.

06 July 2015, 06:00

HK'S HANG SENG INDEX FALLS OVER 3 PCT IN MORNING TRADE

06 July 2015, 05:52

- No clarity on how Greece will play out so Asia taking no

chances

- Plenty of emergency meetings still to play out on Greece

- Pair weakness late last week pronounced , iron ore -10.5% on

week

- Break and sustained below 0.7500 levels may reach to 0.7000 levels

06 July 2015, 05:25

TAIWAN TOP FINANCIAL REGULATOR SAYS WELCOMES CHINESE BANKS' HEADQUARTERS,

INCLUDING CHINA DEVELOPMENT BANK, TO SELL YUAN BONDS IN TAIWAN

06 July 2015, 05:19

JAPAN CHIEF GOVT SPOKESMAN: THINKS EURO NATIONS WILL TAKE RESPONSIBLE ACTIONS

TO GREEK SITUATION

06 July 2015, 05:11

PHILIPPINE HEALTH MINISTRY SAYS CONDITION OF MERS PATIENT IMPROVING

06 July 2015, 05:09

A multi-year fiscal plan approved by the Japanese cabinet on 30 June does not

increase the likelihood of the country's high public debt ratios beginning to

decline in a sustainable and substantive manner any time soon, says Fitch

Ratings. The strategy focuses on enhancing growth through structural reforms as

the guiding principle for fiscal consolidation. Many of the planned reforms are

positive for enhancing productivity and encouraging investment, but Fitch

believes that the government's expectations of their effect on growth are highly

optimistic.

The government's plan targets achieving a primary deficit of 1% of GDP by 2018 on the way to a balanced budget by 2020, through raising potential growth to above 2%. Notably, beyond previously announced plans to raise the consumption tax by two percentage points to 10% in April 2017, the government is relying almost wholly on economic growth to increase tax revenue.

At the same time, the central government has not set a hard cap on general spending, though it aims to keep annual increases in general spending to JPY1.6trn through to the fiscal year to March 2018. The lack of a hard cap leaves room for fiscal slippage. The government's plans to control expenditure focus on improving efficiencies through technology, innovation, greater use of the private sector in the provision of public services and reforming incentives, which are broadly positive for long-term efficiency, but are not likely to curb expenditure growth materially over the medium term.

The reliance on economic growth for fiscal consolidation comes with risks. The planned consumption tax hike in 2017 is likely to have a negative effect on household spending. If this is larger than expected by the government, it could undermine the fiscal plan's long-term growth assumptions.

Furthermore, Japan's primary deficit has narrowed recently, due in part to a cyclical macroeconomic upswing. However, the IMF estimates that the Japanese economy is operating at near-potential. This suggests that the prospects for a further cyclical acceleration in economic growth are limited, and the economy will provide less support to narrowing the primary deficit in future. Judged from a cyclically adjusted basis, Japan's reduction in the primary deficit has been unremarkable relative to other advanced economies.

Japan's Foreign- and Local-Currency Issuer Default Ratings were cut to 'A'/Stable from 'A+'/Rating Watch Negative on 27 April. Japan's main sovereign credit and rating weakness is the high and rising level of government debt.

The government's plan targets achieving a primary deficit of 1% of GDP by 2018 on the way to a balanced budget by 2020, through raising potential growth to above 2%. Notably, beyond previously announced plans to raise the consumption tax by two percentage points to 10% in April 2017, the government is relying almost wholly on economic growth to increase tax revenue.

At the same time, the central government has not set a hard cap on general spending, though it aims to keep annual increases in general spending to JPY1.6trn through to the fiscal year to March 2018. The lack of a hard cap leaves room for fiscal slippage. The government's plans to control expenditure focus on improving efficiencies through technology, innovation, greater use of the private sector in the provision of public services and reforming incentives, which are broadly positive for long-term efficiency, but are not likely to curb expenditure growth materially over the medium term.

