NEWS

02 July 2015, 10:53

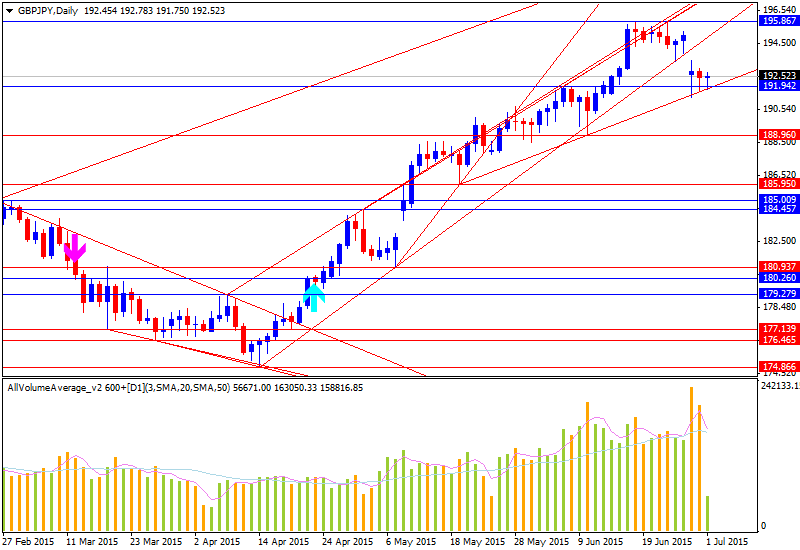

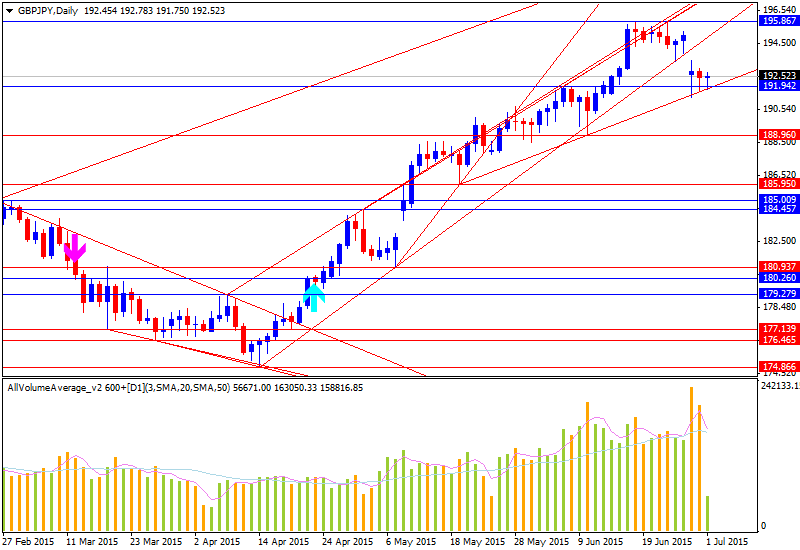

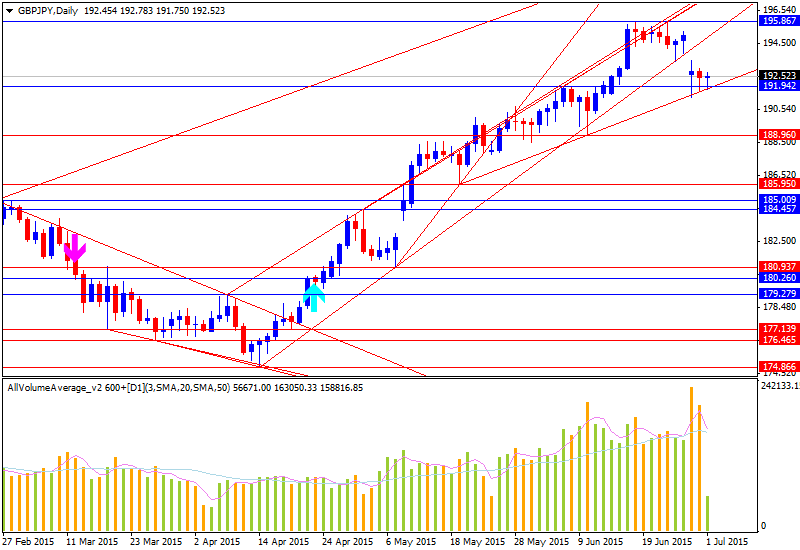

SCOTIABANK: GBP IS EXPECTED TO FADE ITS BOE-DRIVEN RALLY, SOFTENING INTO

YEAR-END ON THE BACK OF RELATIVE POLICY

02 July 2015, 10:52

SCOTIABANK: WE ANTICIPATE MILD DEPRECIATION IN BOTH CAD AND MXN ON THE BACK

OF INTEREST RATE DIFFERENTIALS, MITIGATED SOMEWHAT BY THE POSITIVE IMPACT OF AN

ACCELERATING PACE OF GROWTH IN THE

2 July 2015, 10:49

A poll showed more Greeks are leaning to accept deeper cuts - against the

government’s call to vote against creditors’ terms for more aid.

“Come Monday, the Greek government will be at the negotiating table after the referendum, with better terms for the Greek people,” Tsipras said in a Twitter message posted as he spoke on national television. “A popular verdict is much stronger than the will of a government.”

If it means staying in the European Union, the majority of the country's citizens may be willing to vote against the very government they elected five months ago to take a stand against austerity.

A GPO survey cited by euro2day.gr said 47 percent of people are inclined toward a “yes” vote, with those in the “no” territory not far behind with 43 percent.

On Tuesday GPO interviewed 1,000 adults, four days after Tsipras’s call for referendum. There is a margin of error of 3.1 percentage points.

Greek Prime Minister announced a bank holiday over the weekend, and the lenders are to remain shut possibly until after the referendum.

The European Central Bank blocked their liquidity lifeline, and on Wednesday decided to keep the emergency funding at the same level.

The queue of pensioners in Athens at the few banks that are still open these days underscored the country’s plight, says Bloomberg.

At 7 a.m., a few dozen pensioners were outside a central branch of the National Bank of Greece. They were to withdraw a maximum of 120 euros ($133), compared with the average monthly payment of about 600 euros. Many received nothing after being told only those with last names from letters A to K would get paid.

“Come Monday, the Greek government will be at the negotiating table after the referendum, with better terms for the Greek people,” Tsipras said in a Twitter message posted as he spoke on national television. “A popular verdict is much stronger than the will of a government.”

If it means staying in the European Union, the majority of the country's citizens may be willing to vote against the very government they elected five months ago to take a stand against austerity.

A GPO survey cited by euro2day.gr said 47 percent of people are inclined toward a “yes” vote, with those in the “no” territory not far behind with 43 percent.

On Tuesday GPO interviewed 1,000 adults, four days after Tsipras’s call for referendum. There is a margin of error of 3.1 percentage points.

Greek Prime Minister announced a bank holiday over the weekend, and the lenders are to remain shut possibly until after the referendum.

The European Central Bank blocked their liquidity lifeline, and on Wednesday decided to keep the emergency funding at the same level.

The queue of pensioners in Athens at the few banks that are still open these days underscored the country’s plight, says Bloomberg.

At 7 a.m., a few dozen pensioners were outside a central branch of the National Bank of Greece. They were to withdraw a maximum of 120 euros ($133), compared with the average monthly payment of about 600 euros. Many received nothing after being told only those with last names from letters A to K would get paid.

02 July 2015, 10:49

DOLLAR HITS 3-WEEK HIGH OF 96.396 VS BASKET OF MAJOR CURRENCIES

02 July 2015, 10:48

RABO BANK: THE LIKELY DOWNWARD REVISION OF CANADA’S GDP GROWTH IN JULY, WOULD

LEAD TO A 25BPS RATE CUT, WHICH IS EXPECTED TO BE MADE IN Q3, MOSTLY IN JULY

02 July 2015, 10:48

Source: Thomson Reuters

- 1mth vs 3mth atm traded 0.125 for 1mth on AUD 850mln vanilla in

Asia

- Spread wider now - 1mth atm trades early London 11.65 and 3mth

11.35

- 1mth up from 10.7 (low since March) last week to a 12.7 peak

Monday

- Note 1mth expiry now captures 04 Aug RBA. Next RBA is Tuesday

- 3mth traded 11.0-11.5 between Thurs-Mon. 1yr 11.15-11.5 and now 11.225

02 July 2015, 10:41

Riksbank is facing a dilemma ahead of today's meeting. The recent inflation

data was not bad really, which would suggest leaving its monetary policy

unchanged. On the other hand the Swedish central bankers will have to ask

themselves whether sufficient autonomous inflation momentum may have been

created so that further support from an expansionary monetary policy is no

longer required.

If the support ends too quickly inflation might collapse again. All previous efforts would have been in vain and Riksbank would once again be exposed to the criticism of sado-monetarism by left-leaning US economists.

In similar situations many central banks decide in favour of a possibly excessively expansionary monetary policy, as deflation seems to be more difficult to fight than inflation. However, amongst Riksbank members this approach is unlikely to be uncontroversial.

There is still widespread fear of a bubble on the property market. "Erring on the inflationary side" which the Fed can no doubt afford seems too risky to Riksbank, says Commerzbank.

If the support ends too quickly inflation might collapse again. All previous efforts would have been in vain and Riksbank would once again be exposed to the criticism of sado-monetarism by left-leaning US economists.

In similar situations many central banks decide in favour of a possibly excessively expansionary monetary policy, as deflation seems to be more difficult to fight than inflation. However, amongst Riksbank members this approach is unlikely to be uncontroversial.