The reliance on economic growth for fiscal consolidation comes with risks. The planned consumption tax hike in 2017 is likely to have a negative effect on household spending. If this is larger than expected by the government, it could undermine the fiscal plan's long-term growth assumptions.

Furthermore, Japan's primary deficit has narrowed recently, due in part to a cyclical macroeconomic upswing. However, the IMF estimates that the Japanese economy is operating at near-potential. This suggests that the prospects for a further cyclical acceleration in economic growth are limited, and the economy will provide less support to narrowing the primary deficit in future. Judged from a cyclically adjusted basis, Japan's reduction in the primary deficit has been unremarkable relative to other advanced economies.

Japan's Foreign- and Local-Currency Issuer Default Ratings were cut to 'A'/Stable from 'A+'/Rating Watch Negative on 27 April. Japan's main sovereign credit and rating weakness is the high and rising level of government debt.

06 July 2015, 05:05

FITCH ON JAPAN FISCAL PLAN- THE GOVERNMENT'S EXPECTATIONS OF THEIR EFFECT ON

GROWTH ARE HIGHLY OPTIMISTIC

06 July 2015, 05:04

FITCH ON JAPAN FISCAL PLAN-DOES NOT INCREASE LIKELIHOOD OF JAPAN'S HIGH

PUBLIC DEBT RATIOS TO DECLINE IN A SUSTAINABLE,SUBSTANTIVE MANNER SOON

ooooooooo

ooooooooo

06 July 2015, 04:41

CHINA'S YUAN OPENS TRADE AT 6.2057 PER DOLLAR VS LAST CLOSE AT 6.2057

06 July 2015, 04:39

Taiwan's CPI inflation is expected to inch higher from -0.7% yoy in May to

-0.6% yoy in June, thanks to higher food price inflation. Daily price data

suggested that vegetables, fruits and meat prices all increased over the month.

Hence, food price inflation is expected to have risen further to 1.1% mom in

June from 0.2% mom previously, raising headline inflation by 0.3pp.

That said, a negative base effect from electricity bills and declines in fuel prices will probably offset part of the strength and drag the headline figure down by around 0.2pp. Meanwhile, increases in meat prices and depreciation of the Taiwanese dollar are expected to ease some weakness in the official core CPI inflation.

"We expect the core CPI inflation to have stopped falling and remain unchanged at 0.6% yoy in June",says Societe Generale.

That said, a negative base effect from electricity bills and declines in fuel prices will probably offset part of the strength and drag the headline figure down by around 0.2pp. Meanwhile, increases in meat prices and depreciation of the Taiwanese dollar are expected to ease some weakness in the official core CPI inflation.

"We expect the core CPI inflation to have stopped falling and remain unchanged at 0.6% yoy in June",says Societe Generale.

06 July 2015, 04:30

AUSTRALIA JUNE OVERALL JOB ADS +1.3 PCT MTH/MTH, S/ADJ - ANZ

06 July 2015, 04:30

AUSTRALIA JUN ANZ INTERNET JOB ADS INCREASE TO +1.4 % VS PREV 0.1 %

06 July 2015, 04:27

CHINA'S GROWTH BOARD CHINEXT OPENS UP 6.4 PCT

06 July 2015, 04:26

CHINA'S CSI300 INDEX TO OPEN UP 8.6 PCT AT 4,218.27 POINTS

06 July 2015, 04:25

SHANGHAI COMPOSITE INDEX TO OPEN UP 7.8 PCT AT 3,975.21 POINTS

06 July 2015, 04:22

S.KOREA C.BANK SAYS SELLS 182-DAY MONETARY STABILISATION BONDS AT YIELD OF

1.56 PCT

06 July 2015, 04:20

HK’S HANG SENG INDEX TO OPEN UP 0.1 PCT AT 26,083.99 POINTS

06 July 2015, 04:15

CHINA 7-DAY REPO OPENS AT 2.5500 PCT VERSUS 2.8316 PCT WEIGHTED AVERAGE

PREVIOUS CLOSE

06 July 2015, 04:15

CSI300 INDEX FUTURES FOR JULY DELIVERY OPENS UP 8.5 PCT

06 July 2015, 04:00

TAIWAN STOCKS OPEN DOWN 0.5 PCT AT 9,309.86 POINTS

06 July 2015, 03:54

Notwithstanding the outsized 42k jump in employment in May (equivalent to an

annualised rate of 4.4%), net job creation is expected to have remained positive

in June, albeit only just.

The recent data suggest that the job losses in mining and those sectors associated with mining investment are more than being offset by gains in residential construction, catering services and other parts of the services sector - there is little reason to expect a change in this dynamic in the near future.

With the forecast of 5k new jobs - and ignoring likely revisions - employment growth would have slowed to an 11k average monthly gain over the three months to June, down quite sizably from the average 28k in the three months to March. However, the growth of employment in Q2 of 61k qoq (2.1% annualised rate) would not be far behind the 78k qoq (2.7% saar) of Q1. And in year-on-year terms, growth would have run at 1.8%, just ahead of the 1.7% rate of growth in the population of 15 years and up.

"With labour force growth in line with the demographic trend - i.e. an unchanged participation rate - we expect a 10k rise in unemployment, but this would not be sufficient to raise the rounded unemployment rate from 6.0%",says Societe Generale.

The recent data suggest that the job losses in mining and those sectors associated with mining investment are more than being offset by gains in residential construction, catering services and other parts of the services sector - there is little reason to expect a change in this dynamic in the near future.

With the forecast of 5k new jobs - and ignoring likely revisions - employment growth would have slowed to an 11k average monthly gain over the three months to June, down quite sizably from the average 28k in the three months to March. However, the growth of employment in Q2 of 61k qoq (2.1% annualised rate) would not be far behind the 78k qoq (2.7% saar) of Q1. And in year-on-year terms, growth would have run at 1.8%, just ahead of the 1.7% rate of growth in the population of 15 years and up.

"With labour force growth in line with the demographic trend - i.e. an unchanged participation rate - we expect a 10k rise in unemployment, but this would not be sufficient to raise the rounded unemployment rate from 6.0%",says Societe Generale.

06 July 2015, 03:54

MALAYSIAN RINGGIT FALLS TO ITS WEAKEST SINCE MAY 1999 AT 3.8070 PER DOLLAR

06 July 2015, 03:47

China's CPI is expected to rebound to 1.4% yoy from 1.2% yoy in May. The

biggest contributor should have been faster food inflation. The high-frequency

agriculture prices pointed to a mom increase of 0.5% in food CPI in June,

compared with -0.9% in May.

If that proves to be the case, the yoy rate of food CPI should have ticked up by a full percentage point to 2.7%. In addition, housing inflation likely edged up further amid the strong recovery of housing prices in major cities.

The CPI is on a slow-moving upward trend, partially thanks to base effects. If this is indeed the case, it will limit the scope of further easing for the PBoC. PPI likely remained unchanged at -4.6% yoy in June, implying a mom rate of -0.3% (vs -0.1% in May). In both the Markit and official PMI reports, the input price index deteriorated in June, indicating that there are still immense deflationary pressures on the manufacturing sector.

If that proves to be the case, the yoy rate of food CPI should have ticked up by a full percentage point to 2.7%. In addition, housing inflation likely edged up further amid the strong recovery of housing prices in major cities.

The CPI is on a slow-moving upward trend, partially thanks to base effects. If this is indeed the case, it will limit the scope of further easing for the PBoC. PPI likely remained unchanged at -4.6% yoy in June, implying a mom rate of -0.3% (vs -0.1% in May). In both the Markit and official PMI reports, the input price index deteriorated in June, indicating that there are still immense deflationary pressures on the manufacturing sector.