There is still widespread fear of a bubble on the property market. "Erring on the inflationary side" which the Fed can no doubt afford seems too risky to Riksbank, says Commerzbank.

02 July 2015, 10:38

SWEDISH CROWN EXTENDS LOSSES TO FALL 1 PCT ON DAY VS EURO TO 9.3700

02 July 2015, 10:35

SWEDISH C.BANK SAYS PREPARED TO INTERVENE ON FOREIGN EXCHANGE MARKET IF

UPTURN IN INFLATION IS THREATENED

02 July 2015, 10:35

SWEDISH C.BANK SAYS STILL HAS A HIGH LEVEL OF PREPAREDNESS TO MAKE MONETARY

POLICY EVEN MORE EXPANSIONARY IF NECESSARY

02 July 2015, 10:34

SWEDISH C.BANK SAYS REPO RATE IS EXPECTED TO BE AROUND -0.35 PER CENT FOR

JUST OVER A YEAR

02 July 2015, 10:34

SWEDISH CROWN HITS 3-WEEK LOW OF 9.3500 CROWNS VS EURO AFTER RIKSBANK CUTS

RATES

02 July 2015, 10:33

INDIA CBANK CHIEF RAJAN SAYS DON'T THINK WE CHANGE FOREIGN INVESTOR CAP BASED

ON INTEREST IN GOVT BOND MARKET

02 July 2015, 10:33

SWEDISH C.BANK SAYS OHLSSON CONSIDERED THAT REPO RATE AND REPO-RATE PATH

SHOULD BE HELD UNCHANGED

02 July 2015, 10:33

After this week's disappointing Canada's GDP data for April, it will be very

difficult for GDP growth in Q2 to meet the projections that the Bank of Canada

made in April. The same is true for Q1.

This means that the insurance taken out in January (a 25 bps rate cut) to cushion the negative impact of low oil prices on the Canadian economy may no longer be sufficient. The Canadian economy has shown negative GDP growth in each of the first four months of the year. On July 15, the Bank of Canada will update its projections and a downward revision for GDP growth seems likely, says Rabo bank.

This would set the stage for a 25bps rate cut. This cut is expected to be made in Q3, most likely in July. After this cut, the Bank is expected to remain on hold, added Rabo bank.

This means that the insurance taken out in January (a 25 bps rate cut) to cushion the negative impact of low oil prices on the Canadian economy may no longer be sufficient. The Canadian economy has shown negative GDP growth in each of the first four months of the year. On July 15, the Bank of Canada will update its projections and a downward revision for GDP growth seems likely, says Rabo bank.

This would set the stage for a 25bps rate cut. This cut is expected to be made in Q3, most likely in July. After this cut, the Bank is expected to remain on hold, added Rabo bank.

02 July 2015, 10:33

SWEDISH C.BANK SAYS DEPUTY GOVERNOR HENRY OHLSSON ENTERED A RESERVATION

AGAINST DECISION TO CUT REPO RATE

02 July 2015, 10:32

SWEDISH C.BANK SAYS DEVELOPMENT OF EXCHANGE RATE REMAINS A RISK TO UPTURN IN

INFLATION

02 July 2015, 10:31

SWEDISH C.BANK SAYS UNCERTAINTY ABROAD HAS INCREASED AND IT IS DIFFICULT TO

ASSESS CONSEQUENCES OF SITUATION IN GREECE

02 July 2015, 10:31

SWEDISH C.BANK CUTS KEY REPO RATE TO -0.35 PCT VS FORECAST REPO RATE ON HOLD

AT -0.25 PCT IN REUTERS POLL

02 July 2015, 10:31

SWEDISH CROWN FALLS VS EURO AFTER RIKSBANK DECISION

02 July 2015, 10:31

Though fundamentals such as monetary policy expectations are shifting in

favor of pound, pound in the short term likely to remain short.

Better than expected first quarter GDP figure (growing 2.9% y/y) failed to boost pound.

Furthermore pound has cleared key support against dollar around (1.565 area) after June PMI (51.5) surprised to downside.

Trade recommendation -

- First call was provided to go short on pound around 1.576 with stop loss around 1.582 and 1.595 area targeting 1.548 and 1.532 area. Pound is currently trading at 1.558.

Better than expected first quarter GDP figure (growing 2.9% y/y) failed to boost pound.

Furthermore pound has cleared key support against dollar around (1.565 area) after June PMI (51.5) surprised to downside.

Trade recommendation -

- One might still go short on the above trade with mention stop loss area,

however it is better to wait for the construction PMI at 8:30 GMT, since it

might provide better entry for sell. However one should remain cautious as US

NFP report is likely to add heavy volatility to dollar

leg.

- It would be better to short around 1.564-1.566 area to go short on pound. For those who are looking to play safe, might even wait for the pay roll report to pass and reconsider the trade.

- Housing and real estate sector is of immense importance to UK. So construction PMI is naturally a key figure that would be close watched by economists and market participants.

- In June UK house prices dropped by -0.2%.

- In April, construction PMI was at 55.9. Today median expectation is at 56.5 for May.

02 July 2015, 10:30

SWEDISH CENTRAL BANK - REPO RATE CUT TO -0.35 PER CENT AND PURCHASES OF

GOVERNMENT BONDS EXTENDED BY SEK 45 BILLIONS

02 July 2015, 10:30

SWEDISH HOUSE PRICES +2.0 PCT IN APR-JUN VS JAN-MAR - STATS OFFICE

02 July 2015, 10:25

INDIA CBANK CHIEF RAJAN SAYS GOVT IN DISCUSSION WITH US, THINKING OF

CAPITALISING BANKS AND THAT WILL HELP AS BUFFER

02 July 2015, 10:20

INDIA CBANK CHIEF RAJAN SAYS DIRECT EXPOSURE TO GREECE "VERY VERY" LIMITED

FOR INDIA

02 July 2015, 10:19

The pound slid lower against dollar yesterday as expected after UK

manufacturing activity data showed that it's expanded at the slowest rate in

last 2 years in June, while Greek debt issues continued to hold up demand for

the safe-haven greenback.

Today now its construction PMI's turn, it is expected to rise the surprising May election result saw a housing-friendly conservative administration come to power. This is likely to lead to a post-election increase in housing construction, which should push up the June PMI from 55.9 to 56.5.

It is a quiet day for data releases with the UK construction PMI for June the next most notable. The revisions to UK GDP published earlier this week, which were partially driven by changes to construction estimates, showed that while this sector is relatively small it can have an outsize impact on GDP.

However, it should be observed that the correlation between the PMI and the official construction output series is not always very high. We forecast a PMI rise for June.

GBP/USD hit 1.5676 during European morning trade, the pair's lowest since June 29; the pair subsequently consolidated at 1.5677, shedding 0.21%.

Today now its construction PMI's turn, it is expected to rise the surprising May election result saw a housing-friendly conservative administration come to power. This is likely to lead to a post-election increase in housing construction, which should push up the June PMI from 55.9 to 56.5.

It is a quiet day for data releases with the UK construction PMI for June the next most notable. The revisions to UK GDP published earlier this week, which were partially driven by changes to construction estimates, showed that while this sector is relatively small it can have an outsize impact on GDP.

However, it should be observed that the correlation between the PMI and the official construction output series is not always very high. We forecast a PMI rise for June.

GBP/USD hit 1.5676 during European morning trade, the pair's lowest since June 29; the pair subsequently consolidated at 1.5677, shedding 0.21%.

02 July 2015, 10:16

TURKISH ECONOMY MINISTER ZEYBEKCI SAYS DOMESTIC DEMAND TO BE KEY IN 2015

GROWTH

2 July 2015, 10:11

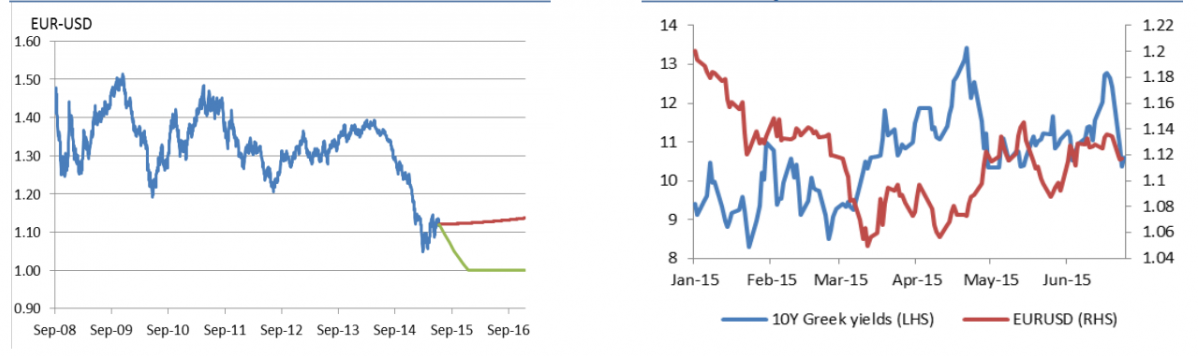

FED, ECB, Greece:

"The Greek Referendum will drive headlines for the near-term. We believe that divergence of monetary policies is a more powerful EUR driver than Greek risks. In this context, the timing of the first Fed rate hike (September is our call) and the ECB’s tone (the market misread the ECB’s message to get used to volatility) are more important for the euro than Greek headlines. Whilst Greek headlines and deadlines are clearly urgent, and the market implications in our view both important and not priced in the short-run, ultimately the evolution of monetary policy is in our mind more important," BofA argues.