06 July 2015, 03:41

The CBI and PMI manufacturing surveys have both indicated weakness in April

and May after reasonably strong output growth in March. The official data show a

fall of 0.4% mom in April which we think exaggerates the softening in the

underlying trend.

"We expect a small bounce of 0.1% mom in May",said Societe Generale in a report on Monday.

"We expect a small bounce of 0.1% mom in May",said Societe Generale in a report on Monday.

06 July 2015, 03:40

The Greek referendum appears to have led to a large victory of the 'No' vote.

At 1am CET, with 90% of the vote counted, the 'No' was largely ahead with 61.5%

of votes. A "reject" vote at the referendum marks a first step towards Grexit

and now see 65% chance of Grexit. Avoiding Grexit is possible but will be

difficult. Although French policymakers have signalled their willingness to

reach a deal, there is no indication that the Troika stands ready to offer

Greece a better deal in terms of reform effort, all the more as Greece will need

a much larger bailout package (€60-80bn) than what was previously

discussed.

In the coming weeks, political uncertainty will remain despite the large victory of the 'No'. First, Greek Constitutional Court will have to legitimate the referendum. Secondly, the pro-European President Pavlopoulos might opt to resign this week, triggering new elections, to be held probably in late July or early August.

A full formal exit is unlikely to happen in the next few days or weeks. Both sides will try to resume negotiations in the coming days. Euro area policymakers are expected to make a statement that places the ball in the court of Athens (ie opening the door to a deal but with strict conditionality attached). If this process fails, both sides are expected to coordinate their actions to manage the exit.

It is clear that the ECB has no appetite to front run the political process and as long as discussions are ongoing between the Greek administration and the euro area it is considered unlikely that the ECB would fully cut the ELA and Greek banks' access to ECB liquidity facilities. But a request of resolution of some Greek banks seems likely in the meantime, which would put pressure on policymakers to make a decision.

The following developments are also seen: 1) Given the timelines involved, it seems likely that after missing the June payment on the IMF, Greece will also default on the ECB on 20 July (and probably on 20 August); 2) Capital controls will not go away anytime soon; 3) the Greek government will issue IOUs.

While the baseline scenario is that contagion from Greece will remain modest thanks to better tools (accelerating QE, ESM, OMT), there is a negative risk scenario that could influence policy decisions further afield and notably slow Fed rate hikes.

In the coming weeks, political uncertainty will remain despite the large victory of the 'No'. First, Greek Constitutional Court will have to legitimate the referendum. Secondly, the pro-European President Pavlopoulos might opt to resign this week, triggering new elections, to be held probably in late July or early August.

A full formal exit is unlikely to happen in the next few days or weeks. Both sides will try to resume negotiations in the coming days. Euro area policymakers are expected to make a statement that places the ball in the court of Athens (ie opening the door to a deal but with strict conditionality attached). If this process fails, both sides are expected to coordinate their actions to manage the exit.

It is clear that the ECB has no appetite to front run the political process and as long as discussions are ongoing between the Greek administration and the euro area it is considered unlikely that the ECB would fully cut the ELA and Greek banks' access to ECB liquidity facilities. But a request of resolution of some Greek banks seems likely in the meantime, which would put pressure on policymakers to make a decision.

The following developments are also seen: 1) Given the timelines involved, it seems likely that after missing the June payment on the IMF, Greece will also default on the ECB on 20 July (and probably on 20 August); 2) Capital controls will not go away anytime soon; 3) the Greek government will issue IOUs.

While the baseline scenario is that contagion from Greece will remain modest thanks to better tools (accelerating QE, ESM, OMT), there is a negative risk scenario that could influence policy decisions further afield and notably slow Fed rate hikes.