"We remain bearish EUR/USD, but the uncertainty around the Fed is not bolstering our conviction levels. The euro’s reaction to Greek headlines has been puzzling, sometimes weakening in response to positive headlines for a deal. In part, this is because the USD is oversold. It can also be that the market does not believe that a deal will fully address Grexit risks, which in turn suggests that the ECB is likely to keep QE to be able to address periphery risks and push against a rates sell-off. This could explain the negative correlation between European equities and the Euro recently. Our view remains that tail risks in Greece are negative for the Euro," BofA adds.

Forecasts:

Forecasts:

"We have marked-to market our Q3 EUR/USD projection, but keep our end-year projection to 1.00. This assumes that US data will improve in H2, the Fed will start hiking rates in September, the ECB will push against the recent sell-off in rates, inflation will remain below the ECB’s target path, and the market will start expecting the ECB to continue with QE after September 2016," BofA projects.

"At the same time, we expect the Fed to push against any strengthening of the USD that goes beyond what data would justify. We do not expect Grexit in our baseline, but believe that Greek risks will continue weighing on the Euro, with Grexit risks increasing as long as Greece remains in a grey zone," BofA adds.

"The Greek Referendum will drive headlines for the near-term. We believe that divergence of monetary policies is a more powerful EUR driver than Greek risks. In this context, the timing of the first Fed rate hike (September is our call) and the ECB’s tone (the market misread the ECB’s message to get used to volatility) are more important for the euro than Greek headlines. Whilst Greek headlines and deadlines are clearly urgent, and the market implications in our view both important and not priced in the short-run, ultimately the evolution of monetary policy is in our mind more important," BofA argues.

"We remain bearish EUR/USD, but the uncertainty around the Fed is not bolstering our conviction levels. The euro’s reaction to Greek headlines has been puzzling, sometimes weakening in response to positive headlines for a deal. In part, this is because the USD is oversold. It can also be that the market does not believe that a deal will fully address Grexit risks, which in turn suggests that the ECB is likely to keep QE to be able to address periphery risks and push against a rates sell-off. This could explain the negative correlation between European equities and the Euro recently. Our view remains that tail risks in Greece are negative for the Euro," BofA adds.

"We have marked-to market our Q3 EUR/USD projection, but keep our end-year projection to 1.00. This assumes that US data will improve in H2, the Fed will start hiking rates in September, the ECB will push against the recent sell-off in rates, inflation will remain below the ECB’s target path, and the market will start expecting the ECB to continue with QE after September 2016," BofA projects.

"At the same time, we expect the Fed to push against any strengthening of the USD that goes beyond what data would justify. We do not expect Grexit in our baseline, but believe that Greek risks will continue weighing on the Euro, with Grexit risks increasing as long as Greece remains in a grey zone," BofA adds.

02 July 2015, 10:11

ECB SAYS 86 MLN EUROS BORROWED USING OVERNIGHT LOAN FACILITY, 105.631 BLN

EUROS DEPOSITED

02 July 2015, 10:08

Following the strong data yesterday (ADP and ISM) the ICE dollar index broke

the 96 mark with ease. The appetite for USD longs is limited today as the

official US labour market report is due for publication today. The FX market is

more interested in the official report than in the ADP when considering the US

labour market.

US data is being discussed more intensively than volatility and the susceptibility to revisions would actually require. Economists call this "sunspot equilibrium".

The information content of the official labour market report is no doubt higher regarding the situation on the labour market than any sunspot counts. But the term describes the phenomenon well.

The market might just as well agree on random indicators. Even if everyone was to realise that they are pointless it would not make sense for the individual market participant to deviate from market habits.

US economists are similarly optimistic for the US labour market report as they had been for yesterday's ADP. If they are correct again, the US currency is likely to find further support.

"Today's data is unlikely to provide a long term USD positive effect. It is likely to constitute another sunspot, although one that attracts a lot of attention", states Commerzbank.

US data is being discussed more intensively than volatility and the susceptibility to revisions would actually require. Economists call this "sunspot equilibrium".

The information content of the official labour market report is no doubt higher regarding the situation on the labour market than any sunspot counts. But the term describes the phenomenon well.

The market might just as well agree on random indicators. Even if everyone was to realise that they are pointless it would not make sense for the individual market participant to deviate from market habits.

US economists are similarly optimistic for the US labour market report as they had been for yesterday's ADP. If they are correct again, the US currency is likely to find further support.

"Today's data is unlikely to provide a long term USD positive effect. It is likely to constitute another sunspot, although one that attracts a lot of attention", states Commerzbank.

02 July 2015, 10:04

CHINA'S CSI300 INDEX CLOSES DOWN 3.4 PCT AT 4,108.00 POINTS

02 July 2015, 10:04

CHINA SHANGHAI COMPOSITE INDEX CLOSES BELOW 4000 FOR FIRST TIME SINCE EARLY

APRIL

02 July 2015, 10:03

GERMANY'S DAX UP 0.1 PCT

02 July 2015, 10:01

SPAIN'S IBEX UP 0.2 PCT

02 July 2015, 10:01

SHANGHAI COMPOSITE INDEX CLOSES DOWN 3.5 PCT AT 3,912.77 POINTS

02 July 2015, 10:01

ITALY’S FTSE MIB FLAT AT 22,961.14 POINTS IN EARLY DEALS

02 July 2015, 10:01

BRITAIN'S FTSE 100 FLAT, FRANCE'S CAC 40 UP 0.3 PCT

02 July 2015, 10:01

SWISS SMI OPENS UP 0.30% AT 8935.50 POINTS

02 July 2015, 10:00

EUROPE'S FTSEUROFIRST 300 UP 0.1 PCT TO 1,535.07 POINTS IN EARLY DEALS

02 July 2015, 10:00

SPAIN JUNE JOBLESS FALLS 2.25 PCT M/M, BY 94,727 PEOPLE, HITS 4.12 MLN PEOPLE

- LABOUR MINISTRY

02 July 2015, 10:00

ROMANIAN PPI -2.4 PCT Y/Y IN MAY VS -2.8 PCT Y/Y IN APRIL; +0.2 PCT M/M-STATS

BOARD

02 July 2015, 09:54

The Mexican peso outperformed most regional currencies yesterday but still

ended the day losing ground vs. the USD (around 0.3%) closing at USD-MXN 15.78.

Banxico (Central Bank of Mexico) announced yesterday via a press release that

the rate-setting meeting schedule for the second half of the year has been

modified. The new schedule has been designed to incorporate all information

available up to that point with respect to a potential US Fed

action.

The fact that now Banxico will be making its own decisions right after the US Fed has met suggests that Mexico is fine tuning its strategy (and timing) to follow an eventual rate hike in the US. In essence this is not news as Banxico has been explicitly linking its domestic monetary conditions to those of the US, but it affirms Banxico's intentions of designing a reaction function and fine tuning the timing around it.

Before the new calendar was released, analysts thought that if the US Fed made a move in its September meeting, then Banxico would equalize its monetary stance in its next meeting (October), but given the new schedule, it may react as soon as September 21.

"Banxico seeks to minimize any disruption in financial markets by unnecessarily delaying a rate hike because of schedule rigidities, with this measure effectively helping to prevent such action. This should be good news for the MXN as there would not be long lasting gaps in US-Mexico interest rate differentials", states Commerzbank.

The fact that now Banxico will be making its own decisions right after the US Fed has met suggests that Mexico is fine tuning its strategy (and timing) to follow an eventual rate hike in the US. In essence this is not news as Banxico has been explicitly linking its domestic monetary conditions to those of the US, but it affirms Banxico's intentions of designing a reaction function and fine tuning the timing around it.

Before the new calendar was released, analysts thought that if the US Fed made a move in its September meeting, then Banxico would equalize its monetary stance in its next meeting (October), but given the new schedule, it may react as soon as September 21.

"Banxico seeks to minimize any disruption in financial markets by unnecessarily delaying a rate hike because of schedule rigidities, with this measure effectively helping to prevent such action. This should be good news for the MXN as there would not be long lasting gaps in US-Mexico interest rate differentials", states Commerzbank.

02 July 2015, 09:50

Not many economic dockets scheduled for today, however risk associated is

high. Focus is on NFP data from US.

Data released so far -

Data released so far -

- Australia - Trade balance improved in May to -$2.75 billion as imports dropped -4% and exports grew +1%.

- New Zealand - ANZ commodity price index dropped -3.1%.

- UK - Nationwide house prices dropped by -0.2% in June on monthly basis but up 3.3% from a year ago.

- Spain - Unemployment change to be released at 7:00 GMT. Prior -118,000, expected today -124,000.

- Euro zone - Producer price index to be released at 9:00 GMT. ECB

will release monetary policy minutes at 11:30 GMT.

- UK - Construction PMI to be released at 8:30 GMT.

- US - Data of the month is scheduled today. NFP report is scheduled at 12:30 GMT. Expected headline number is 230,000. It will be followed by ISM New York at 13:45 GMT and Factory orders at 14:00 GMT. EIA will release weekly natural gas report at 14:30 GMT.

- Australia - AIG performance of services index to be released at 23:30 GMT.

02 July 2015, 09:48

Turkish Exporters Assembly own sample suggests that Turkish exports declined

again by 6.4% y/y in June, but recovered from the -19% y/y of May, which had

been triggered by auto sector strikes.

The June data from the sample continued to show weak exports to the EU - down 5%-6% in June (vs. -21% y/y in May) - and also weak exports to Russia (down more than 30% y/y), notes Commerzbank. While the June data did confirm the anticipated rebound from auto sector strikes in May, the data are still negative for TRY, at the margin, as it highlights an extended soft-patch for Turkish exports, even while CE3 exports have been recovering in recent months.