06 July 2015, 03:32

AUSTRALIA JUNE TD-MI TRIMMED MEAN INFLATION GAUGE +0.1 MO/MO, 1.4 PCT Y/Y

06 July 2015, 03:30

AUSTRALIA JUN TD-MI INFLATION GAUGE DECREASE TO +0.1 % VS PREV 0.3 %

06 July 2015, 03:26

BOJ GOV KURODA: BOJ TO MONITOR MARKETS CLOSELY AFTER GREEK REFERENDUM

06 July 2015, 03:26

BOJ GOV KURODA: BOJ READY TO MAKE NECESSARY POLICY ADJUSTMENTS WITH EYE ON

UPSIDE, DOWNSIDE RISKS TO ECONOMY, PRICES

06 July 2015, 03:25

BOJ GOV KURODA: BOJ WILL MAINTAIN QQE FOR AS LONG AS NEEDED TO ACHIEVE 2 PCT

INFLATION IN STABLE MANNER

06 July 2015, 03:25

BOJ GOV KURODA: JAPAN'S FINANCIAL SYSTEM MAINTAINING STABILITY

06 July 2015, 03:25

BOJ GOV KURODA: ANNUAL CORE CONSUMER INFLATION LIKELY TO HOVER AROUND ZERO

PCT FOR TIME BEING

06 July 2015, 03:25

BOJ GOV KURODA: JAPAN'S ECONOMY LIKELY TO CONTINUE RECOVERING MODERATELY

06 July 2015, 03:25

BOJ GOV KURODA: JAPAN'S ECONOMY CONTINUES TO RECOVER MODERATELY

06 July 2015, 03:15

CORRECTED-U.S. CRUDE FALLS 71 CENTS (NOT MORE THAN $2) TO $54.81/BBL AFTER

GREECE "NO" VOTE

06 July 2015, 03:09

AUSTRALIA'S S&P/ASX 200 INDEX DOWN 1.53 PCT AT 5,453.40 POINTS IN EARLY

TRADE

06 July 2015, 03:07

REFILE-SOUTH KOREAN WON OPENS ONSHORE TRADE AT 1,125.2 PER DOLLAR VS 1,123.0

AT PREVIOUS CLOSE (REMOVES REDUNDANT WORD HOLD)

06 July 2015, 03:00

TOKYO'S NIKKEI SHARE AVERAGE OPENS DOWN 1.65 PCT AT 20,200.15

06 July 2015, 02:58

In May, the German trade surplus is expected to have amounted to €20.4bn,

down from €21.8bn in April. Exports are expected to have decreased by 0.5% mom,

but that reflects more a correction for the three strong previous months, with

the underlying trend still on the rise.

Exports to the US and the UK in particular have been on the rise for some time. Imports are expected to have increased by 0.5% mom, with domestic demand still pushing up imports. Despite tentative signs of improvement in global trade following the weak Q1, there is still considerable uncertainty regarding the strength of global trade.

Exports to the US and the UK in particular have been on the rise for some time. Imports are expected to have increased by 0.5% mom, with domestic demand still pushing up imports. Despite tentative signs of improvement in global trade following the weak Q1, there is still considerable uncertainty regarding the strength of global trade.

06 July 2015, 02:25

U.S. CRUDE FALLS MORE THAN $2 TO AS LOW AS $54.44/BBL AFTER GREECE "NO" VOTE

06 July 2015, 02:23

S.KOREA SENIOR ECONOMY, FINANCIAL POLICYMAKERS IN MEETING AFTER GREECE VOTE -

OFFICIALS

06 July 2015, 02:20

BOJ GOV KURODA: BOJ, GOVT JUST HELD DISCUSSIONS ON RESPONSE TO GREECE THIS

MORNING- STATEMENT

06 July 2015, 02:19

BOJ GOV KURODA: BOJ WILL CONTINUE TO WORK CAREFULLY WITH DOMESTIC, FOREIGN

INSTITUTIONS AND MONITOR MARKETS CLOSELY

06 July 2015, 02:19

BOJ GOV KURODA: ECONOMIC, FINANCIAL RELATIONS BETWEEN JAPAN, GREECE ARE

LIMITED

06 July 2015, 02:19

BOJ GOV KURODA: ECONOMIC, FINANCIAL RELATIONS BETWEEN JAPAN, GREECE ARE

LIMITED

06 July 2015, 02:16

The US manufacturing ISM report released last week suggests that the factory

sector is rebounding from its earlier weakness. The non-manufacturing ISM index

has fared much better all along and is expected to remain at a level consistent

with strong GDP growth.