The June data from the sample continued to show weak exports to the EU - down 5%-6% in June (vs. -21% y/y in May) - and also weak exports to Russia (down more than 30% y/y), notes Commerzbank. While the June data did confirm the anticipated rebound from auto sector strikes in May, the data are still negative for TRY, at the margin, as it highlights an extended soft-patch for Turkish exports, even while CE3 exports have been recovering in recent months.

02 July 2015, 09:46

- EUR/CAD recovered from the low of 1.3808 yesterday on account of weak crude

oil prices.

- Oil price hit two month low yesterday on US inventory data. US stockpiles

rose last week for the first time in nine weeks, according to report from

EIA.

- Technically it is facing resistance around 1.3940 and any break of would

extend gains till 1.4025/1.40533.

- On the downside weakness only below 1.3865 and break of will target 1.3800 level.

02 July 2015, 09:40

A second important macro driver in H2 should be US monetary policy, the FOMC

is expected to start the lift-off in rates, most likely in September. A Fed

tightening cycle should not be especially menacing for global financial

markets.

A first hike has been well telegraphed by the FOMC, as has the message that the rate cycle will likely be gradual. Still, it is a little hard to predict exactly how financial markets will react to a first Fed hike, and a few reasons are seen by Barclays, not to be too complacent.

First, as has been the case for some time, financial market pricing remains below the Fed's own forecast for the path of rates, though the gap has closed substantially since the end of 2014 (mainly from lower FOMC "dots"). Second, if lift-off does occur, it would be the first time in eleven years.

As a recent Wall Street Journal story highlighted, some two-thirds of current traders were not around at the start of the last Fed lift-off. Third, judging from our Global Macro Survey, the "benign" Fed scenario is already well priced: the survey shows that a small majority expects a rate hike in September, but few see Fed policy withdrawal as a major market risk.

A first hike has been well telegraphed by the FOMC, as has the message that the rate cycle will likely be gradual. Still, it is a little hard to predict exactly how financial markets will react to a first Fed hike, and a few reasons are seen by Barclays, not to be too complacent.

First, as has been the case for some time, financial market pricing remains below the Fed's own forecast for the path of rates, though the gap has closed substantially since the end of 2014 (mainly from lower FOMC "dots"). Second, if lift-off does occur, it would be the first time in eleven years.

As a recent Wall Street Journal story highlighted, some two-thirds of current traders were not around at the start of the last Fed lift-off. Third, judging from our Global Macro Survey, the "benign" Fed scenario is already well priced: the survey shows that a small majority expects a rate hike in September, but few see Fed policy withdrawal as a major market risk.

2 July 2015, 09:32

Gold prices were weaker in Asia on Thursday after finishing lower in the U.S.

session, as risk appetite among investors and traders was higher these days,

which is bullish for the stock markets but bearish for safe-haven gold.

The US dollar index was buoyed by positive U.S. data, as well as Greek jitters.

On Thursday, on the Comex division of the New York Mercantile Exchange, gold for August delivery fell 0.13% to $1,167.80 a troy ounce.

Silver for September delivery dipped 0.33% to $15.525 a troy ounce.

Copper for September delivery eased 0.06% to $2.628 a pound.

At the end of the U.S. session, August Comex gold was down $1.70 at $1,170.10 an ounce, while September Comex silver was higher $0.014 at $15.60 an ounce.

The US dollar index has recently been flat at 96.2060.

Traders and investors will now await Thursday morning’s U.S. employment report for June from the Labor Department - released one day early due to the U.S. Independence Day holiday on Friday.

The key non-farm payrolls number of the report is expected to come in at up around 230,000. Some markets could get very active immediately after the release of the report, especially if it’s a big miss on the non-farms number, says Kitco News.

The US dollar index was buoyed by positive U.S. data, as well as Greek jitters.

On Thursday, on the Comex division of the New York Mercantile Exchange, gold for August delivery fell 0.13% to $1,167.80 a troy ounce.

Silver for September delivery dipped 0.33% to $15.525 a troy ounce.

Copper for September delivery eased 0.06% to $2.628 a pound.

At the end of the U.S. session, August Comex gold was down $1.70 at $1,170.10 an ounce, while September Comex silver was higher $0.014 at $15.60 an ounce.

The US dollar index has recently been flat at 96.2060.

Traders and investors will now await Thursday morning’s U.S. employment report for June from the Labor Department - released one day early due to the U.S. Independence Day holiday on Friday.

The key non-farm payrolls number of the report is expected to come in at up around 230,000. Some markets could get very active immediately after the release of the report, especially if it’s a big miss on the non-farms number, says Kitco News.

02 July 2015, 09:30

POLAND'S C.BANK'S BOARD MEMBER RACZKO SAYS POLISH ZLOTY'S RECENT MOVES NOT

SIGNIFICANT FOR REAL ECONOMY

02 July 2015, 09:29

SPAIN'S ECONOMY MINISTER SAYS EVERYONE WANTS GREECE TO REMAIN IN THE EURO

ZONE

02 July 2015, 09:28

FRENCH FINMIN SAYS WE WANT GREECE TO STAY IN THE EURO

02 July 2015, 09:26

FRENCH FINMIN SAYS IF THE YES WINS IN REFERENDUM, WE'LL GET BACK TO WORK TO

REACH A DEAL WITH GREECE

02 July 2015, 09:25

FRENCH FINMIN SAYS IF GREEKS VOTE NO IN REFERENDUM, THAT COULD LEAD TO GREXIT

02 July 2015, 09:23

In the interest of speculators we see buying opportunities in USD/JPY binary

puts at every rise for a target of 123 levels.

Option Strategy: Credit Call Spread

Hedgers should focus on better bear spreads that offers optimal entry points.

In order to establish the above stated strategy, hedgers should focus on selling a Call option and purchase another Call at a higher Strike Price for a net credit.

A Bear Call Spread is better over short Call since it has limited risk unlike unlimited risk in case of short call.

Use a short time for maturity (something like 15 day to near month contracts bearing positive theta value) to take advantage of the time decay and give the underlying currency less time to go against you.

Buy 7D (1%) Out-Of-The-Money 0.25 delta calls and sell 7D (-1%) In-The-Money calls for net credit receivable. The combined delta should have negative delta somewhere close to -0.55 as we have shorts on ITM calls in our position.

Option Strategy: Credit Call Spread

Hedgers should focus on better bear spreads that offers optimal entry points.

In order to establish the above stated strategy, hedgers should focus on selling a Call option and purchase another Call at a higher Strike Price for a net credit.

A Bear Call Spread is better over short Call since it has limited risk unlike unlimited risk in case of short call.

Use a short time for maturity (something like 15 day to near month contracts bearing positive theta value) to take advantage of the time decay and give the underlying currency less time to go against you.

Buy 7D (1%) Out-Of-The-Money 0.25 delta calls and sell 7D (-1%) In-The-Money calls for net credit receivable. The combined delta should have negative delta somewhere close to -0.55 as we have shorts on ITM calls in our position.

02 July 2015, 09:22

FRENCH FINMIN SAYS EUROGROUP WAS UNANIMOUS IN SAYING NO DEAL POSSIBLE SINCE

GREECE CALLED FOR REFERENDUM

02 July 2015, 09:21

FRENCH FINMIN SAPIN , ABOUT GREEK GOVERNMENT, SAYS CANNOT REACH A DEAL WITH

SOMEONE WHO SAYS NO - ITELE

02 July 2015, 09:15

For today, intraday technical charts suggest little sideways to downward and

an indication of little weakness in this pair on EOD charts as we traced a gap

down opening with a spinning top candle pattern and more evidently these price

patterns have been substantiated with abundant volumes. And in addition we

believe it is testing support at 123.12 & at 122.50 levels if it manages to

break these levels then we see all chances dragging until 122 levels back

again.

The Gravestone Doji and shooting stars appeared on a market top and the next candle after doji also falls to the downside, it is a strong confirmation that the earlier doji's signal of market topping would sustain.

Oscillating indicators such as RSI (14) and slow stochastic curves are moving in convergence with prevailing price patterns.

RSI currently oscillating at 60.0323 while %D line cross over at above 80 levels on slow stochastic which is not that significant for both bulls and bears.

We look at either shorting futures for pair to hit targets of 123.10 & then even 122.80 levels or buying at binary puts for the same targets with a strict stop loss at 123.50. Thereby risk reward ratio would be at 0.33.

The Gravestone Doji and shooting stars appeared on a market top and the next candle after doji also falls to the downside, it is a strong confirmation that the earlier doji's signal of market topping would sustain.

Oscillating indicators such as RSI (14) and slow stochastic curves are moving in convergence with prevailing price patterns.

RSI currently oscillating at 60.0323 while %D line cross over at above 80 levels on slow stochastic which is not that significant for both bulls and bears.

We look at either shorting futures for pair to hit targets of 123.10 & then even 122.80 levels or buying at binary puts for the same targets with a strict stop loss at 123.50. Thereby risk reward ratio would be at 0.33.

2 July 2015, 09:09

Chinese shares slid Thursday as Beijing’s fresh measures to stabilize falling

equity markets failed to restrain selling.

Other Asian shares were higher, however, as European markets recovered and investor confidence stabilized.

The Shanghai Composite fell 3.4%.

The smaller Shenzhen market was lower 4.2%.

The ChiNext board, composed of small-cap stocks, fell 2%.

Nearly three weeks of volatile trading has removed some gains from a yearlong rally. Thus, China's authorities have taken steps in recent days to underpin investor confidence, from pumping cash into the financial system to cutting interest rates.

However, even after recent declines, China’s main stock market has almost doubled in value over the past year.