"We project a 1.2 point increase in June to 56.9 which would reverse about 50% of May's decline and keep the composite well within its recent ranges",says Societe Generale

The outperformance of the service sector can be explained by two factors: minimal sensitivity to the dollar's strength and more limited spillover from the weakness in oil & gas investments. These factors have been weighing on manufacturing activity but should begin to dissipate in the coming months.

Weak consumer demand was also a factor supressing demand for both goods and services in Q1, but this is now reversing. The 56.9 forecast for the non-manufacturing ISM would put the composite of the two surveys at 56.5. This is consistent with GDP growth of 3.5%, close to the 3.3% forecast for second quarter growth.

"We project a 1.2 point increase in June to 56.9 which would reverse about 50% of May's decline and keep the composite well within its recent ranges",says Societe Generale

The outperformance of the service sector can be explained by two factors: minimal sensitivity to the dollar's strength and more limited spillover from the weakness in oil & gas investments. These factors have been weighing on manufacturing activity but should begin to dissipate in the coming months.

Weak consumer demand was also a factor supressing demand for both goods and services in Q1, but this is now reversing. The 56.9 forecast for the non-manufacturing ISM would put the composite of the two surveys at 56.5. This is consistent with GDP growth of 3.5%, close to the 3.3% forecast for second quarter growth.

06 July 2015, 02:19

BOJ GOV KURODA: ECONOMIC, FINANCIAL RELATIONS BETWEEN JAPAN, GREECE ARE

LIMITED

06 July 2015, 02:14

JAPAN FINMIN ASO: JAPAN GOVT, BOJ WILL CONTINUE TO WORK CLOSELY TO MONITOR

MARKET DEVELOPMENTS

06 July 2015, 02:13

JAPAN FINMIN ASO: JAPAN GOVT, BOJ REMAIN FULLY PREPARED TO RESPOND TO

POSSIBLE DEVELOPMENTS IN GREECE - STATEMENT

06 July 2015, 02:13

JAPAN FINMIN ASO: DIRECT ECONOMIC AND FINANCIAL LINKAGES BETWEEN JAPAN AND

GREECE ARE LIMITED

06 July 2015, 02:12

JAPAN FINMIN ASO: EURO AREA COUNTRIES NOW WAITING FOR GREEK AUTHORITIES TO

REACT, CALL ON GREECE TO REACT RESPONSIBLY -STATEMENT

06 July 2015, 02:12

JAPAN FINMIN ASO: JAPANESE GOVT HAS BEEN IN CLOSE CONTACT WITH FOREIGN

AUTHORITIES THROUGH WEEKEND ABOUT GREECE

06 July 2015, 02:12

JAPAN FINMIN ASO: EURO AREA FINANCE MINISTERS AND CENTRAL BANKS WILL MAKE

FULL USE OF INSTRUMENTS AVAILABLE TO SAFEGUARD STABILITY OF EURO ZONE -

STATEMENT

06 July 2015, 01:55

BOJ: banks' reserve balance at 171.1 trln at end of day

06 July 2015, 01:55

BOJ: Current account balance at 226.5 trln at end of day

06 July 2015, 01:31

VIENNA - IRAN'S FOREIGN MINISTER ZARIF SAYS SOME DIFFERENCES STILL REMAIN IN

NUCLEAR TALKS WITH MAJOR POWERS

06 July 2015, 01:30

JAPAN GOVERNMENT, BOJ OFFICIALS TO MEET SHORTLY ON GREEK REFERENDUM -

OFFICIAL

06 July 2015, 01:17

JAPAN OFFICIAL SAYS GOVERNMENT READY TO RESPOND AS APPROPRIATE, INCLUDING IN

MARKETS, AFTER GREEK VOTE

06 July 2015, 01:16

JAPAN GOVERNMENT OFFICIAL SAYS IN CLOSE COMMUNICATION WITH OTHER GOVERNMENTS

ON GREEK REFERENDUM, MARKET REACTION

06 July 2015, 01:12

The official projections are out; with 70% of votes counted, the 'no' vote

looks to have achieved a comfortable majority (>60%).