On Wednesday, after sharp stock selloffs, the Shanghai and Shenzhen stock exchanges lowered fees on securities transactions by about a third. Both the Shanghai Composite and the Shenzhen Composite are now in the red territory, down more than 20% from recent highs.

Also yesterday, the China Securities Regulatory Commission amended

regulations governing stock purchases funded by borrowed money.

This move was directed to limiting the forced selling of shares as losses incur. Such selling has added pressure to an already battered market in recent weeks. Margin trading has stimulated much of the increase in China’s stock prices over the past year.

The CSRC cancelled rules that made brokers recall loans of customers whose leverage exceeds maximum levels, allowing them instead to negotiate rollovers of loans directly with clients, state media resource Xinhua reported.

ING analysts wrote in a research report that the CSRC move will bring forward the point at which enough leverage has been bled out of the system for the rally to resume.

On Thursday Asian stocks climbed in early trading after European markets

stabilized a day earlier amid recovering investor confidence, although the

atmosphere around Greece is still quite nervous.

Japan’s Nikkei 225 Stock Average climbed 1.2%.

Australia’s S&P/ASX 200 index rose 0.8%.

South Korea’s Kospi Composite was higher 0.3%.

The Hang Seng Index was last up 0.2%. Hong Kong listings of Chinese companies, known as H-shares, dropped 1.5%.

EUR/USD was last at 1.1065 higher 0.10%.

USD/JPY was 0.20% higher to trade at 123.43.

The greenback was supported overnight after the release of upbeat U.S. jobs and manufacturing data.

Other Asian shares were higher, however, as European markets recovered and investor confidence stabilized.

The Shanghai Composite fell 3.4%.

The smaller Shenzhen market was lower 4.2%.

The ChiNext board, composed of small-cap stocks, fell 2%.

Nearly three weeks of volatile trading has removed some gains from a yearlong rally. Thus, China's authorities have taken steps in recent days to underpin investor confidence, from pumping cash into the financial system to cutting interest rates.

However, even after recent declines, China’s main stock market has almost doubled in value over the past year.

On Wednesday, after sharp stock selloffs, the Shanghai and Shenzhen stock exchanges lowered fees on securities transactions by about a third. Both the Shanghai Composite and the Shenzhen Composite are now in the red territory, down more than 20% from recent highs.

CSRC

Also yesterday, the China Securities Regulatory Commission amended

regulations governing stock purchases funded by borrowed money. This move was directed to limiting the forced selling of shares as losses incur. Such selling has added pressure to an already battered market in recent weeks. Margin trading has stimulated much of the increase in China’s stock prices over the past year.

The CSRC cancelled rules that made brokers recall loans of customers whose leverage exceeds maximum levels, allowing them instead to negotiate rollovers of loans directly with clients, state media resource Xinhua reported.

ING analysts wrote in a research report that the CSRC move will bring forward the point at which enough leverage has been bled out of the system for the rally to resume.

Other Asia

On Thursday Asian stocks climbed in early trading after European markets

stabilized a day earlier amid recovering investor confidence, although the

atmosphere around Greece is still quite nervous.Japan’s Nikkei 225 Stock Average climbed 1.2%.

Australia’s S&P/ASX 200 index rose 0.8%.

South Korea’s Kospi Composite was higher 0.3%.

The Hang Seng Index was last up 0.2%. Hong Kong listings of Chinese companies, known as H-shares, dropped 1.5%.

EUR/USD was last at 1.1065 higher 0.10%.

USD/JPY was 0.20% higher to trade at 123.43.

The greenback was supported overnight after the release of upbeat U.S. jobs and manufacturing data.

02 July 2015, 09:08

BMO ECONOMICS: ISM INDEX CONFIRMS U.S. ECONOMY IS SHAKING-OFF ITS "SOFT

PATCH" SHACKLES AND KEEPING THE FED ON TRACK TO HIKE RATES LATER YEAR

02 July 2015, 09:05

SHANGHAI COMPOSITE INDEX DOWN OVER 4 PCT

02 July 2015, 09:05

The US unemployment rate data for June is due on today.

Societe Generale estimates, the unemployment rate likely to decline from 5.5% to 5.4%, which would reverse the unexpected uptick in May and put it back at the cyclical low first registered in April.

According to the bank, the labour market is nearing full employment which should mark an inflection point on wage growth. The ECI survey is already showing evidence of a build-up of wage pressures, but the monthly data on average hourly earnings tends to lag.

"Despite our bullish outlook for wage growth, we expect the June data to be subdued, with AHE rising by just 0.1% m/m. Our forecast reflects the early survey week (which ended on the 13th of the month) and some payback effects for the 0.3% m/m increase reported for May. If our forecast is correct, the yoy growth rate will decline from 2.3% to 2.2%", estimates Societe Generale.

Societe Generale estimates, the unemployment rate likely to decline from 5.5% to 5.4%, which would reverse the unexpected uptick in May and put it back at the cyclical low first registered in April.

According to the bank, the labour market is nearing full employment which should mark an inflection point on wage growth. The ECI survey is already showing evidence of a build-up of wage pressures, but the monthly data on average hourly earnings tends to lag.

"Despite our bullish outlook for wage growth, we expect the June data to be subdued, with AHE rising by just 0.1% m/m. Our forecast reflects the early survey week (which ended on the 13th of the month) and some payback effects for the 0.3% m/m increase reported for May. If our forecast is correct, the yoy growth rate will decline from 2.3% to 2.2%", estimates Societe Generale.

02 July 2015, 09:00

UNITED KINGDOM JUN NATIONWIDE HOUSE PRICE YY DECREASE TO +3.3 % (FCAST 4.3 %)

VS PREV 4.6 %

02 July 2015, 09:02

SOUTH KOREAN WON UNOFFICIALLY CLOSES ONSHORE TRADE AT 1,125.0 PER DOLLAR VS

1,117.5 AT PREVIOUS CLOSE

02 July 2015, 09:01

GERMAN BUND FUTURES OPEN 28 TICKS LOWER AT 151.28

02 July 2015, 09:01

EUROSTOXX 50 FUTURES FLAT, DAX FUTURES UP 0.1 PCT, CAC 40 FUTURES DOWN 0.1

PCT, FTSE FUTURES DOWN 0.2 PCT

02 July 2015, 09:00

UNITED KINGDOM JUN NATIONWIDE HOUSE PRICE YY DECREASE TO +3.3 % (FCAST 4.3 %)

VS PREV 4.6 %

02 July 2015, 09:00

UNITED KINGDOM JUN NATIONWIDE HOUSE PRICE MM DECREASE TO -0.2 % (FCAST 0.5 %)

VS PREV +0.2 % (REVISED FROM 0.3 %)

02 July 2015, 09:00

SEOUL UNOFFICIALLY CLOSE UP 0.48 PCT

02 July 2015, 09:00

TOKYO'S NIKKEI AVERAGE UNOFFICIALLY CLOSES UP 0.95 PCT AT 20,522.50

02 July 2015, 09:00

AUSTRALIA'S S&P/ASX 200 INDEX UNOFFICALLY CLOSES UP 1.44 PCT AT 5,595.10

POINTS

02 July 2015, 08:59

10-YEAR U.S. TREASURY YIELD AT 2.425 PERCENT VS U.S. CLOSE OF 2.418 PERCENT

ON WEDNESDAY

02 July 2015, 08:46

Australia's retain sales data for May is scheduled to release on 3rd,

July.

Despite stagnating in April, an expansion in May retail sales is expected, but merely in line with trend at 0.3% mom (identical to the average gain in 2014 and over the past five years), states Societe Generale.

Nevertheless, this would raise the gain to 4.8% yoy from 4.1% in April, indicating that while not exactly buoyant, there is not much wrong with retail sales in Australia. In fact, given that disposable income growth in Q1 was a mere 2.6% yoy, the pace of retail sales growth is remarkably strong (though the degree of weakness in disposable income growth is unlikely to persist in our view).

"Specifically in May, food sales are likely to have recovered after an atypical outright decline in April (and they account for about 40% of all sales), but apparel sales are likely to have eased back after very large increases in March and April. The second largest sector, household goods, is expected to have expanded marginally, thus maintaining recent strength. Catering is also expected to continue to show solid growth", adds Societe Generale.

Despite stagnating in April, an expansion in May retail sales is expected, but merely in line with trend at 0.3% mom (identical to the average gain in 2014 and over the past five years), states Societe Generale.

Nevertheless, this would raise the gain to 4.8% yoy from 4.1% in April, indicating that while not exactly buoyant, there is not much wrong with retail sales in Australia. In fact, given that disposable income growth in Q1 was a mere 2.6% yoy, the pace of retail sales growth is remarkably strong (though the degree of weakness in disposable income growth is unlikely to persist in our view).

"Specifically in May, food sales are likely to have recovered after an atypical outright decline in April (and they account for about 40% of all sales), but apparel sales are likely to have eased back after very large increases in March and April. The second largest sector, household goods, is expected to have expanded marginally, thus maintaining recent strength. Catering is also expected to continue to show solid growth", adds Societe Generale.

02 July 2015, 08:44

SHANGHAI COMPOSITE INDEX DOWN OVER 3 PCT, CSI 300 INDEX DOWN OVER 2 PCT

02 July 2015, 08:43

INDONESIA'S C.BANK SAYS FIRST HALF 2015 CREDIT GROWTH AT AROUND 11 PCT

02 July 2015, 08:42

- USD/JPY jumped till 123.45 and is currently trading at 123.37. Overall trend is bullish and further short term weakness can be seen only below 123.