The Greek authorities have indicated a desire to re-start negotiations on a third programme as soon as possible. However, the efficacy of these discussions will depend crucially on the negotiating line taken after the referendum.

"We see a risk that the government will overestimate its bargaining power on the back of the strong 'no' outcome",says RBC Capital Markets.

Much will also depend on the immediate reaction from European leaders and the ECB. The latter is particularly one to watch, though the Governing Council will want to take stock of the political negotiations before taking any decision on emergency liquidity assistance for the Greek banking sector.

In a normal referendum the next steps would be binary--something happens or it doesn't. But this is no ordinary referendum. The government and creditors will have to start negotiations on a third programme (since the second one expired on Tuesday). Both sides indicated they were willing to do so even in the event of a 'no'.

The Greek authorities have indicated a desire to re-start negotiations on a third programme as soon as possible. However, the efficacy of these discussions will depend crucially on the negotiating line taken after the referendum.

"We see a risk that the government will overestimate its bargaining power on the back of the strong 'no' outcome",says RBC Capital Markets.

Much will also depend on the immediate reaction from European leaders and the ECB. The latter is particularly one to watch, though the Governing Council will want to take stock of the political negotiations before taking any decision on emergency liquidity assistance for the Greek banking sector.

In a normal referendum the next steps would be binary--something happens or it doesn't. But this is no ordinary referendum. The government and creditors will have to start negotiations on a third programme (since the second one expired on Tuesday). Both sides indicated they were willing to do so even in the event of a 'no'.

06 July 2015, 01:02

U.S. STOCK INDEX FUTURES OPEN 1.5 PCT LOWER AFTER GREEKS OVERWHELMINGLY VOTE

'NO' IN REFERENDUM

06 July 2015, 01:01

Greek voting stations close at 18h00 CET with the first exit poll expected

shortly after. If the knife-edge vote indicated by the most recent opinion polls

hold true, it will be the early hours of Monday before the actual result is

known.

Societe Generale notes:

We spent much of last week analysing what, respectively, a yes and no vote would entail. As we await the referendum outcome, we consider what it will not change.

First, in Greece - Yes or No - it will take time to gain clarity on the situation. Second, much political damage has already been done in the euro area; and more could be done. Third (and perhaps first in order of importance), the euro area needs urgently to accelerate structural reform; both the national and European level.

While our baseline scenario is that contagion from Greece will remain modest thanks to better tools, there is a negative risk scenario that could influence policy decisions further afield and notably slow Fed rate hikes.

On our list of points that the referendum will not change, however, is the efforts by Chinese authorities to stem the decline in its equity markets. New measures announced by the Chinese authorities (IPO suspension and a new stabilisation fund) will be put to the test next week, whatever the Greeks vote.

Societe Generale notes:

We spent much of last week analysing what, respectively, a yes and no vote would entail. As we await the referendum outcome, we consider what it will not change.

First, in Greece - Yes or No - it will take time to gain clarity on the situation. Second, much political damage has already been done in the euro area; and more could be done. Third (and perhaps first in order of importance), the euro area needs urgently to accelerate structural reform; both the national and European level.

While our baseline scenario is that contagion from Greece will remain modest thanks to better tools, there is a negative risk scenario that could influence policy decisions further afield and notably slow Fed rate hikes.