- The pair's short term resistance is around 123.50 (20 day MA) and break above would extend gains till 124.15/124.40.

- On the downside any break below 123 will drag the pair further down till 122.70/122.40/122.

02 July 2015, 08:40

WESTPAC: IN Q2, AUSTRALIA’S NET EXPORTS WILL BE CONSIDERABLY LESS FAVOURABLE,

WITH A POTENTIALLY NEUTRAL IMPACT

02 July 2015, 08:40

TD ECONOMICS: GROWTH IN US CONSUMER SPENDING ON DURABLES IS LIKELY TO

ACCELERATE FROM 2.1% IN Q1 TO ROUGHLY 3% IN Q2

02 July 2015, 08:37

BARCLAYS: GLOBAL MANUFACTURING OUTPUT SHOULD SHOW AN IMPROVEMENT IN UPCOMING

MONTHS, GIVEN SIGNS OF GROWTH STABILIZATION IN CHINA AND BRIGHTER OUTLOOKS

ELSEWHERE IN ASIA (EM AND JAPAN) FOR H2

02 July 2015, 08:36

BANK OF AMERICA: US FUNDAMENTAL EXCHANGE RATE MODELS SUPPORT CURRENT ACCOUNT

BALANCES AND USD STRENGTH AS WELL

02 July 2015, 08:35

Inflation acceleration continued in Q2 despite the likelihood that

adjustments to the prices of regulated goods and services are nearly over. The

bulk of the upside surprise in May and June (based on the IPCA-15 release

through mid-June) was driven by a higher-thanexpected rise in food prices,

although inflation also continued to accelerate in the housing and

transportation segments. While housing inflation will likely tick above 18% yoy

in June, food inflation likely entered into double digits after a gap of 21

months, said Societe Generale in a report on Thursday.

Higher food price inflation has been surprising given the decline in global agricultural prices but probably reflects the serious effects of drought in several regions. Finally, transportation inflation has averaged nearly 7% this year compared with average inflation of 2.2% in this segment since the beginning of 2012. Given the recent most trends in the key components, and particularly in food prices, the upside risks to the near-term inflation trajectory have risen further above the recently revised 2015 inflation forecast of 8.4%, says Societe Generale.

Higher food price inflation has been surprising given the decline in global agricultural prices but probably reflects the serious effects of drought in several regions. Finally, transportation inflation has averaged nearly 7% this year compared with average inflation of 2.2% in this segment since the beginning of 2012. Given the recent most trends in the key components, and particularly in food prices, the upside risks to the near-term inflation trajectory have risen further above the recently revised 2015 inflation forecast of 8.4%, says Societe Generale.

02 July 2015, 08:33

TAIWAN STOCKS CLOSE FLAT AT 9,379.24

02 July 2015, 08:33

RBI SAYS ACCEPTS ALL 9 BIDS FOR 24.97 BLN RUPEES AT 1-DAY REPO AUCTION

02 July 2015, 08:31

Market Roundup

EUR/USD is supported below 1.1100 levels and currently trading at 1.1068 levels. It has made intraday high at 1.1076 and low at 1.1031 levels. The pair is following a downward trajectory, as the news that Greek PM Tsipras accepted the majority of the creditors' last proposal fades continuously away. Yesterday US ISM manufacturing index for June ticked higher to 53.5, from 52.8 in May and beat analysts' expectations. The June ADP data came out stronger than expected, showing job gains of 237K (consensus 218K) with the May print revised slightly higher to 203K. The pair was dropping on Wednesday, with the sell-off fuelled mainly by solid US figures and Greece's chaotic situation. However, the most crucial data will come on Thursday with the release of non-farm payrolls, the unemployment rate and jobless claims. Later in the session, ECB's Governor Mario Draghi is expected to speak. Initial support is seen around 1.0952 and resistance is seen around 1.1218 levels.

USD/JPY is supported above 123.00 levels and posted a high of 123.45 levels. It has made intraday low at 123.12 and currently trading at 123.32 levels. Pair has been better bid at the start of the month, moving decisively to the upside from the off in Europe all the way through to the US and Asian handover. Tokyo has seen an initial bid and a few pips of a waver here or there, leaving the yen in supply and a positive tone around the greenback. Near term resistance is seen at 124.57 and support is seen at 121.48 levels.

GBP/USD is supported around $1.5600 levels. It made an intraday high at 1.5616 and low at 1.5597 levels. Pair is currently trading at 1.5614 levels. The British sterling fell deeper into the negative territory as the buck struck amid a sluggish factory update in the UK, while US labour and manufacturing provided the necessary strength to maintain the conquered position. Today market will eye on UK construction PMI data as well as US NFP job data for the further direction. Initial support is seen at 1.5600 and resistance is seen around 1.5737 levels.

USD/CHF is supported above 0.9400 levels and trading at 0.9461 levels and made intraday low at 0.9459 and high at 0.9488 levels. Yesterday Switzerland released manufacturing PMI data at 50.00 with market expectations only vs 49.4 previous release. Apart from that US released ADP job data and ISM manufacturing PMI with positive numbers. CHF is depreciating after the data released and now market will eye on US NFP job data for the further direction of the parity. Near term support is seen at 0.9279 levels and resistance is seen at 0.9542 levels.

AUD/USD is supported below 0.7700 levels and trading at 0.7650 levels. It has made intraday high at 0.7656 levels and low at 0.7628 levels. Pair was a minor offer in Tokyo's progression on a better bid greenback and then the Aussie's negative trade balance. Australia's international trade balance remains in the red with a deficit of $2.75 billion in May, larger than the $2.25 million deficit expected by economists. The release of US NFP job data could be very influential for the greenback and would impact on AUD$ too. Initial support is seen at 0.7568 and resistance at 0.7838 levels.

- BOJ Tankan - Japan firms eye CPI +1.4% in year, +1.5% in three, +1.6% in five, previous survey +1.4%, +1.6%, +1.6%, still short of BOJ's 2% target.

- Japan MoF flow data week-ended June 27 - Japanese buy net Y234.0 bln foreign stocks, sell Y45.2 bln bonds, Y64.6 bln bills; foreign investors buy net Y298.2 bln Japanese stocks, sell trln bonds, Y250.9 bln bills.

- Japan June monetary base +33.5% to new record high, trln.

- China PBOC steps up injection despite improving liquidity.

- Fed, industry at odds over bond market liquidity.

- US June auto sales 17.16 mln AR, Toyota sees US industry sales at highest since '05.

- IMF Lagarde - Greece must reform before getting debt relief.

- Australia May trade deficit A$2.751 bln, A$2.2 bln eyed, exports +1% m/m, imports -4%.

- NZ June ANZ commodity price index -3.1% m/m, -19.7% y/y, three-year low.

- NZ Fonterra GDT price index -5.9% but volumes up at latest auction.

- (0430 ET/ 0830 GMT) UK June construction PMI, 56.5 eyed; last 55.9.

- (0500 ET/0900 GMT) Euro zone May producer prices, +0.1% m/m, -2.0% y/y eyed; last -0.1%, -2.2%.

- (0830 ET/1230 GMT) US Jun non-farm payrolls, +230k eyed; last +280k.

- (08300 ET/1230 GMT) US June unemployment, 5.4% eyed; last 5.5%, participation 62.9%.

- (08300 ET/1230 GMT) US June average earnings, +0.2% m/m eyed; last +0.3%.

- (08300 ET/1230 GMT) US June average workweek, 34.5 hrs eyed; last 34.5 hrs.

- (08300 ET/1230 GMT) US weekly initial jobless claims, 270k eyed; last 271k.

- (0945 ET/1345 GMT) US June New York ISM index; last 683.7.

- (1000 ET/1400 GMT) US May factory orders, -0.5% m/m eyed; last -0.4%, ex-transport unchanged.

- (0330 ET/0730 GMT) Riksbank policy announcement, no change in -0.25% repo rate eyed.

- (0330 ET/0730 GMT) EU/Dutch FinMin Dijsselbloem parliamentary testimony at The Hague.

- (0405 ET/0805 GMT) BOE Gracie speech at London cyber-security conference.

- (0430 ET/0830 GMT) Spain E2.5-3.5 bln 3.75/1.15/1.6% 2018/20/25 Bono auctions.

- (0430 ET/0830 GMT) Spain E250-750 mln 1.0% 2030 index-linked Bono auction.

- (0450 ET/0850 GMT) France E7-8 bln 0.5/4.75/4.5% 2025/35/41 OAT auctions.

- (0630 ET/1030 GMT) UK DMO bln 2.0% 2020 Gilt auction.

- (1110 ET/1510 GMT) ECB Pres Draghi at T2S Milan event/17:00 ECB Mersch speech.

EUR/USD is supported below 1.1100 levels and currently trading at 1.1068 levels. It has made intraday high at 1.1076 and low at 1.1031 levels. The pair is following a downward trajectory, as the news that Greek PM Tsipras accepted the majority of the creditors' last proposal fades continuously away. Yesterday US ISM manufacturing index for June ticked higher to 53.5, from 52.8 in May and beat analysts' expectations. The June ADP data came out stronger than expected, showing job gains of 237K (consensus 218K) with the May print revised slightly higher to 203K. The pair was dropping on Wednesday, with the sell-off fuelled mainly by solid US figures and Greece's chaotic situation. However, the most crucial data will come on Thursday with the release of non-farm payrolls, the unemployment rate and jobless claims. Later in the session, ECB's Governor Mario Draghi is expected to speak. Initial support is seen around 1.0952 and resistance is seen around 1.1218 levels.