On our list of points that the referendum will not change, however, is the efforts by Chinese authorities to stem the decline in its equity markets. New measures announced by the Chinese authorities (IPO suspension and a new stabilisation fund) will be put to the test next week, whatever the Greeks vote.

06 July 2015, 01:00

NZ's NZX 50 OPENS AT 5840.890 POINTS, DOWN 0.010 PCT

06 July 2015, 01:00

NZ's NZX 50 OPENS AT 5840.890 POINTS, DOWN 0.010 PCT

06 July 2015, 00:55

DIJSSELBLOEM SAYS DIFFICULT MEASURES AND REFORMS INEVITABLE FOR RECOVERY OF

GREEK ECONOMY

06 July 2015, 00:55

DIJSSELBLOEM SAYS RESULT OF GREEK REFERENDUM IS VERY REGRETTABLE FOR THE

FUTURE OF GREECE

06 July 2015, 00:38

EUROGROUP TO MEET ON TUESDAY TO PREPARE EURO SUMMIT ON GREECE -

DIJSSELBLOEM'S SPOKESMAN

06 July 2015, 00:29

Westpac Research notes:

Australian 3yr government bond (futures) yields fell from 2.10% to 2.07%, while the 10yr yield fell from 3.12% to 3.04%.

Australian 3yr government bond (futures) yields fell from 2.10% to 2.07%, while the 10yr yield fell from 3.12% to 3.04%.

05 July 2015, 23:37

GREEK PM TSIPRAS SAYS DEBT ISSUE WILL NOW BE ON NEGOTIATING TABLE

05 July 2015, 23:37

GREEK PM TSIPRAS SAYS WE ARE READY TO CONTINUE NEGOTIATING WITH A PLAN OF

REFORMS

05 July 2015, 23:37

GREEK DEPUTY FINMIN SAYS GOVERNMENT IS NOT CONSIDERING CHANGE IN CURRENCY

05 July 2015, 23:36

GREEK PM TSIPRAS SAYS GREECE WILL GO TO NEGOTIATING TABLE TOMORROW WITH GOAL

OF RESTORING BANKING SYSTEM

05 July 2015, 23:36

GREEK DEPUTY FINMIN SAYS REFERENDUM RESULT SENDS A MESSAGE SAYING YES TO

EUROPE, YES TO THE EURO, BUT NO TO LENDERS' BAILOUT PROPOSAL

05 July 2015, 23:36

GREEK PM TSIPRAS SAYS GREEK PEOPLE DID NOT ANSWER IN OR OUT OF EUROPE, THAT

QUESTION MUST BE OFF TABLE COMPLETELY

05 July 2015, 23:35

GREEK PM TSIPRAS SAYS THERE ARE NO EASY SOLUTIONS BUT FAIR SOLUTIONS PROVIDED

BOTH SIDES WANT IT

05 July 2015, 23:35

GREEK PM TSIPRAS SAYS THE MANDATE IS TO REACH A VIABLE SOLUTION, I WILL SERVE

THIS MANDATE WITHOUT WASTING TIME

05 July 2015, 23:35

GREEK PM TSIPRAS SAYS GREEKS MADE A BRAVE CHOICE, I'M CONVINCED THAT THE

MANDATE IS NOT TO CLASH WITH EUROPE

05 July 2015, 23:34

GREEK PM TSIPRAS SAYS WE PROVED THAT DEMOCRACY CANNOT BE BLACMAILED

05 July 2015, 23:33

GREEK PM TSIPRAS SAYS TODAY WE TURNED A PAGE IN GREEK HISTORY

05 July 2015, 23:30

Greek developments are likely to overwhelm data this week as noted in detail

above. German factory orders (Monday) and IP (Tuesday) are likely to decline

0.5% m/m (consensus: -0.4%) and increase 0.3% m/m (consensus: 0.1%),

respectively. France and Italy IP (Friday) should both increase 0.3% m/m

(consensus: 0.4% and 0.3%, respectively).