USD/JPY is supported above 123.00 levels and posted a high of 123.45 levels. It has made intraday low at 123.12 and currently trading at 123.32 levels. Pair has been better bid at the start of the month, moving decisively to the upside from the off in Europe all the way through to the US and Asian handover. Tokyo has seen an initial bid and a few pips of a waver here or there, leaving the yen in supply and a positive tone around the greenback. Near term resistance is seen at 124.57 and support is seen at 121.48 levels.

GBP/USD is supported around $1.5600 levels. It made an intraday high at 1.5616 and low at 1.5597 levels. Pair is currently trading at 1.5614 levels. The British sterling fell deeper into the negative territory as the buck struck amid a sluggish factory update in the UK, while US labour and manufacturing provided the necessary strength to maintain the conquered position. Today market will eye on UK construction PMI data as well as US NFP job data for the further direction. Initial support is seen at 1.5600 and resistance is seen around 1.5737 levels.

USD/CHF is supported above 0.9400 levels and trading at 0.9461 levels and made intraday low at 0.9459 and high at 0.9488 levels. Yesterday Switzerland released manufacturing PMI data at 50.00 with market expectations only vs 49.4 previous release. Apart from that US released ADP job data and ISM manufacturing PMI with positive numbers. CHF is depreciating after the data released and now market will eye on US NFP job data for the further direction of the parity. Near term support is seen at 0.9279 levels and resistance is seen at 0.9542 levels.

AUD/USD is supported below 0.7700 levels and trading at 0.7650 levels. It has made intraday high at 0.7656 levels and low at 0.7628 levels. Pair was a minor offer in Tokyo's progression on a better bid greenback and then the Aussie's negative trade balance. Australia's international trade balance remains in the red with a deficit of $2.75 billion in May, larger than the $2.25 million deficit expected by economists. The release of US NFP job data could be very influential for the greenback and would impact on AUD$ too. Initial support is seen at 0.7568 and resistance at 0.7838 levels.

2 July 2015, 08:26

On Tuesday Athens missed the deadline for a €1.5bn ($1.7bn) payment to the

International Monetary Fund (IMF).

Greece no longer has access to billions of euros in funds, as the previous eurozone bailout expired.

IMF head Christine Lagarde said the fund would still try to help and that she hoped the referendum would bring "more clarity".

At a referendum to be held on Sunday July 5, the Greek will be asked to either accept or reject proposals made by creditors last week, with Prime Minister Alexis Tsipras urging a "No" vote.

Finance Minister Yanis Varoufakis said creditors are blackmailing Greece.

But he pledged a deal would be reached soon after the vote and that current limits on bank withdrawals would ease.

Earlier on Wednesday Mr Tsipras put new proposals to eurozone creditors, accepting most of what was on the table before talks with creditors collapsed last week, but with conditions.

His latest offer is tied explicitly to agreement on a request for a third bailout from the eurozone's bailout fund lasting two years and amounting to €29.1bn. However, Dutch Finance Minister and Eurogroup President Jeroen Dijsselbloem commented that a new bailout package could only be discussed "after and on the basis of the outcome of" the vote.

German Chancellor Angela Merkel insisted further negotiations are possible only after the outcome of the vote.

However, French President Francois Hollande said he wanted a deal to be found before the referendum.

The Greek authorities had to imposed capital controls over the weekend, and bank banks did not open this week after the European Central Bank blocked their liquidity lifeline, and on Wednesday decided to keep the emergency funding at the same level.

But the regulator did not decide to demand more collateral from Greek banks as some had speculated it might.

Cash withdrawals are now capped at just €60 a day but some bank branches reopened on Wednesday to allow pensioners - many of whom do not use bank cards - a one-off weekly withdrawal of up to €120, says BBC News.

Overnight, U.S. stocks edged higher on the first day of trading of the second half of the year, ahead of Greece's referendum and of Thursday's release of the U.S. jobs report for June.

The Dow Jones Industrial Average and NASDAQ Composite each rose moderately, driven by gains in Apple Inc while the S&P 500 moved higher one session after ending a quarter in negative territory for the first time in more than two years.

Greece no longer has access to billions of euros in funds, as the previous eurozone bailout expired.

IMF head Christine Lagarde said the fund would still try to help and that she hoped the referendum would bring "more clarity".

At a referendum to be held on Sunday July 5, the Greek will be asked to either accept or reject proposals made by creditors last week, with Prime Minister Alexis Tsipras urging a "No" vote.

Finance Minister Yanis Varoufakis said creditors are blackmailing Greece.

But he pledged a deal would be reached soon after the vote and that current limits on bank withdrawals would ease.

Earlier on Wednesday Mr Tsipras put new proposals to eurozone creditors, accepting most of what was on the table before talks with creditors collapsed last week, but with conditions.

His latest offer is tied explicitly to agreement on a request for a third bailout from the eurozone's bailout fund lasting two years and amounting to €29.1bn. However, Dutch Finance Minister and Eurogroup President Jeroen Dijsselbloem commented that a new bailout package could only be discussed "after and on the basis of the outcome of" the vote.

German Chancellor Angela Merkel insisted further negotiations are possible only after the outcome of the vote.

However, French President Francois Hollande said he wanted a deal to be found before the referendum.

The Greek authorities had to imposed capital controls over the weekend, and bank banks did not open this week after the European Central Bank blocked their liquidity lifeline, and on Wednesday decided to keep the emergency funding at the same level.

But the regulator did not decide to demand more collateral from Greek banks as some had speculated it might.

Cash withdrawals are now capped at just €60 a day but some bank branches reopened on Wednesday to allow pensioners - many of whom do not use bank cards - a one-off weekly withdrawal of up to €120, says BBC News.

Owners of the Greek debt (in euros)

Source: BBC News

Lenders' proposals, key points

- VAT (sales tax): Greek PM accepts a new three-tier system, but wants to keep 30% discount on the Greek islands' VAT rates. Lenders want the islands' discounts removed.

- Pensions: Ekas top-up grant for some 200,000 poorer pensioners will be gradually reduced by 2020 - as demanded by lenders. But Mr Tsipras says no to immediate Ekas cut for the wealthiest 20% of Ekas recipients

- Defence: Mr Tsipras says reduce ceiling for military spending by €200m in 2016 and €400m in 2017. Lenders call for €400m reduction - no mention of €200m

Overnight, U.S. stocks edged higher on the first day of trading of the second half of the year, ahead of Greece's referendum and of Thursday's release of the U.S. jobs report for June.

The Dow Jones Industrial Average and NASDAQ Composite each rose moderately, driven by gains in Apple Inc while the S&P 500 moved higher one session after ending a quarter in negative territory for the first time in more than two years.

02 July 2015, 08:21

BANK OF ENGLAND'S CUNLIFFE SAYS SITUATION IN GREECE IS "VERY DANGEROUS" - BBC

02 July 2015, 08:18

The BLS is expected to report that US nonfarm payrolls expanded by 210k in

June, but broadly in line with the YTD average of 217k. Although job openings

rose to a new record high in April, jobless claims suggest that the pace of job

gains slowed somewhat in June.

Initial jobless claims averaged at 277k during the four weeks leading to the June establishment survey week, up from 267k during the preceding month which suggest marginally weaker labour market conditions.

Moreover, continuing claims increased by 21k between the two relevant survey weeks. This marks the first increase since March when continuing claims rose by 44k and nonfarm payrolls increased by just 119k.

To be sure, 210k increase in payrolls projected would be strong enough to reduce the unemployment rate and thus mark further progress on the labour market, consistent with the Fed's stated condition for a lift-off in rates, says Societe Generale.

Initial jobless claims averaged at 277k during the four weeks leading to the June establishment survey week, up from 267k during the preceding month which suggest marginally weaker labour market conditions.

Moreover, continuing claims increased by 21k between the two relevant survey weeks. This marks the first increase since March when continuing claims rose by 44k and nonfarm payrolls increased by just 119k.

To be sure, 210k increase in payrolls projected would be strong enough to reduce the unemployment rate and thus mark further progress on the labour market, consistent with the Fed's stated condition for a lift-off in rates, says Societe Generale.

02 July 2015, 08:12

Assuming the same IP rate sustains as per first four months for the rest of

the year, Brazil's supply side economic activity index should fall by -1.5% in

2015. However, year-to-date economic activity has collapsed slightly more than

predicted by the model and continues to add to the downside risks to our growth

forecast although economy might do slightly better in H2.

"Given the trends in trade and the initial survey-based releases, IP is expected to decline by -6.8% yoy in May leaving the year-to-date collapse unchanged at 6.4%. IP is expected to post yet another significant decline in May (-0.7% mom). These numbers are broadly in line with the Q2 growth estimate of -7.9% qoq (at an annualized rate)", forecats Societe Generale.

Given these sequential growth rates, IP growth in Q2 could be worse than in Q1 on sequential and seasonally-adjusted terms. Industrial production declined by 3.2% in 2014 after modest growth of 2.1% in 2013. This was mainly the result of the manufacturing sector's lack of competitiveness (reflected in Brazil's falling external balance) and, more recently, falling domestic demand.

While the BRL has depreciated significantly over the past few quarters not withstanding recent appreciation, further heavy depreciation is probably the only realistic way to improve competitiveness in the medium term and revive Brazilian manufacturing.

"Given the trends in trade and the initial survey-based releases, IP is expected to decline by -6.8% yoy in May leaving the year-to-date collapse unchanged at 6.4%. IP is expected to post yet another significant decline in May (-0.7% mom). These numbers are broadly in line with the Q2 growth estimate of -7.9% qoq (at an annualized rate)", forecats Societe Generale.

Given these sequential growth rates, IP growth in Q2 could be worse than in Q1 on sequential and seasonally-adjusted terms. Industrial production declined by 3.2% in 2014 after modest growth of 2.1% in 2013. This was mainly the result of the manufacturing sector's lack of competitiveness (reflected in Brazil's falling external balance) and, more recently, falling domestic demand.

While the BRL has depreciated significantly over the past few quarters not withstanding recent appreciation, further heavy depreciation is probably the only realistic way to improve competitiveness in the medium term and revive Brazilian manufacturing.

02 July 2015, 08:05

Inflation has been on an upward trajectory since 2009 (for a number of

structural reasons - labour market rigidities and low productivity growth, low

domestic savings and fiscal profligacy).

Even after assuming that real interest rates will not fall from their current levels and that the output gap will widen sharply starting in Q2, estimates Societe Generale. The medium-term inflation trajectory appears closely dependent on the BRL movement and the current inflation and/or inflation expectations (which are shaped by the current inflation, the fiscal trajectory, the BRL movement and the perception about the BCB's ability to contain inflation). Upside risk to inflation also implies upside risks to peak Selic rate.

"Despite the possibility of the base effect leading to inflation moderation in 2016 (current forecast is 6.3%), we note that structurally higher prices would be difficult to tame in such a short timespan particularly when the BRL remains under pressure due to domestic and external reasons and trend inflation is already threatening to surpass the BCB's target ceiling. Given this situation, the upside risks to our cyclically peak Selic rate forecast of 14.50% continue to rise", says Societe Generale.

Even after assuming that real interest rates will not fall from their current levels and that the output gap will widen sharply starting in Q2, estimates Societe Generale. The medium-term inflation trajectory appears closely dependent on the BRL movement and the current inflation and/or inflation expectations (which are shaped by the current inflation, the fiscal trajectory, the BRL movement and the perception about the BCB's ability to contain inflation). Upside risk to inflation also implies upside risks to peak Selic rate.

"Despite the possibility of the base effect leading to inflation moderation in 2016 (current forecast is 6.3%), we note that structurally higher prices would be difficult to tame in such a short timespan particularly when the BRL remains under pressure due to domestic and external reasons and trend inflation is already threatening to surpass the BCB's target ceiling. Given this situation, the upside risks to our cyclically peak Selic rate forecast of 14.50% continue to rise", says Societe Generale.

02 July 2015, 08:00

UK construction PMI peaked at a high level in 2014, driven by a surge in

housing construction. That has cooled, as has the temporary surge in

infrastructure constructionfuelled by a need to rebuild flood defences in parts

of southern England.

"But the shock May election result saw a housing-friendly Conservative administration come to power. This should lead to a post-election increase in housing construction which should push up the PMI from 55.9 to 56.5", states Societe Generale.

"But the shock May election result saw a housing-friendly Conservative administration come to power. This should lead to a post-election increase in housing construction which should push up the PMI from 55.9 to 56.5", states Societe Generale.

02 July 2015, 08:00

BOE'S CUNLIFFE SAYS THERE ARE SIGNS THAT UK PRODUCTIVITY IS IMPROVING - BBC

02 July 2015, 07:58

BOE'S CUNLIFFE SAYS HSBC DECISION ON WHETHER TO LEAVE UK IS A BUSINESS ONE,

NOT DRIVEN BY REGULATION - BBC

02 July 2015, 07:53

BANK OF ENGLAND DEPUTY GOVERNOR CUNLIFFE SAYS SEES NO SIGN OF CONTAGION FROM

GREECE TO OTHER PERIPHERAL EURO ZONE COUNTRIES - BBC

02 July 2015, 07:46

Australia's trade deficit narrowed to $2.8bn in May, from a revised $4.1bn

deficit in April. For the June quarter, the trade deficit could approach

$10bn.

That would be a more than $5bn deterioration on a $4.5bn deficit for the March quarter. That is a sizeable quarter on quarter deterioration and will represent a headwind to growth in the period.

The terms of trade fell further in Q2, potentially exceeding the 3% fall in Q1. This would continue to squeeze incomes and constrain spending power across the economy. Net exports were a sizeable positive in Q1, adding 0.5ppts to Q1 GDP growth, with export volumes expanding by 5%.

However, in Q2, net exports will be considerably less favourable, with a potentially broadly neutral impact, says Westpac.

That would be a more than $5bn deterioration on a $4.5bn deficit for the March quarter. That is a sizeable quarter on quarter deterioration and will represent a headwind to growth in the period.

The terms of trade fell further in Q2, potentially exceeding the 3% fall in Q1. This would continue to squeeze incomes and constrain spending power across the economy. Net exports were a sizeable positive in Q1, adding 0.5ppts to Q1 GDP growth, with export volumes expanding by 5%.

However, in Q2, net exports will be considerably less favourable, with a potentially broadly neutral impact, says Westpac.

02 July 2015, 07:42

After decelerating considerably from its 2014 average of 55.7, U.S.

manufacturing is showing signs of life again with two consecutive monthly

gains.

General improvement in U.S. manufacturing reflects stronger domestic spending, but relatively tepid demand abroad. Improvement in euro area growth prospects, as witnessed in the PMI releases earlier today (and assuming an amicable resolution of the Greek crisis), is being offset by subdued activity in many emerging markets. Meanwhile, the strong dollar is and will continue to be a competitive headwind. Still, with stronger domestic momentum, alongside what should be improving foreign demand over the next several months, U.S. manufacturing should continue to improve over the remainder of the year, says TD Economics.

The underlying details were not quite as positive, and market reaction so far has been lackustre. Still, with admittedly volatile yet positive headlines out of Greece alongside the strong ADP employment report released earlier today, the DXY dollar index is up on the day and Treasury yields are up several basis points heading into the all important payrolls report tomorrow. TD Economics expects another +200k print, which should further firm market expectations for a 2015 rate hike.

General improvement in U.S. manufacturing reflects stronger domestic spending, but relatively tepid demand abroad. Improvement in euro area growth prospects, as witnessed in the PMI releases earlier today (and assuming an amicable resolution of the Greek crisis), is being offset by subdued activity in many emerging markets. Meanwhile, the strong dollar is and will continue to be a competitive headwind. Still, with stronger domestic momentum, alongside what should be improving foreign demand over the next several months, U.S. manufacturing should continue to improve over the remainder of the year, says TD Economics.

The underlying details were not quite as positive, and market reaction so far has been lackustre. Still, with admittedly volatile yet positive headlines out of Greece alongside the strong ADP employment report released earlier today, the DXY dollar index is up on the day and Treasury yields are up several basis points heading into the all important payrolls report tomorrow. TD Economics expects another +200k print, which should further firm market expectations for a 2015 rate hike.

02 July 2015, 07:36

First, the ECB will discuss the level of emergency lending to Greek banks

today and may reassess the haircuts it imposes on Greek bank collateral in

exchange forfunds. No changes are likely.

Second, without a bailout extension or a new programme in the next two weeks, Greece will miss the 20 July deadline for repaying €3.50bnto the ECB.

Last night, Greece submitted a last-minute proposal (a two-year €29.1bn extension with debt restructuring) in return for calling-off a referendum, but unless there is a U-turn by EU officials, no breakthrough is likely before Sunday's referendum, states Societe Generale.

The Eurogroup is holding another teleconference today, but German chancellor Merkel has already ruled out new negotiations until after the referendum.

Third, on Sunday 5 July, Greek voters must choose between accepting or rejecting the latest bailout proposal.

Second, without a bailout extension or a new programme in the next two weeks, Greece will miss the 20 July deadline for repaying €3.50bnto the ECB.

Last night, Greece submitted a last-minute proposal (a two-year €29.1bn extension with debt restructuring) in return for calling-off a referendum, but unless there is a U-turn by EU officials, no breakthrough is likely before Sunday's referendum, states Societe Generale.

The Eurogroup is holding another teleconference today, but German chancellor Merkel has already ruled out new negotiations until after the referendum.

Third, on Sunday 5 July, Greek voters must choose between accepting or rejecting the latest bailout proposal.

02 July 2015, 07:30

Source: Thomson Reuters

- AUD/CNH 5, 10 & 20 dma's edge lower- modest bearish setup

- 4.7055 Jun base & 4.8408 38.2% Fibo defined month's range - pivotal levels

- Earlier 4.7318 low & 4.7583 38.2% of yesterday's fall are initial support/resistance

- Doji so far in Asia - bearish outside day yesterday - closed -0.8% AUD led

-

02 July 2015, 07:28Although the level of sales came down a notch from a monster May, June's tally is nothing to sneer at. Both the University of Michigan's and the Conference Board's consumer confidence indices surged in June, leading buyers into showrooms.

Higher incentive spending at roughly +3.6% Y/Y according to TrueCar, also helped boost sales. With continued improvement in the labor market, slowly leading into stronger wage growth, auto sales should maintain a relatively lofty level ahead.

A go-slow Fed should also ensure that borrowing costs remain cheap. While further gains from this level will likely be harder to come by, auto sales are on pace to come in just shy of 17mn on the year.

New auto sales grew over 12% annualized this quarter, suggesting strong quarterly spending on durables. Overall, growth in consumer spending is likely to accelerate from 2.1% in the first quarter to roughly 3% in the second, says Economic TD.

02 July 2015, 07:16

- While markets await further developments in the Greek crisis, the focus today will at least briefly turn to the US. The monthly employment report has usually been seen as the key release of the month and that the FOMC has made "further improvement" in the labour market as one of the criteria it wishes to see met before it starts to raise interest rates, has underlined its importance. By and large data have suggested that economic growth has picked up in Q2 and this is expected to reflect in a solid June payrolls report today, says Lloyds bank.